Whirlpool 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 55

Notes to Consolidated Financial Statements

54

>09 GUARANTEES, COMMITMENTS AND CONTINGENCIES

Guarantees

The company guarantees the bills of exchange related to a European business (“affiliate”) in which Whirlpool is a

minority shareholder. These bills of exchange are short-term agreements, usually for 90 days, which allow the issuer to

convert its receivables into cash, less a minor fee paid to the bank. The bills of exchange are issued both by the company

for loans made to the affiliate and by the affiliate for its trade accounts receivable. In the event the affiliate defaults on

its obligations under any of the bills of exchange, the company would be liable for the related amounts. The company

has limited recourse provisions against the assets of the affiliate in the event of its insolvency. As of December 31, 2002

and 2001, the company had approximately $30 million and $24 million of guarantees outstanding for the bills of

exchange related to the affiliate.

The company also has guarantee arrangements in place in a Brazilian subsidiary. As a standard business practice in

Brazil, the subsidiary guarantees customer lines of credit at commercial banks following its normal credit policies. In

the event that a customer were to default on its line of credit with the bank, the subsidiary would be required to satisfy

the obligation with the bank, and the receivable would revert back to the subsidiary. The total amount of the related

guarantees at December 31, 2002 and 2001, is approximately $66 million and $124 million, respectively. The only recourse

available on these guarantees would be legal or administrative collection efforts directed against the customer.

The company provides guarantees of indebtedness for various consolidated subsidiaries. Guarantee agreements for

consolidated subsidiaries totaled $1.4 billion and $1.3 billion at December 31, 2002 and 2001, respectively.

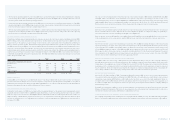

Product warranty reserves are established in the same period that revenue from the sale of the related products is

recognized. The amounts of those reserves are based on established terms and the company’s best estimate of the

amounts necessary to settle future and existing claims on products sold as of the balance sheet date. The product

warranty reserves increased in 2002 due to increased sales volume and an extension of certain product warranty terms

from one to two years in various European operations. The following represents a reconciliation of the changes in product

warranty reserves for the periods presented:

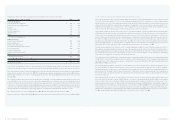

December 31 –Millions of dollars 2002 2001

Balance at January 1 $ 108 $ 114

Warranties issued 228 198

Warranties acquired 7 –

Settlements made (214) (203)

Other changes (1) (1)

Balance at December 31 $ 128 $ 108

Current portion $71$63

Non-current portion 57 45

Total $ 128 $ 108

Commitments and Contingencies

The company is involved in various legal actions arising in the normal course of business. Management, after taking

into consideration legal counsel’s evaluation of such actions, is of the opinion that the outcome of these matters will

not have a material adverse effect on the company’s financial position.

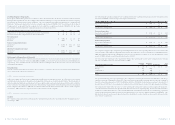

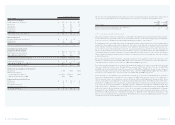

At December 31, 2002, the company had non-cancelable operating lease commitments totaling $203 million. The annual

future minimum lease payments are detailed in the table below.

Millions of dollars

2003 $54

2004 41

2005 34

2006 31

2007 26

Thereafter 17

Total non-cancelable operating lease commitments $ 203

The company’s rent expense was $72 million, $98 million and $93 million for the years 2002, 2001 and 2000, respectively.

>10 HEDGES AND DERIVATIVE FINANCIAL INSTRUMENTS

The company is exposed to market risk from changes in foreign currency exchange rates, domestic and foreign interest

rates, and commodity prices. Fluctuations in these rates and prices can affect the company’s operating results and

financial condition. The company manages its exposure to these market risks through its operating and financing

activities, and through the use of derivative financial instruments. The company does not enter into derivative financial

instruments for trading purposes.

Using derivative markets means assuming counter-party credit risk. Counter-party risk relates to the loss the company could

incur if a counter-party defaulted on a derivative contract. The company deals only with investment-grade counterparties to

these contracts and monitors its overall credit risk and exposure to individual counter-parties. The company does not

anticipate nonperformance by any counter-parties. The amount of counter-party credit exposure is generally the unrealized

gains on such derivative contracts. The company does not require, nor does it post, collateral or security on such contracts.

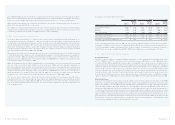

The following summarizes the outstanding derivative contracts at December 31, 2002 and 2001, and the exposures to

which they relate:

Notional Amount

in Millions of Dollars

Exposure Derivative 2002 2001 Hedge Type Term

Forecasted cross Foreign exchange $ 324 $ 421 Cash flow or Various, up to

currency cashflows forwards fair value hedge 18 months

Non-functional Foreign exchange $ 533 $501 Undesignated Various, up to 6 months

currency asset/liability forwards

Raw Material Commodity $ 29 $ 14 Cash flow hedge Various, up to 18 months

Purchases swaps

Floating Rate Debt Interest $ 100 $100 Cash flow hedge 2006

rate swaps

Fixed Rate Debt Interest $ 200 $ – Fair value hedge 2003

rate swaps