Whirlpool 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

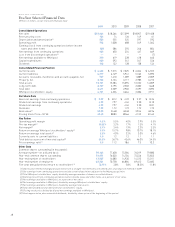

product transition, partially offset by higher net earnings

and more favorable terms of collection of accounts receiv-

able and of payment to suppliers. In addition, the significant

slowing of sales growth in the second half of 2010 resulted

in higher than normal inventory levels of approximately

three days.

The timing of cash flows from operations varies significantly

within a quarter primarily due to changes in production lev-

els, sales patterns, promotional programs, funding require-

ments as well as receivable and payment terms. Dependent

on timing of cash flows, the location of cash balances, as

well as the liquidity requirements of each country, external

sources of funding are used to support working capital

requirements. Due to the variables discussed above, cash

flow used in operations during the year was significantly in

excess of our quarter-end balances.

During the first quarter of 2011, the European Parliament

approved a directive that changes existing laws regarding

supplier payment terms. The approved directive generally

requires payment terms to be 30 days from the invoice date

unless otherwise stated in the contract. An extension of

up to 60 days is allowed if both parties agree to the terms.

Countries within the European Union are required to adopt

this directive within 2 years. We continue to monitor this

situation as these changes, once adopted, could affect our

cash flows to suppliers and from customers, since our pay-

ment terms to affected suppliers are generally longer than

from affected customers.

We offer our suppliers access to third-party payables pro-

cessors. Independent of Whirlpool, the processors allow

suppliers to sell their receivables to financial institutions

at the discretion of only the supplier and the financial insti-

tution. We have no economic interest in the sale of these

receivables and no direct financial relationship with the

financial institutions concerning these services. All of our

obligations, including amounts due, remain to our suppliers

as stated in our supplier agreements. As of December 31,

2011 and 2010, approximately $952 million and $916 million,

respectively, have been sold by suppliers to participating

financial institutions.

Cash Flows from Investing Activities

Cash used in investing activities of $596 million during 2011

was consistent with cash used in 2010 of $606 million. We

continue to increase our capital spending to support new

products and innovation. Cash used in investing activities in

2010 was $606 million, an increased outflow of $107 million

compared to 2009. The increase in cash used in investing

activities was primarily due to increased capital spending

and lower proceeds from the sale of assets.

Cash Flows from Financing Activities

Cash used in financing activities during 2011 totaled $166

million compared to $495 million in 2010. The decrease in

cash used during 2011 is primarily due to proceeds received

from the $300 million bond offering in June 2011, which was

used to repay $300 million of maturing debt. In 2010, $379

million of maturing debt was repaid from available cash. At

December 31, 2011 and 2010, we had no commercial paper

or credit facility borrowings outstanding.

Financing Arrangements

We have a $1.725 billion committed credit facility maturing

on June 28, 2016 which includes a $200 million letter of

credit sub-facility. Borrowings under the credit facility are

available to us and designated subsidiaries for general

corporate purposes, including commercial paper support.

Subsidiary borrowings under this facility, if any, are guaran-

teed by Whirlpool Corporation. Interest under the credit

facility accrues at a variable annual rate based on LIBOR

plus a margin or the prime rate plus a margin. The margin

is dependent on our credit rating at that time. The credit

facility requires us to meet certain leverage and interest

coverage requirements. We will incur a commitment fee

based on Whirlpool’s credit rating for any unused portion of

the credit facility. At December 31, 2011 and 2010, we had

no borrowings outstanding under this credit agreement and

are in compliance with financial covenant requirements.

In December 2011, we obtained a committed credit facility

in Brazil. The credit facility provides borrowings up to 700

million Brazilian reais (approximately $373 million as of

December 31, 2011), with certain restrictions on the amount

available for each draw. The credit facility contains no

financial covenants. As of December 31, 2011, we had no

borrowings outstanding under this credit agreement.

In 2011, we completed a debt offering comprised of $300

million aggregate principal amount of 4.85% notes due June

15, 2021. Proceeds from the issuance were used to repay

$300 million in term debt that matured in June 2011. The

notes contain customary covenants that limit our ability to

incur certain liens or enter into certain sale and lease-back

transactions. In addition, if we experience a specific kind of

change of control, we are required to make an offer to pur-

chase all of the notes at a purchase price of 101% of the

principal amount thereof, plus accrued and unpaid interest.

MARKET RISK

We have in place an enterprise risk management process

that involves systematic risk identification and mitigation

covering the categories of enterprise, strategic, financial,

operation and compliance and reporting risk. The enter-

prise risk management process receives Board of Directors

and Management oversight, drives risk mitigation decision-

making and is fully integrated into our internal audit plan-

ning and execution cycle.

We are exposed to market risk from changes in foreign

currency exchange rates, domestic and foreign interest

rates, and commodity prices, which can affect our operating

results and overall financial condition. We manage expo-

sure to these risks through our operating and financing

activities and, when deemed appropriate, through the use

of derivatives. Derivatives are viewed as risk management

tools and are not used for speculation or for trading pur-

poses. Derivatives are generally contracted with a diversi-

fied group of investment grade counterparties to reduce

exposure to nonperformance on such instruments.