Whirlpool 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 71

Report of Independent Auditors and Management

70

The Stockholders and Board of Directors

Whirlpool Corporation

Benton Harbor, Michigan

We have audited the accompanying consolidated balance sheets of Whirlpool Corporation as of December 31, 2002 and

2001, and the related consolidated statements of operations, stockholders’ equity and cash flows for each of the three

years in the period ended December 31, 2002. These financial statements are the responsibility of the Company’s

management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States. Those

standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial

statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the

amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used

and significant estimates made by management, as well as evaluating the overall financial statement presentation. We

believe our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the

consolidated financial position of Whirlpool Corporation as of December 31, 2002 and 2001, and the consolidated

results of its operations and its cash flows for each of the three years in the period ended December 31, 2002, in

conformity with accounting principles generally accepted in the United States.

As discussed in Note 3 to the consolidated financial statements, in 2002 the Company changed its method of accounting

for goodwill and other intangible assets. As discussed in Note 1 to the consolidated financial statements, in 2001 the

Company changed its method of accounting for derivative instruments and hedging activities.

Chicago, Illinois

February 4, 2003

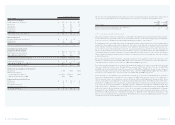

The management of Whirlpool Corporation has prepared the accompanying financial statements. The financial statements

have been audited by Ernst & Young LLP, independent auditors, whose report, based upon their audits, expresses the

opinion that these financial statements present fairly the consolidated financial position, results of operations and cash flows

of Whirlpool and its subsidiaries in accordance with accounting principles generally accepted in the United States. Their

audits are conducted in conformity with auditing standards generally accepted in the United States.

The financial statements were prepared from the company’s accounting records, books and accounts which, in reasonable

detail, accurately and fairly reflect all material transactions. The company maintains a system of internal controls

designed to provide reasonable assurance that the company’s accounting records, books and accounts are accurate and

that transactions are properly recorded in the company’s books and records, and the company’s assets are maintained and

accounted for, in accordance with management’s authorizations. The company’s accounting records, policies and internal

controls are regularly reviewed by an internal audit staff.

The audit committee of the board of directors of the company is composed of five independent directors who, in the opinion of

the board, meet the relevant financial experience, literacy, and expertise requirements. The audit committee provides

independent and objective oversight of the company’s accounting functions and internal controls and monitors the

objectivity of the company’s financial statements, (2) the company’s compliance with legal and regulatory requirements,

(3) the independent auditor’s qualifications and independence, and (4) the performance of the company’s internal audit function

and independent auditors. In performing these functions, the committee has the responsibility to review and discuss

the annual audited financial statements and quarterly financial statements and related reports with management and

independent auditors, including the company’s disclosures under “Management’s Discussion and Analysis of Financial

Condition and Results of Operations;” to monitor the adequacy of financial disclosure; and to retain and terminate the company’s

independent auditors and exercise the committee’s sole authority to review and approve all audit engagement fees and

terms and preapprove the nature, extent, and cost of all non-audit services provided by independent auditors (for 2002 and

prior, the board of directors held this responsibility).

R. Stephen Barrett, Jr.

Executive Vice President and Chief Financial Officer

February 27, 2003

Report of Ernst & Young LLP, Independent Auditors Report by Management on the Consolidated Financial Statements