Xcel Energy 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 XCEL ENERGY | Annual Report 2015

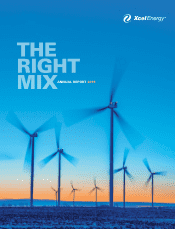

THE

RIGHT

MIX

ANNUAL REPORT 2015

Table of contents

-

Page 1

THE RIGHT MIX ANNUAL REPORT 2015 1 XCEL ENERGY | Annual Report 2015 -

Page 2

... services to 3.5 million electricity customers and 2 million natural gas customers. FINANCIAL HIGHLIGHTS XCEL ENERGY EARNINGS PER SHARE Dollars per share (diluted) 2014 Ongoing earnings per share Total GAAP earnings per share Dividends annualized Stock price (close) Assets (millions) Book value... -

Page 3

...2005 levels) by 2030. In Colorado, we are on schedule and budget for the Clean Air-Clean Jobs project to retire several aging coal facilities and transition to natural gas, as we reduce emissions across the state. These plans have been XCEL ENERGY | Annual Report 2015 3 Solid financial results Year... -

Page 4

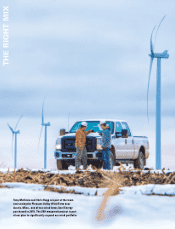

... RIGHT MIX Tony Mallizzio and Chris Hogg are part of the team overseeing the Pleasant Valley Wind Farm near Austin, Minn., one of two wind farms Xcel Energy purchased in 2015. The 200-megawatt project is part of our plan to significantly expand our wind portfolio. 4 XCEL ENERGY | Annual Report 2015 -

Page 5

... to our wind portfolio in Texas and New Mexico through power purchase agreements. Achieve operational excellence Historically, we have done an excellent job of managing our operations and maintenance (O&M) expenses to deliver increased shareholder value. In 2015, we decreased our O&M expenses by... -

Page 6

... the pre-construction phase all the way through." In 2015, the EDA program rewarded Colorado and Minnesota customers with more than $11.2 million in rebates for using energyefficient design in 136 buildings. Expand customer options and solutions Our customers want more ways to save energy and money... -

Page 7

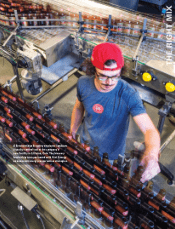

A Breckenridge Brewery employee conducts a quality control test at the company's new facility in Littleton, Colo. The brewery leadership team partnered with Xcel Energy on numerous energy conservation strategies. XCEL ENERGY | Annual Report 2015 7 THE RIGHT MIX -

Page 8

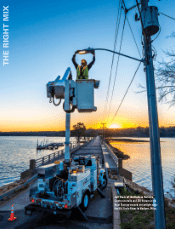

THE RIGHT MIX Jeff Reali of the Hudson Service Center installs an LED fixture in an Xcel Energy-owned streetlight near the St. Croix River in Hudson, Wisc. 8 XCEL ENERGY | Annual Report 2015 -

Page 9

... and home energy management, and we delivered in 2015. Ranked in the top 5 nationally, Xcel Energy's energy-efficiency programs saved customers enough electricity to power 115,000 homes and enough natural gas to serve 17,000 homes. For customers wanting more renewable energy options, we are building... -

Page 10

...areas of our service territory, Xcel Energy is investing hundreds of millions of dollars in the energy grid to provide reliable and affordable power to help drive the New Mexico economy. To meet the time-sensitive nature of our customers' needs- many of whom were burning diesel engines to fuel their... -

Page 11

Ross White, a third-year lineman apprentice and military veteran who joined Xcel Energy after serving six years with the U.S. Marine Corps, installs a conductor damper on a transmission line near Carlsbad, N.M. XCEL ENERGY | Annual Report 2015 11 THE RIGHT MIX -

Page 12

... natural gas facility, part of Xcel Energy's plan to significantly reduce carbon dioxide emissions. In Colorado, we also retired a coal unit at the Cherokee Generating Station and completed construction of a new combined-cycle natural gas plant- two significant milestones in our Clean Air-Clean Jobs... -

Page 13

...the plant that Xcel Energy leases to the United States Fish and Wildlife Service for $1 each year. In Colorado, we also achieved a significant milestone in our Clean Air-Clean Jobs project in 2015 by retiring the third coal unit at our Cherokee Generating Station and bringing online the new combined... -

Page 14

...qualified and trained workforce. The program allows developers to connect solar arrays to Xcel Energy's electric distribution system and participating subscribers to receive a credit on their Xcel Energy bill. The program is designed to provide a new option for Xcel Energy's Minnesota customers who... -

Page 15

... (I.R.S. Employer Identification No.) 414 Nicollet Mall Minneapolis, MN 55401 (Address of principal executive offices) Registrant's telephone number, including area code: 612-330-5500 Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Stock, $2.50 par value per... -

Page 16

-

Page 17

... Developments ...Electric Operating Statistics ...NATURAL GAS UTILITY OPERATIONS ...NSP-Minnesota...NSP-Wisconsin ...PSCo ...SPS ...Natural Gas Operating Statistics...GENERAL...ENVIRONMENTAL MATTERS ...CAPITAL SPENDING AND FINANCING ...EMPLOYEES ...EXECUTIVE OFFICERS ...Item 1A - Risk Factors... -

Page 18

-

Page 19

... and transmission system of NSP-Minnesota and NSP-Wisconsin operated on an integrated basis and managed by NSP-Minnesota NSP-Wisconsin...Northern States Power Company, a Wisconsin corporation Operating companies ...NSP-Minnesota, NSP-Wisconsin, PSCo and SPS PSCo...Public Service Company of Colorado... -

Page 20

...the costs of certain purchased power costs) PGA ...Purchased gas adjustment PSIA ...Pipeline system integrity adjustment QSP...Quality of service plan RDF ...Renewable development fund RER ...Renewable energy rider RES...Renewable energy standard (recovers the costs of new renewable generation) RESA... -

Page 21

... Standards Board Federal implementation plan Financial transmission right Generally accepted accounting principles Greenhouse gas Historic test year Integrated market Independent Spent Fuel Storage Installation Investment Tax Credit Life cycle management Low-level radioactive waste Liquefied natural... -

Page 22

...Regional Transmission Organization Sharyland Distribution and Transmission Services, LLC State implementation plan Sulfur dioxide Southwest Power Pool, Inc. Standard & Poor's Ratings Services Transmission owner Transmission-only subsidiary Total shareholder return Wexpro Development Company Billion... -

