Whirlpool 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

Whirlpool offers our suppliers access to a payables presentment

and settlement service (“PPS”) provided by a third party proces-

sor. This service allows our suppliers to view scheduled Whirlpool

payments online, enabling them to better manage their cash

flow and reduce payment processing costs. Independent of

Whirlpool, the PPS provider also allows suppliers to sell their

receivables to financial institutions at the sole discretion of both

the supplier and the financial institution. We have no economic

interest in the sale of these receivables and no direct relation-

ship with financial institutions concerning this service. All of

our obligations, including amounts due, remain to our suppliers

as stated in our supplier agreements. At 2010, approximately

$272 million has been sold by suppliers to participating finan-

cial institutions, compared to $145 million in 2009. If the PPS

provider or participating financial institutions were no longer

willing or able to purchase the receivables from our suppliers,

the suppliers may seek to renegotiate supply terms with us,

which may affect the timing of our cash flows.

In September 2009, we entered into a settlement agreement

with the Brazilian competition commission that requires us to

make payments totaling 100 million Brazilian reais. The pay-

ments are to be made in twelve equal semiannual installments

of approximately $5 million through 2015, totaling approxi-

mately $56 million. As of December 31, 2010, approximately

$15 million of this amount had been paid.

In September 2010, we entered into a plea agreement with the

United States Department of Justice that requires us to pay a

fine totaling $91.8 million to the United States government. The

amount will be paid in one initial installment of $16.8 million

plus accrued interest and five additional annual installments of

$15 million each, plus accrued interest. The first installment of

$16.8 million plus accrued interest was paid in January 2011.

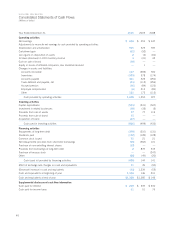

Cash Flows from Investing Activities

Cash used in investing activities in 2010 was $606 million,

an increased outflow of $107 million compared to 2009. The

increase in cash used in investing activities was primarily due to

increased capital spending to support new products and innova-

tion, the purchase of a brand and lower proceeds from the sale

of assets. Cash used in investing activities in 2009 was $499

million compared to an outflow of $433 million in 2008. The

increase in cash used in investing activities in 2009 was pri-

marily due to lower proceeds from the sale of assets in 2009

and higher investments primarily associated with business

acquisition activity in our international locations.

The goal of our global operating platform is to enhance our

competitive position in the global home appliance industry by

reducing costs, driving productivity and quality improvements,

and accelerating our rate of innovation. We plan to continue our

comprehensive worldwide effort to optimize our regional manu-

facturing facilities, supply base, product platforms and technol-

ogy resources to better support our global products, brands and

customers. We intend to make additional investments to improve

our competitiveness in 2011, including capital spending of

between $600 and $650 million.

Cash Flows from Financing Activities

Cash used in financing activities in 2010 was $495 million

compared to a $144 million inflow in 2009. The decrease was

primarily due to a decrease in proceeds from long-term borrow-

ings and the repayment of long-term debt. During 2010, we

repaid $379 million of long-term debt and reduced short-term

debt by $20 million. In addition, we paid dividends to common

stockholders totaling $132 million, and received proceeds from

the issuance of common stock related to option exercises of

$72 million.

Cash provided by financing activities in 2009 was an inflow of

$144 million compared to an inflow of $141 million in 2008.

Cash provided by financing activities in 2009 includes proceeds

received related to two debt offerings totaling $850 million while

2008 includes proceeds received related to the issuance of

$500 million of 5.5% notes due March 1, 2013. In addition,

2009 includes net repayments of short-term borrowings and

long-term debt repayments totaling $572 million compared

to net repayments of $30 million in 2008. During 2009, we

paid dividends to common stockholders totaling $128 million,

paid debt financing fees of $38 million and received proceeds

from the issuance of common stock related to option exercises

of $21 million. During 2008, we repurchased stock totaling

$247 million, paid dividends to common stockholders totaling

$128 million and received proceeds from the issuance of com-

mon stock related to option exercises of $21 million.

Financing Arrangements

We have a $1.35 billion committed credit facility maturing on

August 13, 2012 which includes a $200 million letter of credit

sub-facility. Borrowings under the credit facility are available to

us and designated subsidiaries for general corporate purposes,

including commercial paper support. Subsidiary borrowings under

this facility, if any, are guaranteed by Whirlpool Corporation.

Interest under the credit facility accrues at a variable annual rate

based on LIBOR plus a margin or the prime rate plus a margin.

The margin is dependent on our credit rating at that time. The

credit facility requires us to meet certain leverage and interest

coverage requirements. We will incur a commitment fee for any

unused portion of the credit facility which is based on Whirlpool’s

credit rating. At December 31, 2010 and 2009, we had no

borrowings outstanding under this credit agreement and are in

compliance with financial covenant requirements.

We also had a $522 million committed credit facility which

expired on December 1, 2010. At the expiration date and at

December 31, 2009, we had no borrowings outstanding under

this credit agreement and were in compliance with financial

covenant requirements.

In 2009, we completed a debt offering comprised of (1) $350

million aggregate principal amount of 8.0% notes due May 1,

2012 and (2) $500 million aggregate principal amount of 8.6%

notes due May 1, 2014. If we experience a downgrade in our

credit ratings, the notes are subject to an increase in the interest

rate, resulting in higher interest payments. The notes contain

customary covenants that limit our ability to incur certain liens

or enter into certain sale and lease-back transactions. In addi-

tion, if we experience a specific kind of change of control, we

are required to make an offer to purchase all of the notes at a

purchase price of 101% of the principal amount thereof, plus

accrued and unpaid interest.