eTrade 2001 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2001 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Derivative gains and losses not considered highly effective in hedging the change in fair value or expected cash flows of the hedged

item are recognized in the consolidated statement of operations as gains on the bank loans held for sale and other securities-net as

these derivatives do not qualify for hedge accounting under SFASNo. 133.

Prior to October 1, 2000, unrealized gains and losses on financial derivatives used for hedging purposes were generally not required to

be reported in the consolidated balance sheet. For interest rate swaps, the net interest received or paid was treated as an adjustment to

the interest income or expense related to the hedged assets or obligations in the period in which such amounts were due. Premiums and

fees associated with interest rate caps were amortized to interest income or expense on a straight-line basis over the lives of the

contracts. For instruments that did not qualify as hedges, realized and unrealized gains and losses were recognized in the statement of

operations as gains on the bank loans held for sale and other securities-net in our consolidated statements of operations.

Comprehensive Income— The Company’ s comprehensive income is comprised of net income, foreign currency cumulative translation

adjustments, unrealized gains and losses on available-for-sale mortgage-backed and investment securities, and the effective portion of

the unrealized gains and losses on financial derivatives in cash flow hedge relationships, net of reclassification adjustments and related

taxes. Comprehensive income is reflected in the consolidated statements of shareowners’ equity.

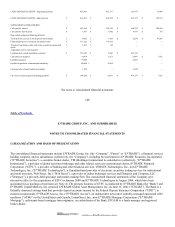

The components of accumulated other comprehensive income (loss) are as follows (in thousands):

December31, 2001 September30, 2000

Unrealized gains (losses) on available-for-sale securities $ (47,048 ) $ 66,334

Unrealized losses on derivative instruments (148,252 ) —

Foreign currency translation (2,077 ) 388

Accumulated other comprehensive income (loss) $ (197,377 ) $ 66,722

107

Table of Contents

Segment Information— The Company reports its segment operating results consistent with the internal organization that is used by

management for making operating decisions and assessing performance.

New Accounting Standards —In September 2000, the FASB issued SFAS No. 140 , Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities . SFAS No. 140 replaces SFAS No. 125 , Accounting for Transfers and Servicing

of Financial Assets and Extinguishments of Liabilities . SFAS No. 140 revises the standards for accounting for securitizations and

other transfers of financial assets and collateral and requires certain disclosures, but it carries over most of SFAS No. 125’ s provisions

without reconsideration. SFAS No. 140 was effective for transactions after March 31, 2001. The effect of the adoption was not

material to its consolidated financial statements.

In June 2001, the FASB issued SFAS No. 141 and SFAS No. 142, effective for fiscal year ending December31, 2002. The effects of

the adoption of SFAS No. 141 and SFAS No. 142 are discussed under the section, Goodwill and Other Intangibles , above.

In October 2001, the FASB issued SFAS No. 144, Impairment on Disposal of Long-Lived Assets , effective for fiscal year December

2002. EDGAR Online, Inc.