Page 23

... under the laws of Minnesota in 1909. Xcel Energy's executive offices are located at 414 Nicollet Mall, Minneapolis, Minn. 55401. Its website address is www.xcelenergy.com. Xcel Energy makes available, free of charge through its website, its annual report on Form 10-K, quarterly reports on Form 10... -

Page 24

... in the generation, purchase, transmission, distribution and sale of electricity in Colorado. The wholesale customers served by PSCo comprised approximately 11 percent of its total KWh sold in 2015. PSCo also purchases, transports, distributes and sells natural gas to retail customers and transports... -

Page 25

...hydroelectric licensing, accounting practices, wholesale sales for resale, transmission of electricity in interstate commerce, compliance with NERC electric reliability standards, asset transfers and mergers, and natural gas transactions in interstate commerce. As approved by the FERC, NSP-Minnesota... -

Page 26

... to obtain energy at a lower cost. Purchased Transmission Services - NSP-Minnesota and NSP-Wisconsin have contracts with MISO and other regional transmission service providers to deliver power and energy to their customers. Courtenay Wind Farm - In September 2015, NSP-Minnesota began construction of... -

Page 27

..., S.D. 345 KV transmission line - Construction on the line began in September 2015, with completion anticipated in 2017. Minnesota Solar - Minnesota legislation requires 1.5 percent of a public utility's total electric retail sales to retail customers be generated using solar energy by 2020. Of... -

Page 28

...outage event within the 2013 AAA docket. The 2013 and 2012 AAA dockets remain pending. In September 2015, the 2014 AAA was filed with the MPUC and also remains pending. Nuclear Power Operations and Waste Disposal NSP-Minnesota owns two nuclear generating plants: the Monticello plant and the PI plant... -

Page 29

... has the responsibility to permanently dispose of domestic spent nuclear fuel and other high-level radioactive wastes. The Nuclear Waste Policy Act requires the DOE to implement a program for nuclear high-level waste management. This includes the siting, licensing, construction and operation of... -

Page 30

... resource requirements and may sell surplus RECs. Includes energy from other sources, including solar, biomass, oil and refuse. Distributed generation from the Solar*Rewards program is not included, and was approximately eight, seven, and eight million net KWh for 2015, 2014, and 2013, respectively... -

Page 31

...2015 and 2014, coal requirements for the NSP System's major coal-fired generating plants were approximately 8.3 million tons and 9.3 million tons, respectively. Coal requirements for 2015 were lower due to the retirement of Black Dog Units 3 and 4 and relatively low natural gas prices. The estimated... -

Page 32

... electric capacity, energy, ancillary services and energy-related products. NSP-Minnesota uses physical and financial instruments to minimize commodity price and credit risk and hedge sales and purchases. NSP-Minnesota does not serve any wholesale requirements customers at cost-based regulated rates... -

Page 33

... licensing, accounting practices, wholesale sales for resale, the transmission of electricity in interstate commerce, compliance with the NERC electric reliability standards, asset transactions and mergers, and natural gas transactions in interstate commerce. NSP-Wisconsin and NSP-Minnesota have... -

Page 34

... commerce, compliance with the NERC electric reliability standards, asset transactions and mergers and natural gas transactions in interstate commerce. PSCo is authorized to make wholesale electric sales at market-based prices to customers outside its balancing authority area. Fuel, Purchased Energy... -

Page 35

...cost. Purchased Transmission Services - In addition to using its own transmission system, PSCo has contracts with regional transmission service providers to deliver energy to PSCo's customers. Colorado ERP and All-Source Solicitation - The CPUC provided final approval to PSCo's plan in December 2013... -

Page 36

... RECs. PSCo uses RECs to meet or exceed state resource requirements and may sell surplus RECs. Distributed generation from the Solar*Rewards program is not included, and was approximately 245, 197, and 172 million net KWh for 2015, 2014, and 2013, respectively. Fuel Supply and Costs The following... -

Page 37

.... PSCo's generation stations use low-sulfur western coal purchased primarily under contracts with suppliers operating in Colorado and Wyoming. During 2015 and 2014, PSCo's coal requirements for existing plants were approximately 10.5 million tons and 10.3 million tons, respectively. The estimated... -

Page 38

...electric reliability standards, asset transactions and mergers, and natural gas transactions in interstate commerce. As approved by the FERC, SPS operates within the SPP RTO and SPP IM wholesale market. SPS is authorized to make wholesale electric sales at market-based prices. Fuel, Purchased Energy... -

Page 39

...Purchased Transmission Services - SPS has contractual arrangements with SPP and regional transmission service providers, including PSCo, to deliver power and energy to its native load customers. High Priority Incremental Load Study Report - In April 2014, the SPP Board of Directors approved the High... -

Page 40

... New Mexico during spring 2016. The estimated project cost is $139 million. The line is anticipated to be in service in 2018. SPS Resource Plans - SPS was required to develop and implement a renewable portfolio plan by 2015, in which 15 percent of its energy to serve its New Mexico retail customers... -

Page 41

... of fuel consumed for owned electric generation, the percentage of total fuel requirements represented by each category of fuel and the total weighted average cost of all fuels. Coal SPS Generating Plants Cost Percent Natural Gas Cost Percent Weighted Average Owned Fuel Cost 2015 ...2014 ...2013... -

Page 42

... Developments The FERC has jurisdiction over rates for electric transmission service in interstate commerce and electricity sold at wholesale, hydro facility licensing, natural gas transportation, asset transactions and mergers, accounting practices and certain other activities of Xcel Energy... -

Page 43

... to be material. Electric Operating Statistics Electric Sales Statistics Year Ended Dec. 31 2015 2014 2013 Electric sales (Millions of KWh) Residential...Large C&I ...Small C&I ...Public authorities and other...Total retail ...Sales for resale ...Total energy sold ...Number of customers at end of... -

Page 44

... fracturing, safety requirements for natural gas pipelines and the continued trend of declining use per residential and small C&I customer, as a result of improved building construction technologies, higher appliance efficiencies and conservation. From 2000 to 2015, average annual sales to the... -

Page 45

...and propaneair plants provide a cost-effective alternative to annual fixed pipeline transportation charges to meet the peaks caused by firm space heating demand on extremely cold winter days. NSP-Minnesota is required to file for a change in natural gas supply contract levels to meet peak demand, to... -

