Whirlpool 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 15

Chairman’s Letter

14

TO OUR SHAREHOLDERS – Whirlpool faced many challenges

last year, and we responded appropriately and aggressively

to the changing dynamics of world economies and the

markets in which we participate. As a result, 2002 was an

important year of milestones and accomplishments that

reflect the strength of our operations and the company’s

ability to deliver consistent, ongoing improvements in

operating and revenue performance. For example:

>Net revenues exceeded $11 billion, a record for the

company.

>Excluding one-time charges, full-year core earnings

of $6.07 per diluted share marked a record level of

performance for our operations.

>Through our strategic focus of building unmatched

levels of customer loyalty for our brands globally, we

extended our brand leadership position worldwide.

>Our brands set a record for the most product innovations

ever introduced by the company in a single year,

reinforcing Whirlpool’s standing as the innovation

leader within the appliance industry. Examples of these

innovations are highlighted throughout this report.

>

We successfully integrated two strategically important

acquisitions during the year, and, in doing so, strengthened

our manufacturing and brand positions in North America

and Europe.

>We identified the activities and finalized the charges of

our most significant and important restructuring effort

in the company’s history. When fully implemented, the

restructuring will reduce ongoing structural costs by

more than $200 million a year. Changes to date have

already strengthened our global platform and improved

our manufacturing cost position.

>Improvements in global procurement, technology,

product development and manufacturing helped drive

record levels of productivity savings.

>Our operations generated $290 million of free cash

flow as company-wide efforts resulted in record low

levels of working capital.

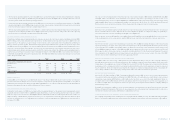

RECORD REVENUES

Revenue growth across most regions during the year led

to record net sales of more than $11 billion and solidified

Whirlpool’s position as the world’s top major appliance

manufacturer and marketer. Contributing to the sales

improvement was the continued growth of the

Whirlpool

brand – the No. 1 selling appliance brand in the world.

Whirlpool Corporation is strongly positioned as the market

leader in the United States, Canada, Latin America, Central

Europe and India. The company also holds the No. 2 market

position in Mexico, and the No. 3 spot in Western and

Central Europe. Whirlpool also continues to build a strong

and growing presence in China.

Throughout the year, our operations leveraged Whirlpool’s

global capabilities and regional market positions to deliver

the record revenue growth and extend our brand leadership.

RESTRUCTURING

We recorded final charges for the company’s global

restructuring effort that we announced in December of 2000.

Since then, the initiative has resulted in restructuring and

related charges totaling $373 million, and the elimination

of more than 7,000 positions worldwide. Much of the

restructuring initiative focused on Whirlpool’s European

operation. The initiative has created a more cost-effective

global structure that is better aligned to support the

company’s value creation strategies. When fully implemented,

the corporate restructuring effort is expected to result in

annualized savings of more than $200 million.

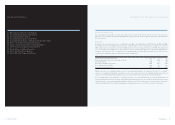

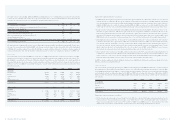

NET AND OPERATING RESULTS

A number of one-time charges contributed to a net loss

of $5.68 per diluted share in 2002. The most significant

of these charges related to the company’s adoption of the

change in accounting principle pertaining to goodwill

(Statement of Financial Accounting Standards No. 142),

final costs for the company’s global restructuring initiative

and the write-off of aircraft-lease assets following the

bankruptcy of UAL Corp.

Excluding these one-time charges, our operations delivered

full-year record core operating earnings of $6.07 per diluted

share, an 11-percent improvement from comparable

earnings in 2001, which was a solid achievement that met

our growth expectations. These results were driven by the

combination of record sales, unprecedented levels of product

innovation, significant cost savings from productivity

improvements and the benefits from restructuring.

Details about the charges, their effect on 2002 net earnings,

and the reconciliation of net earnings to non-GAAP core

earnings are discussed in the Management’s Discussion

and Analysis section of this report.

REGIONAL GROWTH THROUGH ACQUISITION

Whirlpool bolstered its global position during the year

through the acquisition of two strategic businesses in

key markets. In Mexico, we completed the purchase of

Vitromatic S.A. de C.V., which had been a joint venture

between Whirlpool and Vitro S.A. since 1987. Vitromatic,

now called Whirlpool Mexico, is a leading appliance

manufacturer that gives us direct access to the fast-

growing Mexican market. The acquisition extends our

North American manufacturing base and provides

additional export opportunities to countries in the

Caribbean, Central America and northern parts of South

America, as well as to the United States. In Central

Europe, Whirlpool acquired Polar S.A., a leading appliance

manufacturer with the No. 1 brand name in Poland. The

acquisition of Polar improves our brand presence in

Central Europe and provides Whirlpool Europe with a

low-cost manufacturing source to serve the entire region.

RECORD PACE OF INNOVATION

Our brands introduced a record number of product

innovations to consumers worldwide in 2002. The

introductions contributed to our record sales results

and helped drive higher levels of customer loyalty to our

brands. Over the last three years, we have built and

embedded within our global enterprise the skills and

capabilities required to discover, develop and rapidly

bring to market true innovation. These innovations are

giving our brands a sustainable competitive advantage

in the marketplace and creating value for our customers,

trade partners and shareholders.

Chairman’s Letter

> David R. Whitwam

Chairman of the Board and Chief Executive Officer