Whirlpool 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

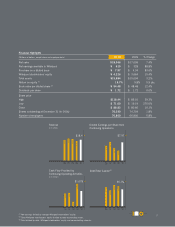

2010 Fiscal Results

We saw a return to growth in 2010 with our revenues growing 7 percent to $18.4 billion.

Net earnings per share were $7.97 per diluted share compared to $4.34 per diluted share

reported for 2009. Cash flow from continuing operations reached $1.1 billion, and we reduced

total debt levels by approximately $400 million. In addition, we paid $132 million in dividends

while maintaining a $1.4 billion cash balance. Overall, we made strong progress toward our

value creation objectives.

Strategy Drives Performance

During the year, we saw improvements in the marketplace despite global pricing pressures

and increasing material costs. Our international businesses performed well, led by our Latin

America and Asia regions. Our North America region saw industry growth for the first time in

four years. We achieved record branded share levels during the year, and we remain confident

in the opportunities that exist in the North America market. As evidence, in 2010 we broke

ground on a new state-of-the-art cooking facility in Tennessee, part of our four-year investment

of $1 billion in our U.S. operating footprint.

We remain committed to delivering all elements of our brand-value creation strategy —

focusing on consumer-relevant innovation, providing the industry’s best service to our trade

customers and end consumers, and driving lower costs and higher product quality across our

global operations. We know that our strong brands, fueled by innovation, enable us to attract

and retain loyal customers for life. And it is through these trusted brands that we provide

strong value to our consumers.

Chairman’s Letter

Jeff M. Fettig

Chairman of the Board and

Chief Executive Officer

+5% – 7% REVENUE

+10% – 15% EARNINGS PER SHARE GROWTH

4% – 5% FREE CASH FLOW* % TO SALES

Value Creation Objectives

*For a definition of Free Cash Flow, see page 34. 3