Page 46

...propane-air plants provide a cost-effective alternative to annual fixed pipeline transportation charges to meet the peaks caused by firm space heating demand on extremely cold winter days. NSP-Wisconsin is required to file a natural gas supply plan with the PSCW annually to change natural gas supply... -

Page 47

... costs associated with transmission and distribution pipeline integrity management programs and two projects to replace large transmission pipelines. The rider was extended through 2018. QSP Requirements - The CPUC established a natural gas QSP that provides for bill credits to customers if PSCo... -

Page 48

... rates. In addition, PSCo conducts natural gas price hedging activities that have been approved by the CPUC. The following table summarizes the average delivered cost per MMBtu of natural gas purchased for resale by PSCo's regulated retail natural gas distribution business: 2015 ...$ 2014 ...2013... -

Page 49

...states have policies designed to promote the development of solar and other distributed energy resources through significant incentive policies; with these incentives and federal tax subsidies, distributed generating resources are potential competitors to Xcel Energy's electric service business. 31 -

Page 50

...the use of clean energy technologies and regulate emissions of GHGs to address climate change. Xcel Energy has undertaken a number of initiatives to meet current requirements and prepare for potential future regulations, reduce GHG emissions and respond to state renewable and energy efficiency goals... -

Page 51

...and Chief Executive Officer, NSP-Wisconsin, January 2012 to December 2014; Vice President, Portfolio Strategy and Business Development, Xcel Energy Services Inc., August 2000 to December 2011. Scott M. Wilensky, 59, Executive Vice President, General Counsel, Xcel Energy Inc., January 2015 to present... -

Page 52

..., including air emissions, water quality, wastewater discharges and the generation, transport and disposal of solid wastes and hazardous substances. These laws and regulations require us to obtain and comply with a wide variety of environmental requirements including those for protected natural and... -

Page 53

...including siting and construction of facilities, customer service and the rates that we can charge customers. The FERC has jurisdiction, among other things, over wholesale rates for electric transmission service, the sale of electric energy in interstate commerce and certain natural gas transactions... -

Page 54

... the credit ratings of the letter of credit issuers were to drop below the designated investment grade rating stipulated in the underlying long-term purchased power contracts, the supplier would need to replace that security with an acceptable substitute. If the security were not replaced, the party... -

Page 55

... related to health care could also significantly change our benefit programs and costs. We must rely on cash from our subsidiaries to make dividend payments. We are a holding company and our investments in our subsidiaries are our primary assets. Substantially all of our operations are conducted by... -

Page 56

... use per customer driven by appliance and lighting efficiency and the availability of cost-effective distributed generation puts downward pressure on load growth. This could lead to under recovery of costs, excess resources to meet customer demand, and increases in electric rates. Our natural gas... -

Page 57

... our natural gas transmission or distribution lines located near populated areas, the level of potential damages resulting from these risks is greater. Additionally, the operating or other costs that may be required in order to comply with potential new regulations, including the Pipeline Safety Act... -

Page 58

... the number of customers is growing, sales growth is relatively modest due to an increased focus on energy efficiency including federal standards for appliance and lighting efficiency and distributed generation, primarily solar PV. Instability in the financial markets also may affect the cost of... -

Page 59

... additional costs (e.g., penalties, third party claims, repairs, insurance or compliance) and potentially disrupt our supply and markets for natural gas, oil and other fuels. We maintain security measures designed to protect our information technology systems, network infrastructure and other assets... -

Page 60

... Virtually all of the utility plant property of NSP-Minnesota, NSP-Wisconsin, PSCo and SPS is subject to the lien of their first mortgage bond indentures. Electric Utility Generating Stations: NSP-Minnesota Station, Location and Unit Fuel Installed Summer 2015 Net Dependable Capability (MW) Steam... -

Page 61

...Location and Unit Fuel Installed Summer 2015 Net Dependable Capability (MW) Steam: Harrington-Amarillo, Texas, 3 Units ...Tolk-Muleshoe, Texas, 2 Units...Cunningham-Hobbs, N.M., 2 Units ...Jones-Lubbock, Texas, 2 Units...Maddox-Hobbs, N.M., 1 Unit...Nichols-Amarillo, Texas, 3 Units...Plant X-Earth... -

Page 62

...-day high and low stock prices based on the NYSE Composite Transactions for the quarters of 2015 and 2014 and the dividends declared per share during those quarters. See Item 7 and Note 4 to the consolidated financial statements for further discussion of Xcel Energy Inc.'s dividend policy. 2015 High... -

Page 63

... required under Item 5 - Securities Authorized for Issuance Under Equity Compensation Plans is contained in Xcel Energy Inc.'s Proxy Statement for its 2016 Annual Meeting of Shareholders, which is incorporated by reference. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS Purchases... -

Page 64

... Xcel Energy Inc. is a public utility holding company. Xcel Energy's operations included the activity of four utility subsidiaries that serve electric and natural gas customers in eight states. These utility subsidiaries are NSP-Minnesota, NSP-Wisconsin, PSCo and SPS. These utilities serve customers... -

Page 65

... factors. Management's Strategic Plans Xcel Energy strives to provide our investors an attractive total return and our customers with safe, clean and reliable energy services at a competitive price. This mission is enabled via four key strategic priorities Improving utility performance; Driving... -

Page 66

... investment plan includes continuing investments in transmission, adding new generation, reducing emissions in our power plants, refreshing our infrastructure, improving reliability, replacing natural gas pipelines and increasing the levels of renewable energy on our system. In addition, Xcel Energy... -

Page 67

... as alternatives to measures calculated and reported in accordance with GAAP. Results of Operations The following table summarizes the diluted EPS for Xcel Energy: Diluted Earnings (Loss) Per Share 2015 2014 2013 PSCo...$ NSP-Minnesota ...SPS ...NSP-Wisconsin...Equity earnings of unconsolidated... -

Page 68

... with 2013 Xcel Energy - Overall, ongoing earnings increased $0.08 per share for 2014. Ongoing earnings increased as a result of higher electric and natural gas margins due to rate increases in various jurisdictions, weather-normalized sales growth and lower interest charges. These positive factors... -

Page 69

... from at-the-market program, direct stock purchase plan and benefit plans...Other, net ...2014 ongoing and GAAP diluted EPS...$ The following table summarizes the ROE for Xcel Energy and its utility subsidiaries: ROE - 2015 PSCo NSP-Minnesota SPS NSP-Wisconsin Operating (a) Companies 0.26 0.06 0.01... -

