Whirlpool 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

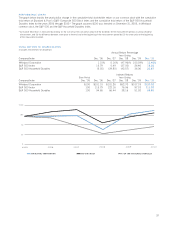

Net Earnings Available to Whirlpool

Net earnings available to Whirlpool increased $291 million

compared to 2009 to $619 million or $7.97 per diluted share.

The increase was primarily due to cost reductions and improved

productivity, $156 million higher BEFIEX credits recognized,

higher energy tax credits and higher volumes, partially offset

by unfavorable product price/mix and higher material and oil-

related costs.

FO RWARD -LOO KIN G PE RSP EC TIV E

For 2011, we currently estimate earnings per diluted share to be

in the range of $12.00 to $13.00, and free cash flow to be in

the range of $400 million to $500 million. This outlook includes

$200 million, or approximately $2.60 per diluted share, of BEFIEX

credits and $300 million, or approximately $4.00 per diluted

share, of United States energy tax credits, that we expect to

earn during 2011. Our estimate of free cash flow includes con-

tributions to our United States pension plans of approximately

$300 million. The energy tax credits are not expected to be

monetized during 2011. In North America we expect industry

demand to increase 2–3% and in Latin America we expect

industry demand to increase 5–10%. In Europe and Asia we

expect industry demand to increase 2–4% and 6–8%, respec-

tively. Inflation is expected to increase material costs by approxi-

mately $250 million to $300 million, largely driven by increases

in component parts, steel and base metals, such as copper, alu-

minum, zinc and nickel. We expect to offset these higher costs

with productivity improvements and new product introductions.

Our innovation product pipeline continues to grow, consumer

and trade response to our new product offerings has been posi-

tive and we continue to accelerate our global branded consumer

products strategy of delivering relevant innovation to markets

worldwide.

The table below reconciles projected 2011 cash provided by

operations determined in accordance with generally accepted

accounting principles in the United States (GAAP) to free cash

flow, a non-GAAP measure. Management believes that free

cash flow provides stockholders with a relevant measure of

liquidity and a useful basis for assessing Whirlpool’s ability

to fund its activities and obligations. There are limitations to

using non-GAAP financial measures, including the difficulty

associated with comparing companies that use similarly named

non-GAAP measures whose calculations may differ from our

calculations. We define free cash flow as cash provided by

continuing operations after capital expenditures and proceeds

from the sale of assets/businesses.

These projections are based on many estimates and are inher-

ently subject to change based on future decisions made by

management and the Board of Directors of Whirlpool, and

significant economic, competitive and other uncertainties and

contingencies.

(Millions of dollars) 2011 Outlook

Cash provided by operating activities $1,000–$1,100

Capital expenditures (600)– (650)

Proceeds from sale of assets/businesses — – 50

Free cash flow $ 400–$ 500

FIN ANCI AL C ONDITIO N AN D LI QUI DIT Y

Our objective is to finance our business through operating cash

flow and the appropriate mix of long-term and short-term debt.

By diversifying the maturity structure, we avoid concentrations

of debt, reducing liquidity risk. We have varying needs for short-

term working capital financing as a result of the nature of our

business. The volume and timing of refrigeration and air condi-

tioning sales impacts our cash flows as we increase inventory to

meet increased demand in the summer months.

We have experienced negative global economic trends in recent

quarters. To succeed in this environment we have recently

announced price increases and have aggressively taken steps to

further reduce all areas of cost, production capacity and working

capital. We believe that operating cash flow, together with access

to sufficient sources of liquidity, will be adequate to meet our

ongoing requirements to fund our operations.

Our cash flow priorities for the business in the near term are

focused on returning our credit ratings to pre-recession levels.

During 2010, we paid down approximately $400 million in debt

while funding our capital expenditures, pension and maintaining

our dividend. Over the next 15 months, we have $650 million

in debt maturities and expect to make a cash pension contribu-

tion of approximately $300 million. We may begin to look at

addressing a portion of our maturities over the next 15 months

as part of our normal capital structure review.

Overall, however, our cash flow and credit rating priorities remain

unchanged from our previous priorities and we will continue to

prioritize our cash flow accordingly.

Sources and Uses of Cash

We expect to meet our cash needs for 2011 from cash flows from

operations, cash and equivalents and financing arrangements.

Our cash and equivalents were $1.4 billion at December 31,

2010 and 2009.

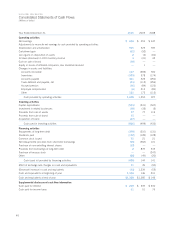

Cash Flows from Operating Activities

Cash provided by operating activities in 2010 was $1,078 mil-

lion, a decrease of $472 million compared to 2009. The reduc-

tion in cash provided by operations primarily resulted from

required increases in inventory to support product availability

and product transitions, partially offset by higher net earnings

and more favorable terms of collection of accounts receivable

and of payment to suppliers. In addition, the significant slowing

of sales growth in the second half resulted in higher than normal

inventory levels of approximately three days. Cash provided by

operating activities in 2009 was $1,550 million, an increase of

$1,223 million compared to 2008. Cash provided by operations

in 2009 included lower payments for inventory, lower cash pay-

ments for accounts payable and other operating accruals and

lower employee compensation payments, partially offset by

lower collections of accounts receivable.