Whirlpool 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 31

Management’s Discussion and Analysis

RESULTS OF OPERATIONS

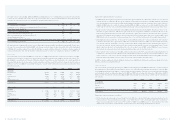

The consolidated statements of operations summarize operating results for the last three years. This section of

Management’s Discussion and Analysis highlights the main factors affecting changes in operating results during the

three-year period.

EARNINGS

Earnings from continuing operations were $262 million in 2002 versus $34 million and $367 million in 2001 and 2000.

The significant increase in 2002 relates primarily to the $181 million in after-tax product recall charges recorded in

2001, slightly lower restructuring expenses in 2002 and improved operating performance over 2001. The significant

decrease in 2001 versus 2000 is due to the product recall and restructuring expenses recognized in 2001. Charges

relating to the cumulative effect of changes in accounting principle and discontinued operations are excluded from

earnings from continuing operations but included in net earnings (loss).

Millions of dollars, except per share data 2002 2001 2000

Earnings from continuing operations $ 262 $ 34 $ 367

Diluted earnings per share from continuing operations 3.78 0.50 5.20

Net earnings (loss) (394) 21 367

Diluted net earnings (loss) per share (5.68) 0.31 5.20

Core earnings from operations 420 371 367

Diluted core earnings per share 6.07 5.45 5.20

Whirlpool provides core earnings analysis as a view of the underlying strength of our operations. The term “core earnings”

refers to net earnings excluding the cumulative effects of the adoption of new accounting standards, discontinued

operations, restructuring and related charges, write-off of asset impairments, and product recall related charges.

Core earnings improved for 2002 due to a strong performance in our North American operations, which achieved

strong growth in both sales and earnings, along with a significant improvement in earnings in our European operations

and the benefits of our restructuring and ongoing productivity efforts. These combined to offset the effects of economic

and political instability in Latin American markets accompanied by severe currency fluctuations for the region.

Financial Contents

30

Financial Contents

Management’s Discussion and Analysis

Consolidated Statements of Operations

Consolidated Balance Sheets

Consolidated Statements of Cash Flows

Consolidated Statements of Changes in Stockholders’ Equity

Notes to Consolidated Financial Statements

Reports of Independent Auditors and Management

Eleven-Year Consolidated Statistical Review

Shareholders’ and Other Information

Directors & Executive Committee

Senior Officers & Company Addresses

31

41

42

44

45

46

70

72

74

75

76