Page 70

... cold winters increase electric and natural gas sales, while mild weather reduces electric and natural gas sales. The estimated impact of weather on earnings is based on the number of customers, temperature variances and the amount of natural gas or electricity the average customer historically uses... -

Page 71

...• • Weather-normalized Natural Gas 2015 Decline • Across natural gas service territories, lower natural gas sales reflect a decline in customer use. Weather-normalized sales for 2016 are projected to increase approximately 0.5 percent to 1.0 percent for retail electric customers and remain... -

Page 72

...Dollars) 2015 vs. 2014 Fuel and purchased power cost recovery ...$ Conservation and DSM program revenues (offset by expenses)...Estimated impact of weather ...Trading...Retail rate increases (a) ...Colorado CACJA non-fuel rider ...Transmission revenue ...PSCo earnings test refund ...Non-fuel riders... -

Page 73

...at NSP-Minnesota, NSPWisconsin and SPS as well as the non-fuel rider in Colorado. Electric Revenues (Millions of Dollars) 2014 vs. 2013 (a) Retail rate increases ...$ Trading...Fuel and purchased power cost recovery ...Non-fuel riders ...Transmission revenue ...Conservation and DSM program revenues... -

Page 74

...Margin (Millions of Dollars) 2014 vs. 2013 Retail rate increases (a) ...$ Non-fuel riders ...Conservation and DSM program revenues (offset by expenses)...Transmission revenue, net of costs ...Retail sales growth, excluding weather impact ...NSP-Wisconsin fuel recovery ...Estimated impact of weather... -

Page 75

... winter weather and lower gas recovery rates primarily in NSP-Minnesota and PSCo. Natural Gas Revenues (Millions of Dollars) (30) (13) 30 5 4 (4) 2014 vs. 2013 Purchased natural gas adjustment clause recovery ...$ Retail rate increases (Colorado)...PSIA rider (Colorado) ...Retail sales growth... -

Page 76

... change in O&M expenses: (Millions of Dollars) 2014 vs. 2013 Nuclear plant operations and amortization ...$ 2013 gain on sale of transmission assets ...Transmission costs ...Electric and natural gas distribution expenses ...Employee benefits ...Plant generation costs ...Other, net ...Total increase... -

Page 77

...general business conditions and the cost of energy services. Various regulatory agencies approve the prices for electric and natural gas service within their respective jurisdictions and affect Xcel Energy's ability to recover its costs from customers. The historical and future trends of Xcel Energy... -

Page 78

...compliance. Costs charged to operating expenses for nuclear decommissioning and spent nuclear fuel disposal expenses, environmental monitoring and disposal of hazardous materials and waste were approximately 292 million in 2015; $292 million in 2014; and $275 million in 2013. Xcel Energy estimates... -

Page 79

... price increases for materials and services required to deliver electric and natural gas services to customers. These potential cost increases could in turn lead to increased prices to customers. If current low oil prices lead to sustained deflation, that could also reduce general economic activity... -

Page 80

... the assumed levels in 2014, investment returns were below the assumed levels in 2013 and 2015. The pension cost calculation uses a market-related valuation of pension assets. Xcel Energy uses a calculated value method to determine the market-related value of the plan assets. The market-related... -

Page 81

... adopted at the end of 2014 is consistent with the new projection table and continues to be representative of Xcel Energy's population. Therefore, no changes are required. At Dec. 31, 2015, Xcel Energy set the rate of return on assets used to measure pension costs at 6.87 percent, which is... -

Page 82

...Minnesota recognizes pension expense in all regulatory jurisdictions as calculated using the aggregate normal cost actuarial method. Differences between aggregate normal cost and expense as calculated by pension accounting standards are deferred as a regulatory liability. Colorado, Texas, New Mexico... -

Page 83

... their electric and natural gas operations. Commodity price risk is managed by entering into long- and short-term physical purchase and sales contracts for electric capacity, energy and energy-related products and for various fuels used in generation and distribution activities. Commodity price risk... -

Page 84

... rate risk to be managed through the use of fixed rate debt, floating rate debt and interest rate derivatives such as swaps, caps, collars and put or call options. At Dec. 31, 2015 and 2014, a 100 basis point change in the benchmark rate on Xcel Energy's variable rate debt would impact annual... -

Page 85

... assets and liabilities, respectively, measured at fair value at Dec. 31, 2015. Determining the fair value of FTRs requires numerous management forecasts that vary in observability, including various forward commodity prices, retail and wholesale demand, generation and resulting transmission system... -

Page 86

...PI steam generator replacement. The change in capital expenditures was partially offset by the impact of higher insurance proceeds related to Sherco Unit 3 and proceeds received from the sale of certain transmission assets to Sharyland in 2013. (Millions of Dollars) 2015 2014 2013 Net cash provided... -

Page 87

... from the estimates due to changes in electric and natural gas projected load growth, regulatory decisions, legislative initiatives, reserve margin requirements, the availability of purchased power, alternative plans for meeting long-term energy needs, compliance with environmental requirements, RPS... -

Page 88

... nuclear fuel and natural gas requirements. Additionally, the utility subsidiaries of Xcel Energy Inc. have entered into agreements with utilities and other energy suppliers for purchased power to meet system load and energy requirements, replace generation from company-owned units under maintenance... -

Page 89

... (663) Excludes nonqualified plan of $42 million and $47 million at Dec. 31, 2015 and 2014, respectively. 2015 2014 Pension Assumptions Discount rate...Expected long-term rate of return...Capital Sources 4.66% 6.87 4.11% 7.09 Short-Term Funding Sources - Xcel Energy uses a number of sources to... -

Page 90

... state regulatory commissions. NSP-Wisconsin does not participate in the money pool. Registration Statements - Xcel Energy Inc.'s Articles of Incorporation authorize the issuance of one billion shares of $2.50 par value common stock. As of Dec. 31, 2015 and 2014, Xcel Energy Inc. had approximately... -

Page 91

... approximately 0.5 percent to 1.0 percent. Weather normalized retail firm natural gas sales are projected to be relatively flat. Capital rider revenue is projected to increase by $70 million to $80 million over 2015 levels. The change in O&M expenses is projected to be within a range of 0 percent... -

Page 92

... mid-point of Xcel Energy's 2015 ongoing guidance range; Deliver annual dividend increases of 5 percent to 7 percent; Target a dividend payout ratio of 60 percent to 70 percent; and Maintain senior unsecured debt credit ratings in the BBB+ to A range. Ongoing earnings is calculated using net income... -

