Whirlpool 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

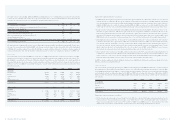

2002 Annual Report 41

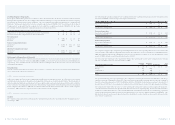

Consolidated Statements of Operations

Year Ended December 31 – Millions of dollars except per share data 2002 2001 2000

Net sales $ 11,016 $ 10,343 $ 10,325

Expenses

Cost of products sold 8,464 7,925 7,838

Selling, general and administrative 1,736 1,639 1,651

Intangible amortization 14 28 29

Product recall costs 9 295 –

Restructuring costs 101 150 –

Operating Profit 692 306 807

Other income (expense)

Interest income and sundry (54) (51) (50)

Interest expense (143) (162) (180)

Earnings from continuing operations before income taxes and other items 495 93 577

Income taxes 193 43 200

Earnings from continuing operations

before equity earnings and minority interests 302 50 377

Equity in earnings (loss) of affiliated companies (27) (4) 3

Minority interests (13) (12) (13)

Earnings from continuing operations 262 34 367

Discontinued operations, net of tax (43) (21) –

Cumulative effect of change in accounting principle, net of tax (613) 8 –

Net earnings (loss) $ (394) $ 21 $ 367

Per share of common stock

Basic earnings from continuing operations $ 3.86 $ 0.51 $ 5.24

Discontinued operations, net of tax (0.62) (0.32) —

Cumulative effect of change in accounting principle, net of tax (9.03) 0.12 —

Basic net earnings (loss) $ (5.79) $ 0.31 $ 5.24

Diluted earnings from continuing operations $ 3.78 $ 0.50 $ 5.20

Discontinued operations, net of tax (0.62) (0.31) —

Cumulative effect of change in accounting principle, net of tax (8.84) 0.12 —

Diluted net earnings (loss) $ (5.68) $ 0.31 $ 5.20

Dividends $ 1.36 $ 1.36 $ 1.36

Weighted-average shares outstanding: (millions)

Basic 67.9 66.7 70.2

Diluted 69.3 68.0 70.6

See notes to consolidated financial statements

Management’s Discussion and Analysis

40

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or

on behalf of the company. Management’s Discussion and Analysis and other sections of this report may contain forward-

looking statements that reflect our current views with respect to future events and financial performance.

Certain statements contained in this annual report and other written and oral statements made from time to time by

the company do not relate strictly to historical or current facts. As such, they are considered “forward-looking statements”

which provide current expectations or forecasts of future events. Such statements can be identified by the use of

terminology such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “could,” “possible,” “plan,” “project,”

“will,” “forecast,” and similar words or expressions. Our forward-looking statements generally relate to our growth

strategies, financial results, product development and sales efforts. These forward-looking statements should be

considered with the understanding that such statements involve a variety of risks and uncertainties, known and

unknown, and may be affected by inaccurate assumptions. Consequently, no forward-looking statement can be

guaranteed, and actual results may vary materially.

Many factors could cause actual results to differ materially from the company’s forward-looking statements. Among

these factors are: (1) competitive pressure to reduce prices; (2) the ability to gain or maintain market share in intensely

competitive global markets; (3) the success of our global strategy to develop brand differentiation and brand loyalty; (4)

our ability to control operating and selling costs, and to maintain profit margins during industry downturns; (5) the

success of our Latin American businesses operating in challenging and volatile environments; (6) continuation of our

strong relationship with Sears, Roebuck and Co. in North America, which accounted for approximately 21% of our

consolidated net sales of $11 billion in 2002; (7) currency exchange rate fluctuations; (8) social, economic and political

volatility in developing markets; (9) continuing uncertainty in the North American, Latin American, Asian and European

economies; (10) changes in North America’s consumer preferences regarding how appliances are purchased; (11) the

effectiveness of the series of restructuring actions the company has announced and/or completed through 2002; and

(12) the threat of terrorist activities or the possibility of war.

We undertake no obligation to update every forward-looking statement, and investors are advised to review disclosures

in our filings with the Securities and Exchange Commission. It is not possible to foresee or identify all factors that

could cause actual results to differ from expected or historic results. Therefore, investors should not consider the

foregoing factors to be an exhaustive statement of all risks, uncertainties, or factors that could potentially cause

actual results to differ.