Xcel Energy 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

XCEL ENERGY | Annual Report 2015 5

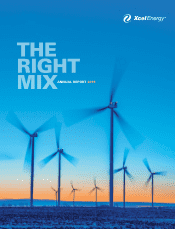

EXPANDING OUR WIND PORTFOLIO

THROUGH AN OWNERSHIP STAKE

As the No. 1 utility wind energy provider for the 11th consecutive year,

Xcel Energy is continuing to build a strong portfolio of owned wind

resources to bring value to both our customers and shareholders.

We closed 2015 with the purchase of two new wind farms: the

Pleasant Valley Wind Farm near Austin, Minn., and the Border Wind

Farm in Rolette County, N.D. These additions increased wind capacity

by 20 percent in the Upper Midwest and are expected to generate

enough clean electricity to power more than 180,000 homes.

Xcel Energy is also building the Courtenay Wind Farm in central

North Dakota, which is scheduled to begin powering homes and

businesses before the end of 2016. Taking an active ownership in

building or buying wind farms positions the company to deliver 35

percent of renewable energy to our Upper Midwest customers by 2030.

Wind continues to play an increasing role in our energy portfolio.

Our Colorado energy system has the capacity for more than

2,500 megawatts of wind generation, enough to power 1.3 million

average-size homes for a year. We set a record for wind generation

in 2015 when more than half of our Colorado customers’ power for

an entire day came from wind energy, and met nearly 20 percent of

overall electric demand for the year with wind power. We are also

adding to our wind portfolio in Texas and New Mexico through power

purchase agreements.

well received by local leaders and environmental groups,

and further our position as a clean energy leader.

The Right Mix doesn’t work if you can’t deliver on price. I am

proud of our ability to transform our energy supply portfolio,

protect the environment through clean energy sources and

state-of-the-art emissions controls and invest signicantly

in our communities through jobs, tax base and economic

development—all at a competitive price.

Improve utility performance

Our assets are long lived and best optimized via a long

runway. A key objective is to establish longer-term

regulatory agreements to support just that, positioning us to

continue to close the gap between our earned and allowed

returns while creating greater price certainty for customers.

In 2015, we achieved a 9.07 percent (weather adjusted)

ongoing return on equity (ROE) for our regulated businesses,

consistent with our goal of closing the ROE gap.

Through legislation and regulatory lings, we made

signicant progress in securing longer-term frameworks. In

particular, we reached a settlement on a three-year plan in

our Colorado electric case, which had strong stakeholder

support and demonstrates the shared benets of such

plans. We also supported the enactment of new legislation

in Minnesota and Texas that provides the foundation for

more timely and holistic recovery of costs in those states.

We led a thoughtful, multi-year electric plan in Minnesota

consistent with that legislation. In December, the Minnesota

commission approved our 2016 interim rate request of

approximately $164 million, subject to refund, and will

review the plan in 2016. And our Wisconsin operating

company successfully completed a combined gas and

electric case that will bring added stability to our revenues

over time with the rst xed charge increase since 2006.

Our 2015 results demonstrate that we have a solid plan

and effective execution. We will continue to work with

stakeholders to create sound regulatory frameworks that

meet our states’ policy objectives and allow us to implement

the right energy mix for the future.

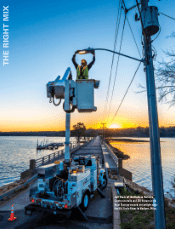

Achieve operational excellence

Historically, we have done an excellent job of managing

our operations and maintenance (O&M) expenses to deliver

increased shareholder value. In 2015, we decreased our

O&M expenses by 0.2 percent, as compared to 2014,

without impacting service levels to our customers.

We are also investing in technology to improve the function

and efciency of our business systems. An example is the

Limon III wind farm supplies power for customers in Colorado.