Page 93

... public accounting firm has issued an audit report on the Xcel Energy Inc.'s internal control over financial reporting. Its report appears herein. /s/ BEN FOWKE Ben Fowke Chairman, President and Chief Executive Officer Feb. 19, 2016 /s/ TERESA S. MADDEN Teresa S. Madden Executive Vice President... -

Page 94

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Xcel Energy Inc. Minneapolis, Minnesota We have audited the accompanying consolidated balance sheets and statements of capitalization of Xcel Energy Inc. and subsidiaries (the "Company") as of December 31, 2015 and 2014... -

Page 95

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Xcel Energy Inc. Minneapolis, Minnesota We have audited the internal control over financial reporting of Xcel Energy Inc. and subsidiaries (the "Company") as of December 31, 2015, based on criteria ... -

Page 96

... 2013 Operating revenues Electric ...Natural gas ...Other...Total operating revenues ...Operating expenses Electric fuel and purchased power ...Cost of natural gas sold and transported ...Cost of sales - other ...Operating and maintenance expenses ...Conservation and demand side management program... -

Page 97

XCEL ENERGY INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (amounts in thousands) Year Ended Dec. 31 2015 2014 2013 Net income ...Other comprehensive (loss) income Pension and retiree medical benefits: Net pension and retiree medical benefit (losses) gains arising during the ... -

Page 98

... equity funds used during construction ...Equity earnings of unconsolidated subsidiaries...Dividends from unconsolidated subsidiaries ...Provision for bad debts ...Share-based compensation expense...Gain on sale of transmission assets ...Loss on Monticello life cycle management/extended power uprate... -

Page 99

... ...Regulatory liabilities...Asset retirement obligations ...Derivative instruments ...Customer advances ...Pension and employee benefit obligations ...Other ...Total deferred credits and other liabilities ...Commitments and contingencies Capitalization Long-term debt ...Common stock - 1,000,000... -

Page 100

... on common stock ...Issuances of common stock ...10,012 Share-based compensation ...Balance at Dec. 31, 2013 ...497,972 Net income ...Other comprehensive loss...Dividends declared on common stock ...Issuances of common stock ...7,761 Share-based compensation ...Balance at Dec. 31, 2014 ...505,733... -

Page 101

XCEL ENERGY INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CAPITALIZATION (amounts in thousands, except share and per share data) Dec. 31 2015 2014 Long-Term Debt NSP-Minnesota First Mortgage Bonds, Series due: Aug. 15, 2015... ...Total NSP-Minnesota long-term debt...PSCo First Mortgage Bonds... -

Page 102

... of PSCo capital lease obligation) ...Total Xcel Energy Inc. long-term debt...Total long-term debt ...Common Stockholders' Equity Common stock - 1,000,000,000 shares authorized of $2.50 par value; 507,535,523 and 505,733,267 shares outstanding at Dec. 31, 2015 and Dec. 31, 2014, respectively... -

Page 103

...electric and natural gas customers in portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas and Wisconsin. Also included in Xcel Energy's operations are WGI, an interstate natural gas pipeline company, and WYCO, a joint venture with CIG to develop and lease natural... -

Page 104

...their retail jurisdictions to assist customers in reducing peak demand and conserving energy on the electric and natural gas systems. These programs include efficiency and redesign programs, as well as rebates for the purchase of items such as high efficiency lighting. The costs incurred for DSM and... -

Page 105

... are included in Xcel Energy's rate base for establishing utility service rates. In addition to construction-related amounts, cost of capital also is recorded to reflect returns on capital used to finance conservation programs in Minnesota. Generally, AFUDC costs are recovered from customers as the... -

Page 106

...allowed to recover in electric or natural gas rates the costs of certain financial instruments purchased to reduce commodity cost volatility. For further information on derivatives entered to mitigate commodity price risk on behalf of electric and natural gas customers, see Note 11. Cash Flow Hedges... -

Page 107

...'s commodity trading operations are conducted by NSP-Minnesota, and PSCo. Commodity trading activities are not associated with energy produced from Xcel Energy's generation assets or energy and capacity purchased to serve native load. Commodity trading contracts are recorded at fair market value and... -

Page 108

... - Xcel Energy maintains pension and postretirement benefit plans for eligible employees. Recognizing the cost of providing benefits and measuring the projected benefit obligation of these plans under applicable accounting guidance requires management to make various assumptions and estimates. Based... -

Page 109

... the new guidance, other than when the consolidation or equity method of accounting is utilized, changes in the fair value of equity securities are to be recognized in earnings. This guidance will be effective for interim and annual reporting periods beginning after Dec. 15, 2017. Xcel Energy is... -

Page 110

... total assets, default on certain indebtedness in an aggregate principal amount exceeding $75 million. Xcel Energy Inc. and its subsidiaries were in compliance with all financial covenants in their debt agreements as of Dec. 31, 2015 and 2014. The interest rates under these lines of credit are... -

Page 111

... the respective credit facilities. Xcel Energy Inc. and its subsidiaries had no direct advances on the credit facilities outstanding at Dec. 31, 2015 and 2014. Long-Term Borrowings and Other Financing Instruments Generally, all real and personal property of NSP-Minnesota, NSP-Wisconsin, PSCo and SPS... -

Page 112

... in fees and commissions. Xcel Energy completed its ATM program as of June 30, 2014. The proceeds from the issuances of common stock were used to repay short-term debt, infuse equity into the utility subsidiaries and for other general corporate purposes. Deferred Financing Costs - Other assets... -

Page 113

... investments by Xcel Energy Inc.'s utility subsidiaries in jointly owned generation, transmission and gas facilities and the related ownership percentages as of Dec. 31, 2015: (Thousands of Dollars) Plant in Service Accumulated Depreciation CWIP Ownership % NSP-Minnesota Electric Generation: Sherco... -

Page 114

... fourth quarter of 2014 because a change in tax law is accounted for in the period of enactment. American Taxpayer Relief Act of 2012 - In 2013, the American Taxpayer Relief Act (ATRA) was signed into law. The ATRA provided for the following The top tax rate for dividends increased from 15 percent... -

Page 115

... state tax returns based on income in its major operating jurisdictions of Colorado, Minnesota, Texas, and Wisconsin, and various other state income-based tax returns. As of Dec. 31, 2015, Xcel Energy's earliest open tax years that are subject to examination by state taxing authorities in... -

Page 116

... years ending Dec. 31: 2015 2014 2013 Federal statutory rate...Increases (decreases) in tax from: State income taxes, net of federal income tax benefit ...Change in unrecognized tax benefits ...NOL carryback ...Regulatory differences - utility plant items ...Tax credits recognized, net of federal... -

