Whirlpool 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

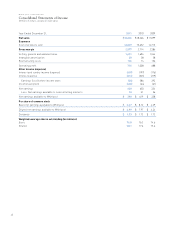

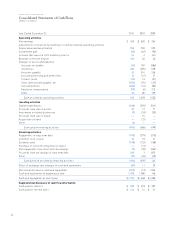

FINANCIAL SUMMARY

The following is a summary of Whirlpool Corporation’s

financial condition and results of operations for 2011, 2010

and 2009. For a more complete understanding of our finan-

cial condition and results, this summary should be read

together with Whirlpool Corporation’s Consolidated Finan-

cial Statements and related notes, and “Management’s

Discussion and Analysis.” This information appears in the

Financial Supplement to the Company’s Proxy Statement

and in the Financial Supplement to the 2011 Annual Report

on Form 10-K filed with the Securities and Exchange

Commission, both of which are also available on the com-

pany’s website at www.whirlpoolcorp.com.

ABOUT WHIRLPOOL

Whirlpool Corporation (“Whirlpool”) is the world’s leading

manufacturer of major home appliances with revenues

of approximately $19 billion and net earnings available to

Whirlpool of $390 million in 2011. We are a leading producer

of major home appliances in North America and Latin

America and have a significant presence in markets

throughout Europe and India. We have received worldwide

recognition for accomplishments in a variety of business

and social efforts, including leadership, diversity, innovative

product design, business ethics, social responsibility and

community involvement. We conduct our business through

four reportable segments, which we define based on geog-

raphy. Our reportable segments consist of North America,

Latin America, EMEA (Europe, Middle East and Africa) and

Asia. Our customer base includes large, sophisticated trade

customers who have many choices and demand competitive

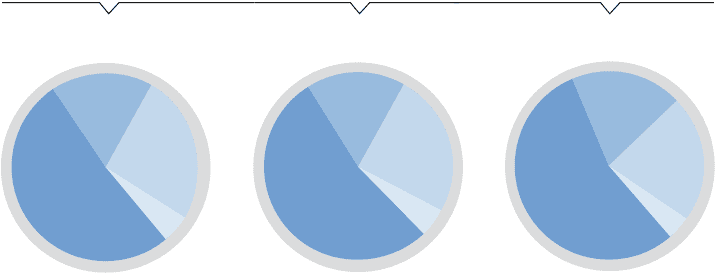

products, services and prices. The charts below summarize

the balance of net sales by reportable segment for 2011,

2010 and 2009, respectively:

We monitor country-specific economic factors such as

gross domestic product, unemployment, consumer confi-

dence, retail trends, housing starts and completions, sales

of existing homes and mortgage interest rates as key indi-

cators of industry demand. In addition to profitability, we

also focus on country, brand, product and channel sales

when assessing and forecasting financial results.

Our leading portfolio of brands includes:

Whirlpool, Maytag,

KitchenAid, Brastemp

and

Consul,

each of which has

annual revenues in excess of $1 billion. Our global branded

consumer products strategy is to introduce innovative new

products, increase brand customer loyalty, expand our

presence in foreign markets, enhance our trade manage-

ment platform, improve total cost and quality by expanding

and leveraging our global operating platform and, where

appropriate, make strategic acquisitions and investments.

As we grow revenues in our core products, our strategy is

to extend our business by offering products and services

that are dependent on and related to our core business

and expand into adjacent products, such as

Gladiator

GarageWorks, through stand-alone businesses that lever-

age our core competencies and business infrastructure.

2011 OVERVIEW

Whirlpool and the home appliance industry as a whole

continued to face significant macroeconomic challenges

across much of the world in 2011, including recessionary

demand levels in developed countries, a slowdown in

emerging markets, high levels of inflation in material costs

and volatility in foreign currencies. To be successful in

this period of uncertain economic growth and consumer

demand, we have taken aggressive actions to expand our

operating margins and improve our earnings. These actions

include implementation of our previously announced cost-

based price increases, continued investment in new prod-

uct innovation, execution of announced cost and capacity

reductions, continued productivity improvements and legal

actions taken to promote fair trade within the industry.

During 2011, we settled a long-standing collection dispute

with Banco Safra S.A. and an antitrust investigation by the

European Commission into the refrigeration compressor

industry. While these settlements negatively impacted our

2011 results, they have removed significant uncertainty and

financial risk by bringing closure to these items.

Sales by Region

200920102011

Europe,

Middle East,

Africa

19%

Europe,

Middle East,

Africa

17%

North

America

55%

North

America

53%

Latin

America

22%

Latin

America

25%

Asia

5% Asia

8%

Asia

4%

Europe,

Middle East,

Africa

17%

North

America

51%

Latin

America

27%

Asia

5%