Whirlpool 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

Whirlpool’s ongoing focus on cost reductions, productivity

improvements and investment in innovative new products

continue to enable Whirlpool to adapt to changes in the

macroeconomic environment and maintain our position as

the global number one home appliance maker.

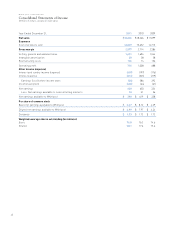

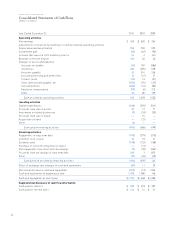

Consolidated Net Sales

Consolidated net sales increased 1.6% compared to 2010

primarily due to the favorable impact of foreign currency

and higher BEFIEX credits recognized, partially offset by

lower unit shipments. Excluding the impact of foreign cur-

rency, consolidated net sales decreased 0.4% compared

to 2010. Consolidated net sales for 2010 increased 7.4%

compared to 2009 primarily due to higher unit shipments,

higher BEFIEX credits recognized and the favorable impact

of foreign currency, partially offset by unfavorable product

price/mix. Excluding the impact of foreign currency, consol-

idated net sales for 2010 increased 5.3% compared to 2009.

Significant regional trends were as follows:

• North America net sales decreased 2.1% compared to

2010 primarily due to a 2.0% decrease in units sold.

Improvements in product price/mix were experienced

during the second half of 2011 as we began to realize

the effects of pricing actions taken earlier in the year.

However, for the full year, net sales were slightly unfa-

vorable to 2010 as a result of product price/mix. Foreign

currency did not have a significant impact on North

America net sales in 2011. North America net sales for

2010 increased 2.0% compared to 2009 primarily due to

a 5.9% increase in units sold. The increase in units sold

was driven by strong industry growth in the first half

which slowed significantly in the second half primarily in

the United States. In addition, net sales were negatively

impacted by unfavorable product price/mix, including

pricing actions during the second half of 2010 taken to

match aggressive competitive pricing pressure, partially

offset by the favorable impact of foreign currency. Exclud-

ing the impact of foreign currency, North America net

sales increased 0.7% in 2010.

• Latin America net sales increased 7.8% compared to

2010 primarily due to the favorable impact of foreign

currency, improved product price/mix, higher BEFIEX

credits recognized and a 1.4% increase in units sold.

Excluding the impact of foreign currency and higher

BEFIEX credits, Latin America net sales increased 3.0%

in 2011. Latin America net sales for 2010 increased 26.7%

compared to 2009 primarily due to a 16.1% increase

in units sold. The increase in units sold was driven by

strong industry growth in the first half which moderated

somewhat in the second half of the year. In addition, net

sales increased due to the favorable impact of foreign

currency and higher BEFIEX credits recognized, partially

offset by unfavorable product price/mix. Excluding the

impact of foreign currency and higher BEFIEX credits,

Latin America net sales increased 13.7% in 2010.

In previous years, our Brazilian operations earned tax

credits under the Brazilian government’s export incentive

program (BEFIEX). These credits reduce Brazilian federal

excise taxes on domestic sales, resulting in an increase

in the operations’ recorded net sales. After a favorable

court decision in 2005, upheld by a December 2011 appel-

late court decision, we were able to recognize approxi-

mately $266 million, $225 million, and $69 million of

export credits during 2011, 2010 and 2009, respectively.

Export credits recognized are not subject to income

taxes. We recognize exports credits as they are monetized;

however, future actions by the Brazilian government

could limit our ability to monetize these export credits.

The Brazilian government announced an Impostos

sobre Produtos (“IPI”) sales tax holiday on appliances in

December 2011, which expires on March 31, 2012. During

this holiday, we expect to monetize reduced amounts of

export credits because the export credits are monetized

through the offset of IPI taxes due. As of December 31,

2011, approximately $238 million of future cash moneti-

zation remained, including $60 million of related court

awarded fees, which will be payable in subsequent years.

A Brazilian law change to the inflation index tables

reduced available cash monetization by $62 million

in 2011.

• EMEA net sales increased 2.4% compared to 2010, pri-

marily due to the favorable impact of foreign currency,

partially offset by unfavorable product price/mix. Exclud-

ing the impact of foreign currency, net sales decreased

3.1%. EMEA net sales for 2010 decreased 3.3% compared

to 2009, primarily due to the unfavorable impact of foreign

currency and unfavorable product price/mix driven by an

increasingly competitive pricing environment, partially

offset by a 4.7% increase in units sold due to higher

industry demand which accelerated during the second

half of 2010. Excluding the impact of foreign currency,

net sales increased 0.7% in 2010.

• Asia net sales increased 3.1% compared to 2010 primarily

due to improved product price/mix, the favorable impact

of foreign currency and a 0.5% increase in units sold.

Excluding the impact of foreign currency, Asia net sales

increased 2.3%. Asia net sales for 2010 increased 30.6%,

led by results in India and China, compared to 2009 pri-

marily due to a 22.4% increase in units sold. Excluding

the impact of foreign currency, Asia net sales increased

23.8% in 2010.

Gross Margin

The consolidated gross margin percentage decreased 1.0

points to 13.8% compared to 2010, primarily due to material

cost increases, partially offset by productivity improvements

and higher BEFIEX credits recognized. In addition, gross

margin benefited from the net impacts of a supplier recov-

ery payment received in 2011, charges related to a product

recall in 2010 that did not recur in 2011, partially offset by

lower curtailment gains in a postretirement healthcare plan

during 2011.