Page 117

... average number of potentially dilutive shares outstanding used to calculate Xcel Energy Inc.'s diluted EPS is calculated using the treasury stock method. Common Stock Equivalents - Xcel Energy Inc. currently has common stock equivalents related to certain equity awards in sharebased compensation... -

Page 118

...234 496,532 $ 1.91 Dividend Reinvestment and Stock Purchase Plan and Stock Compensation Settlements - In October 2015, the Xcel Energy Inc. Board of Directors authorized open market purchases by the plan administrator as the source of shares for the dividend reinvestment program as well as market... -

Page 119

... in February 2016. Equity award units granted to employees, excluding restricted stock and applicable 401(k) employer match settlements, for the years ended Dec. 31 were as follows: (Units in Thousands) 2015 2014 2013 Granted units ...Weighted average grant date fair value ...$ 496 36.09 $ 588... -

Page 120

... current stock price and performance achievement, and final expense is based on the market value of the shares on the date the award is settled. The compensation costs related to share-based awards for the years ended Dec. 31 were as follows: (Thousands of Dollars) 2015 2014 2013 Compensation cost... -

Page 121

... in separate accounts of the insurer, which are priced based on observable inputs. Investments in equity securities and other funds - Equity securities are valued using quoted prices in active markets. Preferred stock is valued using recent trades and quoted prices of similar securities. The fair... -

Page 122

... benefit pension plans that cover almost all employees. Generally, benefits are based on a combination of years of service, the employee's average pay and, in some cases, social security benefits. Xcel Energy's policy is to fully fund into an external trust the actuarially determined pension costs... -

Page 123

...levels, Xcel Energy's pension plan assets that are measured at fair value as of Dec. 31, 2015 and 2014: Dec. 31, 2015 (Thousands of Dollars) Level 1 Level 2 Level 3 Total Cash equivalents ...$ Derivatives...Government securities ...Corporate bonds...Asset-backed securities ...Common stock...Private... -

Page 124

...2014 Change in Projected Benefit Obligation: Obligation at Jan. 1...$ Service cost ...Interest cost ...Actuarial (gain) loss ...Benefit payments ...Obligation at Dec. 31 ...$ (Thousands of Dollars) 3,746,752 $ 99,311 148,524 (169,678) (256,982) 3,567,927 $ 2015 Change in Fair Value of Plan Assets... -

Page 125

... participants in the Xcel Energy Pension Plan. Benefit Costs - The components of Xcel Energy's net periodic pension cost were: (Thousands of Dollars) 2015 2014 2013 Service cost ...Interest cost ...Expected return on plan assets ...Amortization of prior service (credit) cost ...Amortization of net... -

Page 126

... health care program with no employer subsidy. Plan Assets - Certain state agencies that regulate Xcel Energy Inc.'s utility subsidiaries also have issued guidelines related to the funding of postretirement benefit costs. SPS is required to fund postretirement benefit costs for Texas and New Mexico... -

Page 127

...plan assets for Xcel Energy is presented in the following table: (Thousands of Dollars) 2015 2014 Change in Projected Benefit Obligation: Obligation at Jan. 1...Service cost ...Interest cost ...Medicare subsidy reimbursements ...Plan participants' contributions ...Actuarial gain ...Benefit payments... -

Page 128

.... Benefit Costs - The components of Xcel Energy's net periodic postretirement benefit costs were: (Thousands of Dollars) 2015 2014 2013 Service cost ...$ Interest cost ...Expected return on plan assets ...Amortization of transition obligation ...Amortization of prior service credit ...Amortization... -

Page 129

2015 2014 2013 Significant Assumptions Used to Measure Costs: Discount rate ...Expected average long-term rate of return on assets...Projected Benefit Payments 4.08% 5.80 4.82% 7.17 4.10% 7.11 The following table lists Xcel Energy's projected benefit payments for the pension and ... -

Page 130

... a given transmission path. Unplanned plant outages, scheduled plant maintenance, changes in the relative costs of fuels used in generation, weather and overall changes in demand for electricity can each impact the operating schedules of the power plants on the transmission grid and the value of an... -

Page 131

... PI nuclear generating plants. The fund contains cash equivalents, debt securities, equity securities and other investments - all classified as available-for-sale. NSP-Minnesota plans to reinvest matured securities until decommissioning begins. NSP-Minnesota uses the MPUC approved asset allocation... -

Page 132

...Real estate ...43,859 Debt securities: Government securities...30,674 U.S. corporate bonds ...81,463 International corporate bonds ...16,950 Municipal bonds ...242,282 Asset-backed securities ...9,131 Mortgage-backed securities ...23,225 Equity securities: Common stock ...369,751 Total...$ 1,465,922... -

Page 133

... instruments that mitigate commodity price risk on behalf of electric and natural gas customers but are not designated as qualifying hedging transactions. Changes in the fair value of non-trading commodity derivative instruments are recorded in OCI or deferred as a regulatory asset or liability. The... -

Page 134

... Assets and (Liabilities) Pre-Tax Losses Recognized During the Period in Income (Thousands of Dollars) Derivatives designated as cash flow hedges Interest rate ...Vehicle fuel and other commodity...Total ...Other derivative instruments Commodity trading ...Electric commodity ...Natural gas... -

Page 135

... on derivatives entered to mitigate natural gas price risk for electric generation, recorded to electric fuel and purchased power, subject to cost-recovery mechanisms and reclassified to a regulatory asset, as appropriate. Such losses for the years ended Dec. 31, 2014 and 2013 were immaterial. The... -

Page 136

...to accounting requirements related to underlying price adjustments. As these purchases are recovered through normal regulatory recovery mechanisms in the respective jurisdictions, the changes in fair value for these contracts were offset by regulatory assets and liabilities. During 2006, Xcel Energy... -

Page 137

...to accounting requirements related to underlying price adjustments. As these purchases are recovered through normal regulatory recovery mechanisms in the respective jurisdictions, the changes in fair value for these contracts were offset by regulatory assets and liabilities. During 2006, Xcel Energy... -

Page 138

...360,236 The fair value of Xcel Energy's long-term debt is estimated based on recent trades and observable spreads from benchmark interest rates for similar securities. The fair value estimates are based on information available to management as of Dec. 31, 2015 and 2014, and given the observability... -

