eTrade 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the secondary market.

Loan Portfolio Composition .At December 31, 2001, our net loans receivable totaled $8.0 billion or 59.5% of total bank assets. As of

the same date, $6.3 billion, or 79.1%, of the total gross loan portfolio consisted of one- to four-family residential mortgage loans.

Automobiles and recreational vehicles loans amounted to $1.6 billion or 20.5% of our total gross loans portfolio. Multi-family,

commercial, mixed-use real estate home equity line of credit and second mortgage loans and other loans amounted to $38.1 million, or

0.5%, of our total gross loan portfolio.

13

Table of Contents

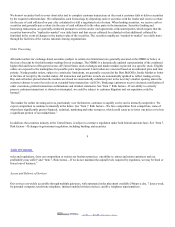

The following table presents information concerning our banking loan portfolio, in dollar amounts and in percentages, by type of loan.

December31, 2001 % September30, 2000 % September30, 1999 % September30, 1998 % September30, 1997 %

(dollars in thousands)

Realestateloans:

One- tofour-family fixed-rate $ 3,672,512 45.95 %

$ 1,583,129 37.45 %

$ 1,391,254 63.69 %

$ 466,850 50.76 %

$ 211,287 38.11 %

One- to four-family

adjustable-rate

2,645,952 33.11 2,635,955 62.36 785,821 35.98 430,319 46.79 336,470 60.69

Multi-family 183 — 203 0.01 1,330 0.06 3,223 0.35 1,447 0.26

Commercial 1,981 0.03 2,717 0.06 3,050 0.14 8,916 0.97 3,033 0.55

Mixed-use 635 0.01 503 0.01 945 0.04 929 0.10 856 0.15

Land — — — 0.00 279 0.01 316 0.03 463 0.08

Total real estate loans(1) 6,321,263 79.10 4,222,507 99.89 2,182,679 99.92 910,553 99.00 553,556 99.84

Consumer and other loans:

Automobiles and recreational

vehicles

loans

1,635,050 20.46 224 0.01 430 0.02 2,758 0.30 305 0.06

Home equity lines of credit and

second mortgage loans

23,059 0.29 4,042 0.10 1,024 0.05 5,895 0.64 564 0.10

Other 12,237 0.15 82 0.00 255 0.01 554 0.06 — —

Total consumer and other loans 1,670,346 20.90 4,348 0.11 1,709 0.08 9,207 1.00 869 0.16

Total loans 7,991,609 100.00 %

4,226,855 100.00 %

2,184,388 100.00 %

919,760 100.00 %

554,425 100.00 %

Add (deduct):

Discounts and deferred fees on

loans

38,722 (43,171 )

(22,718 )

(9,989 )

(9,938 )

Allowance for loan losses (19,874 )

(10,930 )

(7,161 )

(4,766 )

(3,594 )

Other — — — (151 )

(189 )

Total 18,848 (54,101 )

(29,879 )

(14,906 )

(13,721 )

Loans receivable, net(1)(2) $ 8,010,457 $ 4,172,754 $ 2,154,509 $ 904,854 $ 540,704

(1) Includes loans held for sale, principally one- to four-family real estate loans. These loans were $1,616,089 at December 31,

2001, $95,400 at September 30, 2000, $89,862 at September 30, 1999, $117,928 at September 30, 1998, and $149,086 at

September 30, 1997.

(2) The largest concentrations of mortgage loans at December 31, 2001 are located in California (32.9% of the portfolio), New York

(8.0% of the portfolio) and New Jersey (4.3% of the portfolio).

14

2002. EDGAR Online, Inc.