Whirlpool 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

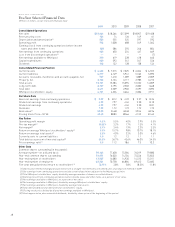

TOTAL RETURN TO SHAREHOLDERS

(Includes reinvestment of dividends)

Annual Return Percentage

Years Ending

Company/Index Dec. ’07 Dec. ’08 Dec. ’09 Dec. ’10 Dec. ’11

Whirlpool Corporation 0.16% (47.96)% 103.39% 12.45% (45.00)%

S&P 500 Index 5.49 (37.00) 26.46 15.06 2.11

S&P 500 Household Durables (29.80) (42.57) 36.06 22.87 (2.88)

Indexed Returns

Base Period Years Ending

Company/Index Dec. ’06 Dec. ’07 Dec. ’08 Dec. ’09 Dec. ’10 Dec. ’11

Whirlpool Corporation $100 $100.16 $52.13 $106.02 $119.21 $65.57

S&P 500 Index 100 105.49 66.46 84.05 96.71 98.76

S&P 500 Household Durables 100 70.20 40.32 54.86 67.41 65.47

WHIRLPOOL CORPORATION S&P 500 INDEX S&P 500 HOUSEHOLD DURABLES

0

30

60

90

$120

2006 2007 2008 2009 2010 2011

PERFORMANCE GRAPH

The graph below depicts the yearly dollar change in the cumu lative total stockholder return on our common stock with the

cumulative total return of Standard & Poor’s (S&P) Composite 500 Stock Index and the cumulative total return of the S&P

500 Household Durables Index for the years 2007 through 2011.* The graph assumes $100 was invested on December 31,

2006, in Whirlpool Corporation common stock, the S&P 500 and the S&P Household Durables Index.

* Cumulative total return is measured by dividing (1) the sum of (a) the cumulative amount of the dividends for the measurement period, assuming

dividend reinvestment, and (b) the difference between share price at the end and at the beginning of the measurement period by (2) the share price

at the beginning of the measurement period.