Whirlpool 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 67

Notes to Consolidated Financial Statements

66

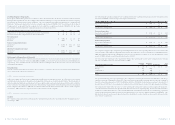

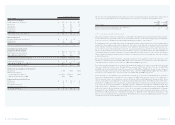

Postretirement Medical Benefits

Millions of dollars 2002 2001 2000

Change in benefit obligation

Benefit obligation as of January 1 $ 525 $ 439 $ 414

Service cost 14 11 9

Interest cost 41 34 32

Amendments (9) (43) –

Actuarial loss 123 108 6

Benefits paid (39) (24) (22)

Benefit obligation as of December 31 $ 655 $ 525 $ 439

Change in plan assets

Fair value of plan assets as of January 1 $ – $ – $ –

Contributions 39 24 22

Benefits paid (39) (24) (22)

Fair value of plan assets as of December 31 $ – $ – $ –

Reconciliation of prepaid (accrued)

cost and total amount recognized

Funded status as of December 31 $ (655) $ (525) $ (439)

Unrecognized actuarial (gain) loss 215 87 (21)

Unrecognized prior service cost (47) (43) –

Prepaid (accrued) cost as of December 31 $ (487) $ (481) $ (460)

Prepaid cost at December 31 $ – $ – $ –

Accrued benefit liability at December 31 (487) (481) (460)

Total recognized as of December 31 $ (487) $ (481) $ (460)

Weighted average assumptions as of December 31

Discount rate 6.75% 7.50% 8.00%

Medical costs trend rate:

For year ending December 31 9.5-10.5% 8.5-10.5% 6.00%

Ultimate medical trend rate (2006) 5.50% 6.00%

Components of net periodic benefit cost

Service cost $14$11$ 9

Interest cost 41 34 32

Recognized actuarial loss 5 ––

Amortization of prior service cost (4) ––

Net periodic benefit cost $ 56 $ 45 $ 41

The medical cost trend significantly affects the reported postretirement benefit cost and benefit obligations. A

one-percentage-point change in the assumed health care cost trend rate would have the following effects:

One One

Percentage Percentage

Point Point

Millions of dollars Increase Decrease

Effect on total service cost and interest cost components $ 1 $ (2)

Effect on postretirement benefit obligation 17 (19)

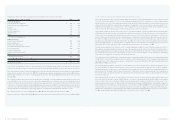

>17 BUSINESS SEGMENT INFORMATION

Operating segments are defined as components of an enterprise about which separate financial information is available

that is evaluated on a regular basis by the chief operating decision maker, or decision making group, in deciding how

to allocate resources to an individual segment and in assessing performance of the segment.

The company identifies such segments based upon geographical regions of operations because each operating segment

manufactures home appliances and related components, but serves strategically different markets. The chief operating

decision maker evaluates performance based upon each segment’s operating income, which is defined as income

before interest income and sundry, interest expense, taxes, minority interests, and before one-time charges. Total

assets by segment are those assets directly associated with the respective operating activities. The “Other/Elimination”

column primarily includes corporate expenses, assets and eliminations, as well as all other one-time charges. Intersegment

sales are eliminated within each region with the exception of compressor sales out of Latin America, which are included

in Other/Eliminations.

Sales activity with Sears, Roebuck and Co., a North American major home appliance retailer, represented 21%, 21%

and 20% of consolidated net sales in 2002, 2001, 2000, respectively. Related receivables were 23%, 25% and 22% of

consolidated trade receivables as of December 31, 2002, 2001 and 2000, respectively.

The company conducts business in two countries that individually comprised over 10% of consolidated net sales and

total assets within the last three years. The United States represented 59%, 59%, and 55% of net sales for 2002, 2001

and 2000, respectively, while Brazil totaled 8%, 9% and 11% for 2002, 2001 and 2000, respectively. As a percentage of

total assets, the United States accounted for 40%, 44% and 41% at the end of 2002, 2001 and 2000, respectively. Brazil

accounted for 11%, 14% and 18% of total assets at the end of 2002, 2001 and 2000, respectively.

As described above, the company’s chief operating decision maker reviews each operating segment’s performance

based upon operating income excluding one-time charges. In 2002, these one-time charges were comprised of

restructuring and other related charges, product recall charges and goodwill impairment charges in Asia. These

charges are included in operating profit on a consolidated basis and included in the Other/Eliminations column in the

tables below. For 2002 year-to-date amounts, the operating segments recorded total restructuring and related charges

(refer to Note 13) as follows: North America – $43 million, Europe – $79 million, Latin America – $24 million, Asia – $11

million and Corporate – $4 million, for a total of $161 million. Also included in Other/Eliminations during 2002 is $9

million of product recall related charges (refer to Note 14) recorded in the fourth quarter and $9 million in goodwill

impairment charges. In 2001, the operating segments recorded total restructuring and related charges as follows:

North America – $35 million, Europe – $92 million, Latin America – $68 million, Asia – $13 million and Corporate – $4

million for a total of $212 million. Also included in the Other/Eliminations column during 2001 is $295 million of product

recall charges related to the North American region.