eTrade 2001 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2001 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31, 2002. Under the new rules, the criteria required for classifying an asset as held-for-sale have been significantly changed. Assets

held-for-sale are stated at the lower of their fair values or carrying amounts and depreciation is no longer recognized. In addition, the

expected future operating losses from discontinued operations will be displayed in discontinued operations in the period in which the

losses are incurred rather than as of the measurement date. More dispositions will qualify for discontinued operations treatment in the

income statement under the new rules. The Company is currently evaluating the impact of SFAS No. 144 to its consolidated financial

statements.

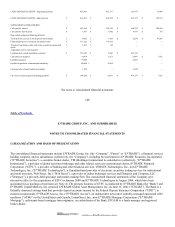

3. FACILITY RESTRUCTURING AND OTHER NONRECURRING CHARGES

On August 29, 2001, the Company announced a restructuring plan aimed at streamlining operations primarily by consolidating

facilities in the United States and Europe. This restructuring resulted in a pre-tax charge of $202.8 million ($148.0 million after tax) in

fiscal 2001.

Over the past three years, the Company has completed more than 16 acquisitions of companies with facilities in major metropolitan

centers in the United States and Europe. The restructuring was designed to consolidate some of these facilities to bring together key

decision-makers and streamline operations. The Company recorded a pre-tax restructuring charge of $131.8 million related to its

facilities consolidation in August 2001, representing the undiscounted value of ongoing lease commitments offset by anticipated third

party subleases. The charge also includes a pre-tax write-off of leasehold improvements and furniture and fixtures totaling

$38.6million. The charge does not include relocation costs that will be incurred over the next 12 months and expensed as incurred. The

cash outflow related to this action will be paid out over the length of committed lease terms of 7 to 11 years.

In calculating the charge related to the Company’ s facilities consolidation, certain estimates were used, including time to vacate

facilities, sublease terms upon the negotiation of future leases, broker commissions, tenant improvements and operating costs. In

developing the Company’ s estimates, the Company obtained information from third party leasing agents to calculate anticipated third

party sublease income. In calculating the undiscounted value of ongoing lease commitments for facilities expected to be vacated or

unused, the Company considered ongoing facility needs and the time required to vacate facilities and execute on the restructuring plan.

The Company’ s ability to vacate premises and sublease facilities ahead of or behind schedule or the negotiation of lease terms

resulting in higher or lower sublease income than estimated will affect the accrual and the related restructuring charge. Differences

between estimates of related broker commissions, tenant improvements and operating costs may increase or decrease the accrual upon

final negotiation. The Company recorded a $3.3million reduction in its initial facility consolidation charge of $131.8 million in the

fourth quarter of 2001 because the Company was able to utilize a larger portion of its furniture and fixtures than originally estimated.

108

Table of Contents

In connection with the Company’ s worldwide consolidation activities, certain software developed for specific locations and certain

other fixed assets will no longer be used. In addition, management reviewed the Company’ s current technology development activities

and has chosen to focus on projects it believes are generating the highest return in the short term. As such, work on less critical

projects has ceased. In total, the Company recorded a pre-tax restructuring charge of $52.5 million related to the write-off of

capitalized software and hardware related to the aforementioned technology projects and other fixed assets. In calculating the charge

related to its asset write-off, the Company calculated the amount of the write-offs as the net book value of assets less the amount of

estimated proceeds upon disposition for certain saleable assets. The $3.1 million increase to the Company’ s initial asset write-off

charge of $49.4 million reflects approximately $1.2 million related to a revision in the estimate of capacity requirements following the

consolidation of certain data center operations in the Alpharetta, Georgia facility. An additional increase in the restructuring accrual

resulted from the identification of additional excess equipment.

The restructuring accrual also included other pre-tax charges of $15.8 million for committed expenses, termination of consulting

agreements and cancellation penalties on various services, that will no longer be required in the facilities the Company is vacating. We

recorded an increase to our initial restructuring charge included in Other of $5.9million for severance payments made to associates

2002. EDGAR Online, Inc.