eTrade 2001 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2001 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

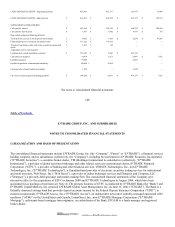

information under arrangements whereby E*TRADE Institutional receives minimum annual commissions. Commission revenues from

these arrangements are recognized at the time the trades are executed. Commission revenues under these arrangements were less than

10% of net revenues in fiscal 2001, for the three months ended December 31, 2000 and in fiscal 2000 and 16% of net revenues in

fiscal 1999. Direct costs arising from these arrangements are expensed as the commissions are received, in proportion to the cost of the

total arrangement. As a result, payments for independent research are deferred or accrued to properly match expenses at the time

commission revenue is earned. For these arrangements, payments for independent research of $6.7 million were deferred and costs of

$21.5 million were accrued at December 31, 2001 and at September 30, 2000, costs of $4.6 million were deferred and costs of

$13.9million were accrued.

Gains on sales of originated loans— Gains or losses resulting from sales of loans originated by E*TRADE Mortgage are recognized at

the date of settlement and are based on the difference between the cash received and the carrying value of the related loans sold less

related transaction costs. Nonrefundable fees and direct costs associated with the origination of mortgage loans are deferred and

recognized when the related loans are sold.

Gains on bank loans held for sale and other securities-net— Includes gains or losses at the Bank resulting from sales of loans, which

the Bank purchases for resale, the sale of available-for-sale securities, other than temporary impairment of available-for-sale securities

and gains or losses on financial derivatives that are not accounted for as hedging instruments under Statement of Financial Accounting

Standards (“SFAS”) No. 133, Accounting for Derivative Instruments and Hedging Activities . Gains or losses resulting from the sale

of Bank loans held for sale are recognized at the date of settlement and are based on the difference between the cash received and the

carrying value of the related loans less related transaction costs. Gains or losses resulting from the sale of available-for-sale securities

are recognized at the trade date based on the difference between the cash received and the amortized cost of the sold specific

securities.

Other Revenues— Other revenues consists primarily of ATM transaction fees, brokerage account maintenance fees, and other

brokerage and banking-related fees for services. Also, beginning in the fourth quarter of fiscal 2001, other revenues includes

market-making revenue earned by Dempsey. Realized and

102

Table of Contents

unrealized gains and losses from Dempsey’ s securities transactions are recognized in other revenues on a trade date basis. Securities

owned and securities sold, not yet purchased, which consist of corporate equity securities, are carried at market value.

Advertising Costs— Advertising production costs are expensed when the initial advertisement is run. Costs of communicating

advertising are expensed as the services are received. The Company incurred $69.9 million in fiscal 2001, $41.2 million in the three

months ended December 31, 2000, $149.4 million in fiscal 2000, and $124.2 million in fiscal 1999 in advertising expense.

Technology Development Costs— Technology development costs are charged to operations as incurred. Technology development

costs include costs incurred in the development and enhancement of software used in connection with services provided by the

Company that do not otherwise qualify for capitalization treatment as internally developed software costs in accordance with

Statement of Position (“SOP”) 98-1 , A ccounting for the Costs of Computer Software Developed or Obtained for Internal Use . In

accordance with SOP 98-1, the cost of internally developed software is capitalized and included in property and equipment at the point

at which the conceptual formulation, design and testing of possible software project alternatives have been completed and management

authorizes and commits to funding the project. Pilot projects and projects where expected future economic benefits are less than

probable, are not capitalized. Internally developed software costs include the cost of software tools and licenses used in the

development of the Company’ s systems, as well as payroll and consulting costs. Capitalized costs were $27.5 million in fiscal 2001,

$20.1 million in the three months ended December 31, 2000, $61.5 million in fiscal 2000, and $12.8 million in fiscal 1999.

Completed projects are transferred to property and equipment at cost and are amortized on a straight-line basis over their estimated

2002. EDGAR Online, Inc.