Page 139

... used-and-useful adjustment ...2014 property tax final true-up ...Other, net...Total 2014 and 2015 step increase ...Impact of interim rate effective March 3, 2015...Estimated revenue impact... $ 166.1 (13.8) (3.1) 0.2 149.4 (3.6) 145.8 $ $ NSP-Minnesota - Minnesota 2016 Multi-Year Electric Rate... -

Page 140

... MPUC for approval to recover the cost of natural gas infrastructure investments in Minnesota to improve safety and reliability. Costs include funding for pipeline assessments as well as deferred costs from NSP-Minnesota's existing sewer separation and pipeline integrity management programs. Sewer... -

Page 141

...: Electric Rate Request (Millions of Dollars) NSP-Wisconsin Request PSCW Approval Capital investments ...ROE & other capital structure adjustments ...Generation and transmission expenses (excluding fuel and purchased power) ...O&M expenses ...Sales forecast ...Rate increase - non-fuel and purchased... -

Page 142

...CPUC's written order (estimated): (Millions of Dollars) ALJ CPUC's Written Order PSCo's filed 2015 base rate request (a) ...ROE...Capital structure and cost of debt ...Cherokee pipeline adjustment ...Move to 2014 HTY ...O&M expenses ...Other, net...Overall recommended rate increase ...(a) $ $ 40... -

Page 143

... assets and deferrals of pension expense in excess of the amount approved in the prior general gas rate case. Interim rates, subject to refund, went into effect Oct. 1, 2015. PSCo has recognized management's best estimate of the potential customer refund obligation. PSCo - Colorado 2015 Steam Rate... -

Page 144

...percent, an electric rate base of approximately $1.7 billion, and an equity ratio of 53.97 percent. As part of its request, SPS included estimated information regarding increases and decreases in SPS' cost of service, including certain expenses, capital investments, cost of capital and sales for the... -

Page 145

...transmission company), effective Nov. 12, 2013. Subsequently, the FERC adopted a new ROE methodology, which requires electric utilities to use a two-step discounted cash flow analysis that incorporates both short-term and long-term growth projections to estimate the cost of equity. The ROE complaint... -

Page 146

... is estimated to reduce transmission revenue, net of expense, between $8 million and $10 million annually for the NSP System. SPS - Global Settlement Agreement - In August 2015, SPS, Golden Spread, four New Mexico Cooperatives, West Texas Municipal Power Agency, Public Service Company of New Mexico... -

Page 147

...Xcel Energy's risk of loss, in the form of increased costs from market price changes in fuel, is mitigated through the use of natural gas and energy cost-rate adjustment mechanisms, which provide for pass-through of most fuel, storage and transportation costs to customers. PPAs - NSP Minnesota, PSCo... -

Page 148

... in 2015, 2014 and 2013, respectively, recorded to electric fuel and purchased power expenses. Included in the future commitments under operating leases are estimated future capacity payments under PPAs that have been accounted for as operating leases in accordance with the applicable accounting... -

Page 149

...to pay 50 percent of the contract value for early termination. Xcel Energy capitalized or expensed $109.5 million, $111.3 million and $90.3 million associated with the IBM contract in 2015, 2014 and 2013, respectively. Xcel Energy's contract with Accenture for information technology services extends... -

Page 150

... Exposure Triggering Event Guarantee of customer loans for the Farm Rewiring Program (a) . Guarantee of the indemnification obligations of Xcel Energy Services Inc. under the aircraft leases (b) ...Guarantee of residual value of assets under the Bank of TokyoMitsubishi Capital Corporation Equipment... -

Page 151

... Bluff and Kreher Park areas of the Site). Fieldwork began in 2012 and continues. Excavation and containment remedies are complete. A long-term groundwater pump and treatment program is now underway. The final design was approved by the EPA in late 2015. The current cost estimate for the cleanup... -

Page 152

... 2015, the EPA issued a final ELG rule for power plants that use coal, natural gas, oil or nuclear materials as fuel and discharge treated effluent to surface waters as well as utility-owned landfills that receive coal combustion residuals. Xcel Energy estimates that the cost to comply with the new... -

Page 153

... jurisdiction, thereby potentially delaying the siting of new generation projects, pipelines, transmission lines and distribution lines, as well as increasing project costs and expanding permitting and reporting requirements. The rule went into effect in August 2015. In October 2015, the U.S. Court... -

Page 154

... EPA's approval of the Minnesota SIP. SPS Harrington Units 1 and 2 are potentially subject to BART. Texas developed a SIP (the Texas SIP) that finds the CAIR equal to BART for EGUs. As a result, no additional controls beyond CAIR compliance would be required. In May 2012, the EPA deferred its review... -

Page 155

... tanks, lithium batteries, mercury and street lighting lamps. The electric and common general AROs include small obligations related to storage tanks, radiation sources and office buildings. In April 2015, the EPA published the final rule regulating the management and disposal of coal combustion... -

Page 156

... information in Note 14. Changes in estimated excavation costs and the timing of future retirement activities resulted in revisions to AROs related to gas transmission and distribution. There were no ARO liabilities settled during the year ended Dec. 31, 2014. (b) The aggregate fair value... -

Page 157

... through historic depreciation expense based on current factors used in the existing depreciation rates. The accumulated balances by entity were as follows at Dec. 31: (Millions of Dollars) 2015 2014 NSP-Minnesota ...PSCo...SPS ...NSP-Wisconsin...Total Xcel Energy ...Nuclear Insurance $ $ 430... -

Page 158

... other U.S. nuclear plants, but no such facility is yet available. NSP-Minnesota has funded its portion of the DOE's permanent disposal program since 1981. Through May 2014, the fuel disposal fees were based on a charge of 0.1 cent per KWh sold to customers from nuclear generation. Since that time... -

Page 159

... recently approved NSP-Minnesota's 2014 nuclear decommissioning study in October 2015. This cost study quantified decommissioning costs in 2014 dollars and utilized escalation rates of 4.36 percent per year for plant removal activities, and 3.36 percent for spent fuel management and site restoration... -

Page 160

... may require to be paid back to customers in future electric and natural gas rates. Any portion of Xcel Energy's business that is not regulated cannot establish regulatory assets and liabilities. If changes in the utility industry or the business of Xcel Energy no longer allow for the application of... -

Page 161

... programs, as well as incentives allowed in certain jurisdictions. Includes the fair value of certain long-term PPAs used to meet energy capacity requirements and valuation adjustments on natural gas commodity purchases. Revenue subject to refund of $75.0 million and $128.3 million for 2015 and 2014... -

