eTrade 2001 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2001 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

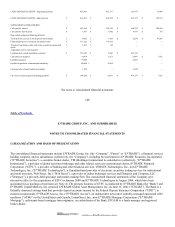

useful lives, generally four years. Amortization expense was $28.5 million in fiscal 2001, $5.7 million in the three months ended

December 31, 2000, $7.8 million in fiscal 2000, and $7.1 million in fiscal 1999.

Stock-Based Compensation— The Company accounts for associate stock-based compensation using the intrinsic value method of

accounting prescribed in Accounting Principles Board Opinion (“APB”) No. 25, Accounting for Stock Issued to Employees . The

Company provides pro forma disclosures of net income (loss) and income (loss) per share as required under Statement of Financial

Accounting Standards (“SFAS”) No. 123, Accounting for Stock-Based Compensation .

Changes in Accounting Principle— In April 1998, the American Institute of Certified Public Accountants issued SOP 98-5, Reporting

on the Cost of Start-up Activities . The statement requires that the cost of start-up activities be expensed as incurred rather than

capitalized, with initial application reported as the cumulative effect of a change in accounting principle, as described in APB No. 20 ,

Accounting Changes. ETFC implemented SOP98-5 in fiscal 1999 and, as a result, recognized a loss of $469,000, net of tax, of

previously capitalized start-up costs, as a cumulative effect of a change in accounting principle. These costs related primarily to the

establishment of TeleBanc Insurance Services.

Effective October 1, 2000, the Company adopted SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as

amended, which establishes accounting and reporting standards for derivative instruments, including certain derivative instruments

embedded in other contracts and for hedging activities. The adoption of SFAS No. 133 resulted in an $82,500 charge, net of tax,

reported as a cumulative effect of a change in accounting principle, and a $6.2 million decrease, net of tax, in shareowner’ s equity in

the Company’ s financial statements for the three months ended December 31, 2000.

Earnings Per Share— Basic earnings per share (“EPS”) is computed by dividing net income by the weighted average common shares

outstanding for the period. Diluted EPS reflects the potential dilution that could occur if securities or other contracts to issue common

stock were exercised or converted into common stock.

Cash and Equivalents— For purposes of reporting cash flows, the Company considers all highly liquid investments with original

maturities of three months or less that are not required to be segregated under Federal

103

Table of Contents

or other regulations to be cash equivalents. Cash and equivalents are composed of interest-bearing and no-interest-bearing deposits,

certificates of deposit, commercial paper, funds due from banks and Federal funds.

Cash and Investments Required to be Segregated Under Federal or Other Regulations— Cash and investments required to be

segregated under Federal or other regulations consist primarily of government-backed securities purchased under agreements to resell

(“Resale Agreements”). Resale Agreements are accounted for as collateralized financing transactions and are recorded at their

contractual amounts, which approximate fair value. The Company obtains possession of collateral with a market value equal to or in

excess of the principal amount loaned and accrued under resale agreements. Collateral is valued by the Company with additional

collateral obtained or refunded when necessary. At December 31, 2001, the Company had resale agreements of $633.7million

maintained in a special reserve bank account for the benefit of customers under Rule 15c 3-3 of the SEC. Included in cash and

investments required to be segregated under Federal or other regulations is $75,000 at December 31, 2001 and $2.5 million at

September 30, 2000, which the Company is required to maintain in an overnight balance in its account with the Federal Reserve Bank

of Richmond.

Loans held for sale —Mortgages acquired by the Bank and loans originated by E*TRADE Mortgage which are intended for sale in the

secondary market are carried at the lower of cost or estimated fair value in the aggregate. The market value of such mortgages is

determined by obtaining market quotes for loans with similar characteristics. Net unrealized losses, if any are recognized through a

2002. EDGAR Online, Inc.