Whirlpool 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 35

Management’s Discussion and Analysis

34

> The European gross margin increased versus 2001 due to productivity improvements and savings from the ongoing

restructuring efforts in Europe. In 2001, the gross margin decreased from 2000 levels due to higher material costs, an

inventory write-down and continued pricing pressures.

> Latin American gross margin declined versus 2001 due to lower sales levels and higher material prices. The 2001

gross margin improved over 2000 as improved product mix, lower pension costs, productivity gains and restructuring

benefits offset material price increases and pricing pressures.

> The Asian gross margin declined versus 2001 due to unfavorable product mix and pricing pressures. Asian gross

margin increased slightly in 2001 versus 2000 as productivity improvements and product mix offset pricing

pressures due to weakening economies included in this region.

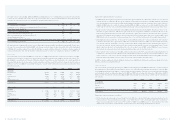

SELLING, GENERAL AND ADMINISTRATIVE

Consolidated selling, general and administrative expenses as a percent of net sales remained unchanged versus 2001.

While selling, general and administrative expenses for the North American region increased over 2001 levels, the

region’s increase in expense as a percentage of sales relates to the acquisition of the remaining 51% of Whirlpool

Mexico and lower pension credits. Consolidated selling, general and administrative expenses as a percent of net sales

for 2001 decreased versus 2000 as cost controls implemented in North America and global restructuring benefits more

than offset increased bad debt expense, increased stock compensation costs, new product introduction costs,

restructuring related charges and lower pension credits. The table below outlines the selling, general and administrative

expenses as a percentage of sales by region, excluding the impact of the 2002 and 2001 restructuring related charges

of $17 million and $9 million from the regional amounts. The 2002 and 2001 restructuring related charges are included

in the “Corporate/Other” line.

As a % As a % As a %

Millions of dollars 2002 of Sales 2001 of Sales 2000 of Sales

Selling, general & administrative expenses

North America $ 894 12.2% $ 788 12.0% $ 825 13.3%

Europe 407 18.5 386 18.8 386 17.9

Latin America 189 15.0 250 16.8 263 15.4

Asia 70 17.8 74 19.9 76 19.4

Corporate/Other 176 –141 –101 –

Consolidated $ 1,736 15.8% $ 1,639 15.8% $ 1,651 16.0%

PRODUCT RECALLS

During 2001, we recognized a total of $295 million of pre-tax charges ($181 million after-tax) related to two separate

product recalls. These charges were recorded as a separate component of operating profit. During 2002, we recognized

additional recall related pre-tax charges of approximately $9 million for one of these recalls. See Note 14 to the Consolidated

Financial Statements for a more detailed description of these charges.

RESTRUCTURING AND RELATED CHARGES

During the fourth quarter of 2002, we recognized the remaining charges for the global restructuring plan that was

originally announced in December of 2000. The plan, which had a total restructuring and related pre-tax cost of $373

million, is expected to result in more than $200 million in annualized savings once fully implemented. At December 31,

2002, a liability of $122 million remains for actions yet to be implemented under the plan. Actions under the plan

include the elimination of over 7,000 positions worldwide, of which approximately 5,000 had been eliminated as of

December 31, 2002.

Our various restructuring initiatives resulted in pre-tax restructuring charges of $101 million and $150 million in 2002

and 2001. These amounts have been identified as a separate component of operating profit. As a result of our

restructuring activity, we also recognized $60 million and $62 million in pre-tax restructuring related charges during

2002 and 2001, which were recorded primarily within cost of products sold. See Note 13 to the Consolidated Financial

Statements for a more detailed description of these charges and the company’s restructuring program.

OTHER INCOME AND EXPENSE

Interest income and sundry expense, which includes foreign currency gains and losses, financial service fees in Latin

America and miscellaneous asset dispositions, increased slightly in expense as compared to 2001, due primarily to

lower interest income, and was essentially flat in 2001 versus 2000 levels.

Interest expense decreased $19 million versus 2001, which was $18 million lower than 2000. Both decreases were due

to the declining interest rate environment, and the 2002 decrease was further driven by lower average debt levels.

INCOME TAXES

The effective income tax rate from continuing operations was 35% in 2002 (excluding the impact of the restructuring

and related charges, the write-off of equity interest and advances, the goodwill impairment and the product recall

related charges), 35% in 2001 (excluding the impact of the product recall and restructuring and related charges) and

35% in 2000. Including the impact of the 2002 and 2001 charges mentioned above, the effective tax rate was 39% and

46%, respectively. See the income tax rate reconciliation included in Note 15 to the Consolidated Financial Statements

for a description of the significant items impacting our consolidated effective income tax rate. We expect the 2003

effective tax rate from continuing operations to be approximately 36%.

EQUITY IN EARNINGS (LOSS) OF AFFILIATED COMPANIES

The 2002 results were reduced by a $22 million after-tax impairment charge related to the company’s minority

investments in and advances to a European business. The company acquired its initial investment in this entity with

its purchase of the appliance operations of Philips Electronics N.V. in 1989. Continued deterioration in the German

marketplace led to overcapacity in the wood cabinet industry, which resulted in the business revising its estimated

future cash flows. These circumstances prompted the company to conduct an impairment review, resulting in the

above charge, which is reflected in equity earnings (loss) in the consolidated statement of operations.

DISCONTINUED OPERATIONS

As a result of the United Airlines (“UAL”) bankruptcy filing in December 2002, we wrote off our related investment in

leveraged aircraft leases during the fourth quarter of 2002. The write-off resulted in a non-cash charge to discontinued

operations of approximately $68 million, or $43 million after tax. Also, as a result of the UAL bankruptcy filing, we

reclassified the related $49 million deferred tax liability on the leveraged leases to current taxes payable as of

December 31, 2002. These leveraged lease assets were part of our previously discontinued finance company, Whirlpool

Financial Corporation.

During the second quarter of 2001, we wrote off an investment in a securitized aircraft portfolio that was also owned by

Whirlpool Financial Corporation. The write-off, due primarily to the softening aircraft leasing industry, resulted in a

loss from discontinued operations of $35 million, or $21 million after-tax.

CUMULATIVE EFFECT OF CHANGES IN ACCOUNTING PRINCIPLE

The company adopted Statement of Financial Accounting Standards (“SFAS”) No. 142, “Goodwill and Other Intangible

Assets,” on January 1, 2002. As a result of this adoption, the company recorded a non-cash, after-tax charge of $613 million.