Whirlpool 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

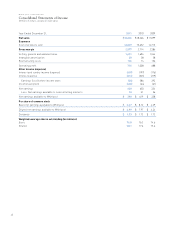

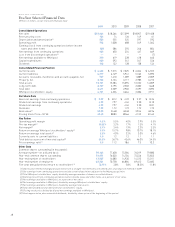

FORWARD-LOOKING PERSPECTIVE

We currently estimate earnings per diluted share, free

cash flow and industry demand for 2012 to be within the

following ranges:

(Millions of dollars, except per share data)

Current Outlook

Estimated earnings per diluted share, for the

year ending December 31, 2012 $5.00–$5.50

Including:

BEFIEX ($60 to $80 million) 0.80–1.00

Restructuring expense ($250–$270 million) (2.30)–(2.50)

Free cash flow $100–$150

Including:

Pension plan contributions (250)–(250)

Brazilian Collection Dispute & Embraco

Antitrust Matters (385)–(385)

Restructuring cash outlays (279)–(279)

BEFIEX 60–80

Industry demand

North America —%–3%

Latin America 2%–5%

EMEA (5)%–(2)%

Asia 2%–4%

The table below reconciles projected 2012 cash provided

by operations determined in accordance with generally

accepted accounting principles in the United States (GAAP)

to free cash flow, a non-GAAP measure. Management

believes that free cash flow provides stockholders with a

relevant measure of liquidity and a useful basis for assess-

ing Whirlpool’s ability to fund its activities and obligations.

There are limitations to using non-GAAP financial measures,

including the difficulty associated with comparing compa-

nies that use similarly named non-GAAP measures whose

calculations may differ from our calculations. We define

free cash flow as cash provided by continuing operations

after capital expenditures and proceeds from the sale of

assets/businesses.

These projections are based on many estimates and are

inherently subject to change based on future decisions

made by management and the Board of Directors of

Whirlpool, and significant economic, competitive and

other uncertainties and contingencies.

(Millions of dollars)

Current Outlook

Cash provided by operating activities $600–$700

Capital expenditures (500)–(550)

Proceeds from sale of assets/businesses —–—

Free cash flow $100–$150

FINANCIAL CONDITION AND LIQUIDITY

Our objective is to finance our business through operating

cash flow and the appropriate mix of long-term and short-

term debt. By diversifying the maturity structure, we avoid

concentrations of debt, reducing liquidity risk. We have

varying needs for short-term working capital financing as

a result of the nature of our business. We regularly review

our capital structure and liquidity priorities, which include

funding the business through capital and engineering

spending to support innovation and productivity initiatives,

funding our pension plan and term debt liabilities, payment

of legacy legal liabilities, return to shareholders and poten-

tial acquisitions in our core business and/or strategic

adjacent business opportunities. These priorities are

aligned with our goal to return our credit ratings to pre-

recession levels.

We have continued to operate under uncertain and volatile

global economic conditions for most of 2011, experiencing

higher material costs, recessionary demand levels in devel-

oped markets and slowing growth in emerging markets. To

succeed in this environment, we have announced aggressive

actions to improve our overall operating performance and

financial condition, including cost-based price increases

across all markets and plans to reduce our cost structure

and production capacity, primarily in North America and

EMEA. Based on the actions taken and announced in 2011,

we believe that operating cash flow, together with access to

sufficient sources of liquidity, will be adequate to meet our

ongoing requirements to fund our operations.

Our short-term potential uses of liquidity include funding

$350 million of term debt maturing in May 2012, $385 mil-

lion related to the Brazilian collection dispute and Embraco

antitrust matters, $279 million of restructuring activities

and approximately $250 million in our United States and

foreign pension plans. At December 31, 2011 and 2010, we

had no borrowings outstanding under credit facilities. We

were in compliance with financial covenant requirements

at December 31, 2011 and 2010.

We monitor the credit ratings and market indicators of

credit risk of our lending, depository, and derivative coun-

terparty banks regularly. We diversify our deposits and

investments in short-term cash equivalents to limit the

concentration of exposure by counterparty. The general

financial instability in the stressed European countries

could have a contagion effect on the region and contribute

to the general instability and uncertainty in the European

Union. At December 31, 2011, Belgium is the only European

country that has cash and cash equivalents and third-party

receivables exceeding 1% of our consolidated assets.

Sources and Uses of Cash

We met our cash needs for 2011 through cash flows from

operations, cash and cash equivalents and financing

arrangements. Our cash and equivalents were $1,109 million

at December 31, 2011 compared to $1,368 million at

December 31, 2010. The decrease in cash during 2011 is

primarily due to a third quarter payment related to the set-

tlement of the Brazilian collection dispute and contributions

to our U.S. funded pension plans, offset by cash generated

from operations.

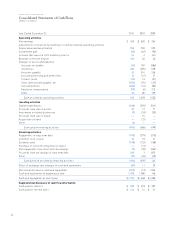

Cash Flows from Operating Activities

The decrease in cash provided by operations during 2011

includes a $301 million payment related to the settlement

of the Brazilian collection dispute, funding of our United

States pension plans of $298 million and lower net earn-

ings, partially offset by significant reductions in inventory.

Cash provided by operating activities in 2010 decreased

$472 million compared to 2009, primarily from required

increases in inventory to support product availability and