Whirlpool 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

Significant regional trends were as follows:

• North America gross margin decreased compared to

2010 primarily due to significant increases in material

costs, partially offset by continued productivity improve-

ments and the favorable impact from product price/mix.

Gross margin also reflects the favorable impact from

$78 million in lower product recall charges and a $61

million supplier recovery payment received in 2011, par-

tially offset by $50 million in higher LIFO adjustments and

$27 million in lower postretirement curtailment gains.

North America gross margin for 2010 decreased com-

pared to 2009 primarily due to unfavorable product price/

mix, higher material costs, $43 million in higher product

recall charges, a $45 million variance in LIFO adjustments

compared to 2009 and $18 million in lower postretirement

curtailment gains. These items were partially offset by

continued cost reductions, improved productivity and

higher volumes.

• Latin America gross margin decreased compared to 2010

primarily due to higher material costs and the unfavorable

impact of foreign currency, partially offset by cost reduc-

tions and $41 million in higher BEFIEX credits recognized.

During 2010, Latin America gross margin increased

compared to 2009 primarily due to $156 million higher

BEFIEX credits recognized, cost reductions and improved

productivity, partially offset by unfavorable product

price/mix.

• EMEA gross margin decreased compared to 2010 pri-

marily due to higher material costs and the unfavorable

impact of product price/mix, partially offset by cost

reductions and improved productivity. During 2010, EMEA

gross margin increased compared to 2009 primarily due

to cost reductions and improved productivity, partially

offset by unfavorable product price/mix.

• Asia gross margin decreased compared to 2010 primarily

due to higher material costs, partially offset by productiv-

ity improvements and cost reductions, improved product

price/mix and the favorable impact of foreign currency.

Asia gross margin during 2010 decreased compared to

2009 primarily due to higher material and oil-related

costs and unfavorable product price/mix, partially offset

by the favorable impact of foreign currency.

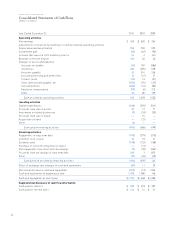

Selling, General and Administrative

Selling, general and administrative expenses remained flat

compared to 2010, with unfavorable foreign currency and

increased brand investments offset by lower employee

incentive compensation. Selling, general and administrative

expenses as a percent of consolidated net sales in 2010

decreased compared to 2009, primarily due to favorable

leverage on increased net sales. Selling, general and

administrative expenses in 2010 increased approximately

$54 million compared to 2009 in Latin America, primarily

due to the unfavorable impact of foreign currency and higher

infrastructure spending to support higher sales volumes.

Research and Development Costs

Research and development costs increased $46 million or

8.6% compared to 2010 to $578 million or 3.1% of consoli-

dated net sales. In 2010, research and development costs

increased $32 million or 6.4% compared to 2009 to $532

million or 2.9% of consolidated net sales. The increases

in 2011 and 2010 were primarily due to increased product

innovation spending.

Restructuring

During the fourth quarter 2011, the Company committed to

restructuring plans (the “2011 Plan”) that will result in sub-

stantial cost and capacity reductions. Including previously

announced restructuring initiatives, we expect to incur

approximately $500 million of total costs beginning in the

fourth quarter 2011 with completion expected by the end

of 2013.

We expect to incur approximately $405 million of future

cash expenditures related to the 2011 Plan. We incurred

total restructuring charges of $136 million, $74 million and

$126 million during the years ended December 31, 2011,

2010 and 2009, respectively.

Interest and Sundry Income (Expense)

Interest and sundry expense increased $410 million com-

pared to 2010 to $607 million, primarily driven by charges

related to the settlement of the Brazilian collection dispute

and Embraco antitrust matters of $528 million in 2011 com-

pared to $146 million in 2010. In addition, 2011 reflects the

unfavorable impact of foreign currency. During 2010, inter-

est and sundry expense increased $22 million compared to

2009 to $197 million, primarily due to higher charges relat-

ing to the Embraco antitrust matters of approximately $40

million, partially offset by the favorable impacts of foreign

currency and higher interest income.

Interest Expense

Interest expense decreased $12 million compared to 2010 to

$213 million, primarily due to lower interest rates, partially

offset by higher average monthly debt levels. During 2010,

interest expense increased compared to 2009, as 2009 ben-

efited from an $8 million reduction in accrued interest as

a result of an operating tax settlement. In addition, 2010

included higher amortization of debt issuance costs, par-

tially offset by a reduction in interest expense due to lower

average debt levels and interest rates.

Income Taxes

The income tax benefit was $436 million, $64 million,

and $61 million in 2011, 2010 and 2009, respectively. The

increase in tax benefit in 2011 compared to 2010 and 2009

is primarily due to a reduction in pre-tax earnings, higher

energy tax credits generated in the United States from the

production of certain eligible energy efficient appliances

and higher non-taxable BEFIEX credits recognized in Brazil.