eTrade 2001 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2001 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foreign Currency Translation —Assets and liabilities of consolidated subsidiaries outside of the United States are translated into U.S.

dollars using the exchange rate in effect at each period end. Revenues and expenses are translated at the average exchange rate during

the period. The effects of foreign currency translation adjustments arising from differences in exchange rates from period to period are

deferred and included in other comprehensive income as the functional currency of our subsidiaries is their local currency. Currency

transaction gains or losses, derived on monetary assets and liabilities stated in a currency other than the functional currency, are

recognized in current operations and have not been significant to the Company’ s operating results in any period.

Impairment of Long-Lived Assets —In the event that facts and circumstances indicate that the carrying value of a long-lived asset,

including associated intangibles, may be impaired, an evaluation of recoverability is performed by comparing the estimated future

undiscounted cash flows associated with the asset to the asset’ s carrying amount to determine if a write-down to market value or

discounted cash flow is required.

Financial Derivative Instruments and Hedging Activities— The Company enters into derivative transactions principally to protect

against the risk of market price or interest rate movements on the value of certain assets and future cash flows. The Company is also

required to recognize certain contracts and commitments as derivatives when the characteristics of those contracts and commitments

meet the definition of a derivative as contained in SFAS 133, Accounting for Derivative Instruments and Hedging Activities, as

amended by SFAS No. 137, Accounting for Derivative Instruments and Hedging Activities—Deferral of the Effective Date of FASB

Statement No. 133 and SFAS No. 138, Accounting for Certain Derivatives Instruments and Hedging Activities, and as interpreted by

the FASB and the Derivative Implementation Group (collectively “SFASNo.133”).

Effective October 1, 2000, the Company adopted SFAS No. 133, which establishes accounting and reporting standards for derivative

instruments including certain derivative instruments embedded in other contracts and for hedging activities. All derivatives are

required to be recorded on the balance sheet at fair value as a freestanding asset or liability. Financial derivative instruments in

hedging relationships that mitigate exposure to changes in the fair value of assets are considered fair value hedges under SFAS No.

133. Financial derivative instruments designated in hedging relationships that mitigate the exposure to the variability in expected

future cash flows or

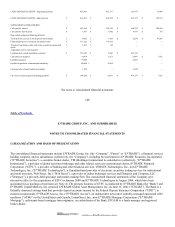

106

Table of Contents

other forecasted transactions are considered cash flow hedges. The company formally documents all relationships between hedging

instruments and hedged items and the risk management objective and strategy for each hedge transaction. If the derivative is

designated as a fair value hedge, the changes in the fair value of the derivative and of the hedged item attributable to the hedged risk

are both recognized in earnings. If the derivative is designated as a cash flow hedge, the effective portion of the changes in the fair

value of the derivative is deferred as a component of OCI and only recorded in the income statement when the hedged item affects

earnings. Ineffective portions of changes in the fair value of cash flow hedges are recognized in earnings immediately. The adoption of

SFAS No. 133 resulted in an $82,500 charge, net of tax, ($0.00 per basic and diluted share) reported as a cumulative effect of a change

in accounting principle and a $6.2 million decrease, net of tax, in shareowners’ equity in the Company’ s consolidated financial

statements for the three months ended December 31, 2000.

Differences between the fair value of the financial derivative instrument and the change in fair value of the item being hedged are

reported as fair value adjustments of financial derivatives in our consolidated statements of operations as non-operating income

(expense). At the hedge’ s inception and at least quarterly thereafter, a formal assessment is performed to determine whether changes in

the fair values or the cash flows of the financial derivative instrument have been highly effective in offsetting changes in the fair values

or cash flows of the hedged items and whether they are expected to be highly effective in the future. If a financial derivative in a fair

value hedging relationship is no longer effective, de-designated from its hedging relationship or terminated, the Company discontinues

fair value hedge accounting for the hedged item. The accumulated adjustment of the carrying amount of the hedged interest-earning

asset is recognized in earnings as an adjustment to interest income over the expected remaining life of the asset using the effective

interest rate method. If it becomes probable that a hedged forecasted transaction will not occur, any amounts included in other

comprehensive income related to the specific hedging instruments are reclassified from other comprehensive income to the

consolidated statements of operations and reported as gains on bank loans held for sale and other securities-net.

2002. EDGAR Online, Inc.