Page 162

...of net periodic pension and postretirement benefit costs. See Note 9 for details regarding these benefit plans. 17. Segments and Related Information The regulated electric utility operating results of NSP-Minnesota, NSP-Wisconsin, PSCo and SPS, as well as the regulated natural gas utility operating... -

Page 163

... Natural Gas All Other Reconciling Eliminations Consolidated Total 2015 Operating revenues from external customers ...$ 9,275,986 Intersegment revenues ...1,511 Total revenues ...$ 9,277,497 Depreciation and amortization ...$ Interest charges and financing costs ...Income tax expense (benefit... -

Page 164

... under the standards and rules issued by the Public Company Accounting Oversight Board and as approved by the SEC and as indicated in Management Report on Internal Controls herein. Effective January 2016, Xcel Energy implemented the general ledger modules of a new enterprise resource planning ("ERP... -

Page 165

...Fees and Services Information required under this Item is contained in Xcel Energy Inc.'s Proxy Statement for its 2016 Annual Meeting of Shareholders, which is incorporated by reference. PART IV Item 15 - Exhibits, Financial Statement Schedules 1. Consolidated Financial Statements: Management Report... -

Page 166

..., Series due 2017 (Exhibit 4.01 to Form 8-K (file no. 001-03034) dated March 30, 2007). 4.04* Junior Subordinated Indenture, dated as of Jan. 1, 2008, by and between Xcel Energy Inc. and Wells Fargo Bank, National Association, as Trustee (Exhibit 4.01 to Form 8-K (file no. 001-03034) dated Jan. 16... -

Page 167

..., Series due May 15, 2023 (Exhibit 4.01 to NSP-Minnesota Form 8-K dated May 20, 2013 (file no. 001-31387)). Supplemental Trust Indenture dated as of May 1, 2014 between NSP-Minnesota and The Bank of New York Mellon Trust Company, N.A., as successor Trustee, creating $300 million principal amount of... -

Page 168

...) dated July 13, 1999). Financing Agreement between Adams County, Colorado and PSCo, dated as of Aug. 1, 2005 relating to $129.5 million Adams County, Colorado Pollution Control Refunding Revenue Bonds, 2005 Series A (Exhibit 4.01 to PSCo Current Report on Form 8-K, dated Aug. 18, 2005, file no. 001... -

Page 169

...10.14b to Form 10-K of Xcel Energy (file no. 001-03034) for the year ended Dec. 31, 2012). 10.15*+ Stock Equivalent Plan for Non-Employee Directors of Xcel Energy Inc. as amended and restated effective Feb. 23, 2011 (Appendix A to the Xcel Energy Definitive Proxy Statement (file no. 001-03034) filed... -

Page 170

...8-K of Xcel Energy, dated Oct. 14, 2014 (file no. 001-03034)). 10.25*+ Xcel Energy Inc. 2015 Omnibus Incentive Plan (incorporated by reference to Appendix B to Schedule 14A, Definitive Proxy Statement to Xcel Energy Inc. (file no. 001-03034) dated April 6, 2015). 10.26*+ Stock Equivalent Program for... -

Page 171

.... 99.01 Statement pursuant to Private Securities Litigation Reform Act of 1995. 101 The following materials from Xcel Energy Inc.'s Annual Report on Form 10-K for the year ended Dec. 31, 2015 are formatted in XBRL (eXtensible Business Reporting Language): (i) the Consolidated Statements of Income... -

Page 172

SCHEDULE I XCEL ENERGY INC. CONDENSED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (amounts in thousands, except per share data) Year Ended Dec. 31 2015 2014 2013 Income Equity earnings of subsidiaries...$ 1,045,788 $ 1,077,714 $ 1,018,783 Total income...1,045,788 1,077,714 1,018,783 Expenses and ... -

Page 173

XCEL ENERGY INC. CONDENSED STATEMENTS OF CASH FLOWS (amounts in thousands) Year Ended Dec. 31 2015 2014 2013 Operating activities Net cash provided by operating activities ...$ 704,823 $ 842,832 $ 545,177 Investing activities (820,382) (422,459) Capital contributions to subsidiaries...(535,653) (... -

Page 174

XCEL ENERGY INC. CONDENSED BALANCE SHEETS (amounts in thousands) Dec. 31 2015 2014 Assets Cash and cash equivalents ...Accounts receivable from subsidiaries ...Other current assets ...Total current assets ...Investment in subsidiaries ...Other assets ...Total other assets ...Total assets ...... -

Page 175

... party receivables net of payables. Accounts receivable and payable with affiliates at Dec. 31 were: 2015 (Thousands of Dollars) Accounts Receivable Accounts Payable Accounts Receivable 2014 Accounts Payable NSP-Minnesota ...NSP-Wisconsin ...PSCo ...SPS ...Xcel Energy Services Inc...Xcel Energy... -

Page 176

... on a daily basis ...Weighted average interest rate at end of period ...Money pool interest income ... $ $ 250 $ - 27 141 0.42% N/A 0.1 $ 250 $ 16 25 250 0.22% 0.45 0.1 $ 250 72 88 243 0.30% 0.25 0.3 See Xcel Energy's notes to the consolidated financial statements in Part II, Item 8 for other... -

Page 177

SCHEDULE II XCEL ENERGY INC. AND SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS YEARS ENDED DEC. 31, 2015, 2014 AND 2013 (amounts in thousands) Additions Balance at Jan. 1 Charged to Costs and Expenses Charged to Other (a) Accounts Deductions from (b) Reserves Balance at Dec. 31 Allowance for bad ... -

Page 178

... has duly caused this annual report to be signed on its behalf by the undersigned thereunto duly authorized. XCEL ENERGY INC. Feb. 19, 2016 By: /s/ TERESA S. MADDEN Teresa S. Madden Executive Vice President, Chief Financial Officer (Principal Financial Officer) Pursuant to the requirements of the... -

Page 179

... Annual Report on Form 10-K for 2015. It has also filed with the New York Stock Exchange the CEO certification for 2015 required by section 303A.12(a) of the New York Stock Exchange's rules relating to compliance with the New York Stock Exchange's corporate governance listing standards. To contact... -

Page 180

... xcelenergy.com | © 2016 Xcel Energy Inc. | Xcel Energy is a registered trademark of Xcel Energy Inc. | Northern States Power Company-Minnesota, Northern States Power Company-Wisconsin, Public Service Company of Colorado and Southwestern Public Service Company, Xcel Energy Companies. | 16-02-124