Whirlpool 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 53

Notes to Consolidated Financial Statements

52

During the second quarter of 2001, the company wrote off a portion of WFC’s investment in securitized aircraft leases.

The write-off, due primarily to the softening aircraft leasing industry, resulted in a loss from discontinued operations of

$35 million, or $21 million after-tax.

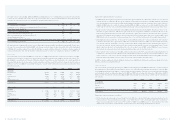

>06 INVENTORIES

December 31 –Millions of dollars 2002 2001

Finished products $ 928 $ 949

Work in process 71 58

Raw materials 226 239

1,225 1,246

Less excess of FIFO cost over LIFO cost (136) (136)

Total inventories $ 1,089 $ 1,110

LIFO inventories represent approximately 33% and 39% of total inventories at December 31, 2002 and 2001, respectively.

>07 ASSET IMPAIRMENT

The company recorded a $22 million after-tax impairment charge in the second quarter of 2002 related to its minority

investments in and advances to a European business. The company acquired its initial investment in this entity with

its purchase of the appliance operations of Philips Electronics N.V. in 1989. Continued deterioration in the marketplace

led to overcapacity in the wood cabinet industry, which resulted in the business revising its estimated future cash

flows. These circumstances prompted the company to conduct an impairment review, resulting in the above charge,

which is reflected in equity earnings (loss) in the consolidated statement of operations.

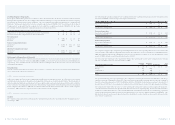

>08 FINANCING ARRANGEMENTS

Notes Payable and Debt

At December 31, 2002, the company had committed unsecured revolving lines of credit available from banks totaling

$1.2 billion. The lines of credit are comprised of a committed $800 million credit agreement, which expires in June

2006, and a committed $400 million 364-day credit agreement maturing in May 2003. These committed lines support

the company’s commercial paper programs and other liquidity needs. The interest rate for borrowing under the credit

agreements is generally based on the London Interbank Offered Rate plus a spread that reflects the company’s debt

rating. The credit agreements require that the company maintain a maximum debt to EBITDA ratio and a minimum

interest coverage ratio. At December 31, 2002, the company was in compliance with its financial covenants. The credit

agreements provide the company with access to adequate and competitive funding under unusual market conditions.

During 2002, there were no borrowings outstanding under the credit agreements.

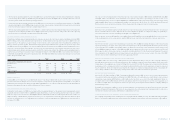

Notes payable consist of the following:

December 31 –Millions of dollars 2002 2001

Payable to banks $ 208 $ 139

Commercial paper 13 9

Total notes payable $ 221 $ 148

The fair value of the company’s notes payable approximates the carrying amount due to the short maturity of these

obligations. The weighted average interest rate on notes payable was 5.7% and 7.6% at December 31, 2002 and 2001.

Long-term debt consists of the following:

December 31 –Millions of dollars 2002 2001

Debentures – 9% due 2003 $ 200 $ 200

Eurobonds (EUR 300 million) – 5.875% due 2006 310 264

Debentures – 9.1% due 2008 125 125

Notes – 8.6% due 2010 325 325

Debentures – 7.75% due 2016 243 243

Other (various interest rates with maturities of 2002-2012) 100 157

$ 1,303 $ 1,314

Less current maturities 211 19

Total long-term debt, net of current maturities $ 1,092 $ 1,295

Annual maturities of long-term debt in the next five years are $211 million, $15 million, $5 million, $318 million and $8

million.

The company paid interest on short-term and long-term debt totaling $141 million, $151 million and $181 million in

2002, 2001 and 2000, respectively.

The fair value of long-term debt (including current maturities) was $1,457 million and $1,348 million as of December 31,

2002 and 2001, and was estimated using discounted cash flow analyses based on incremental borrowing rates for similar

types of borrowing arrangements.

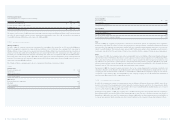

Preferred Stock

Although most of its assets have been divested, WFC remains a legal entity with assets consisting primarily of leveraged

leases (see Note 5). WFC also has 349,300 shares of Series B preferred stock outstanding as of December 31, 2002, with

a face value of $100 per share, an annual dividend of $6.55 per share and a mandatory redemption date of September 1,

2008. As of December 31, 2001, WFC had the above listed Series B preferred stock outstanding as well as 250,000

shares of Series C preferred stock outstanding with a face value of $100 per share, an annual dividend of $6.09 per share

and a mandatory redemption date of February 1, 2002. The Series C preferred stock was redeemed on the mandatory

redemption date. The preferred stock amounts are included within minority interests in the consolidated balance

sheets, and the carrying amounts approximate fair value.

The preferred stockholders are entitled to vote together on a share-for-share basis with WFC’s common stockholder,

Whirlpool Corporation. Preferred stock dividends are payable quarterly. At its option, WFC may redeem the Series B at

any time on or after September 1, 2003. The redemption price is $100 per share plus any accrued unpaid dividends and

the applicable redemption premium, if redeemed early. Commencing September 1, 2003, WFC must pay $1,750,000 per

year to a sinking fund for the benefit of the Series B preferred stockholders, with a final payment of $26,250,000 due on

or before September 1, 2008.

The company and WFC are parties to a support agreement. Pursuant to the agreement, if at the close of any quarter

WFC’s net earnings available for fixed charges (as defined) for the preceding 12 months is less than a stipulated

amount, the company is required to make a cash payment to WFC equal to the insufficiency within 60 days of the end

of the quarter. The company was not required to make any payments under this agreement during 2002, 2001 or 2000.

The support agreement may be terminated by either WFC or the company upon 30 days notice, provided that certain

conditions are met. The company has also agreed to maintain ownership of at least 70% of WFC’s voting stock.