eTrade 2001 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2001 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

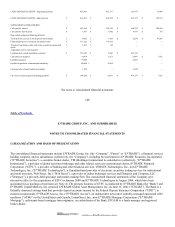

On January 22, 2001, the Company changed its fiscal year end from September 30 to December31; accordingly, results have been

separately disclosed for the three month transition period ended December31, 2000.

The consolidated financial statements of the Company include the accounts of the Parent, and its majority-owned subsidiaries.

Intercompany accounts and transactions are eliminated in consolidation. Entities in which there is at least a 20% ownership or in which

there are other indicators of significant influence are generally accounted for by the equity method; those in which there is a less than

20% ownership are generally carried at cost.

The preparation of the Company’ s consolidated financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the amounts reported in the consolidated

financial statements and related notes for the periods presented. Actual results could differ from management’ s estimates. Material

estimates for which a change is reasonably possible in the near-term relate to the determination of accrued restructuring costs, the

allowance for loan losses; the fair value of investments, available-for-sale mortgage-backed securities, loans receivable held for sale

and trading securities, accounting for financial derivatives, recognition of deferred tax assets, and the valuation of goodwill and

intangible assets. The Company’ s investments in venture funds reflect changes in the fair value of their portfolio investments including

estimated values of non-public companies, which may be subject to adjustments. The Bank also makes estimates to the valuation of

real estate and repossessed assets acquired in connection with foreclosures and repossessions. In addition, the regulatory agencies that

supervise the financial services industry periodically review the Bank’ s allowance for losses on loans. This review, which is an integral

part of their examination process, may result in additions or deductions to the allowance for loan losses based on judgments with

regard to available information provided at the time of their examinations.

Certain prior period items in these consolidated financial statements have been reclassified to conform to the current period

presentation.

101

Table of Contents

2.SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Transaction Revenue— The Company derives transaction revenues from commissions related to domestic retail customer

broker-dealer transactions in equity and debt securities, options and, to a lesser extent, payments from other broker-dealers for order

flow. Revenues from securities transactions are recognized on a trade date basis and are executed by independent broker-dealers and

Dempsey. Order flow revenues are accrued in the same period as the related securities transactions.

Interest Income and Expense— Interest income is primarily comprised of: interest earned by the Company’ s broker-dealer operations

on credit extended to its customers to finance their purchases of securities on margin; fees on customer assets invested in money

market accounts; interest earned by the Company’ s banking operations on purchased pools of loans and mortgage-related securities;

and interest earned on investment securities and other interest-earning assets. Interest expense primarily represents: interest paid to

customers for their brokerage cash balances and banking deposits; interest paid on borrowed funds; and interest paid to other

broker-dealers through the Company’ s stock loan program. Interest income and expense arising from the Company’ s brokerage and

banking operations are reported as components of net revenues. Corporate interest income and expense are included in non-operating

income.

Global and Institutional Revenues— Global and Institutional revenues consist principally of commission revenues from E*TRADE

Institutional and E*TRADE Technologies for institutional transaction execution and commission revenues in the Company’ s

international subsidiaries from retail customer broker-dealer transactions in equity and debt securities, options and payments from

other broker-dealers for order flow. E*TRADE Institutional provides certain institutional customers with market research and other

2002. EDGAR Online, Inc.