Whirlpool 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

We exited 2011 with positive momentum,

and we are well positioned for margin

expansion and earnings growth in the

coming year. In 2012, we will execute

strong actions to continue to improve

operating margins through our capacity

and cost-reduction initiatives, ongoing

productivity programs, improved product

price and mix, and by accelerating our

new higher-margin product innovation

to the marketplace. These efforts will

provide opportunities for growth in 2012

and throughout our second century

of operation.

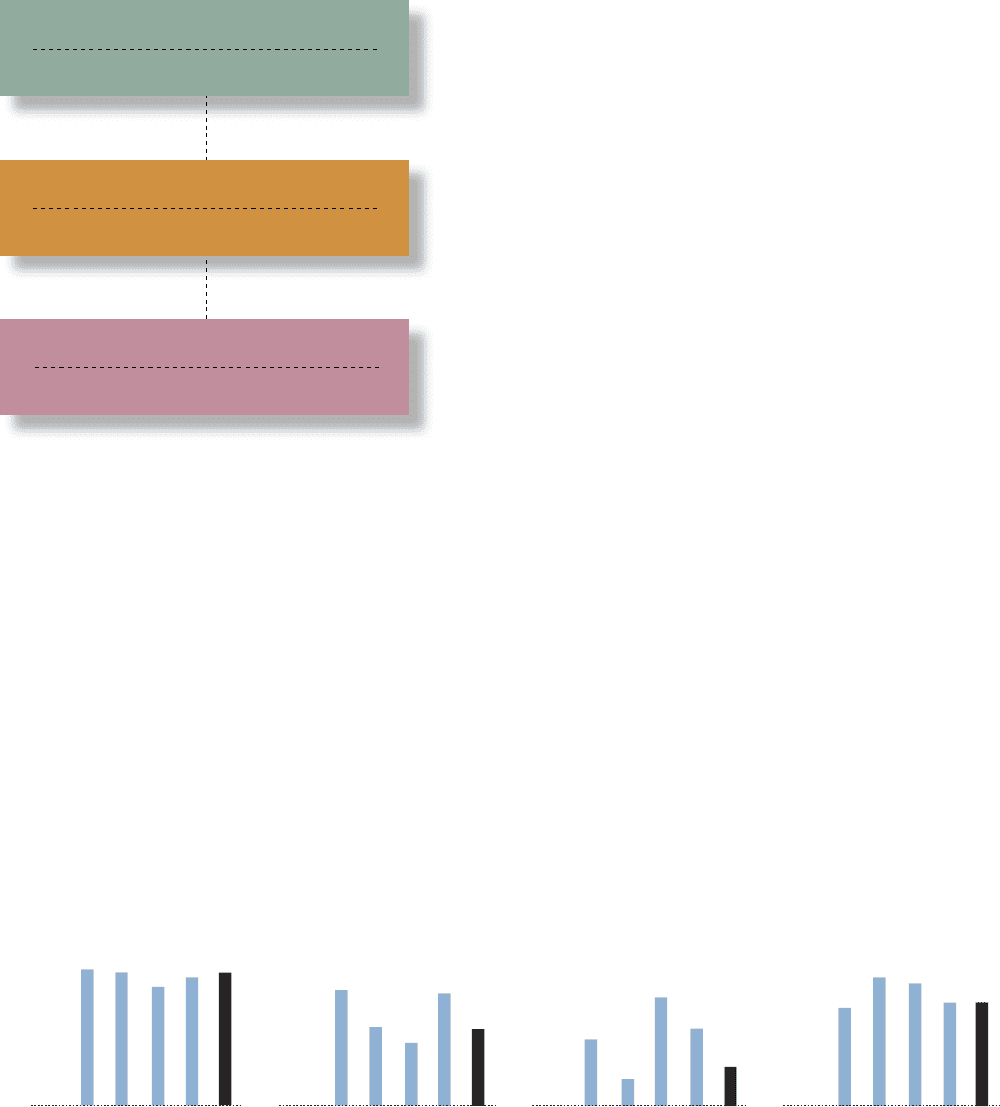

Revenue

$ in millions

’07 ’08 ’09 ’10 ’11

Cash Flow Provided by

Continuing Operating Activities

’07 ’08 ’09 ’10 ’11

Diluted Earnings per Share from

Continuing Operations

’07 ’08 ’09 ’10 ’11

Debt/Total Capital

’07 ’08 ’09 ’10 ’11

$ in billions

$19.4

$18.9

$17.1

$927

$327

$1,550

34.5%

46.0%

43.6%

$8.10

$5.50

$4.34

$1,078

36.7%

(1)

$18.4

$7.97

$18.7

$4.99

$530

36.8%

(1)Total debt divided by total debt and total stockholders’ equity.

GLOBAL OPERATING PLATFORM

BEST COST, QUALITY AND ASSET UTILIZATION

TRADE PLATFORM

BEST TRADE POSITION

BRAND PLATFORM

BEST CONSUMER POSITION