Whirlpool 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 57

Notes to Consolidated Financial Statements

56

Forecasted cross currency cashflows relate primarily to foreign currency denominated expenditures and intercompany

financing agreements, royalty agreements and dividends. Non-functional currency asset and liability hedges are

undesignated, but relate primarily to short-term payables and receivables and intercompany loans. Commodity swaps

relate to raw material purchases (for example, copper and aluminum) used in the manufacturing process. Unrealized

gains and losses on the above foreign currency exchange contracts and commodities swaps were not significant as of

December 31, 2002 and 2001.

The company’s $100 million interest-rate swap maturing in 2006 is designated and is effective as a hedge of future

cash payments, and is treated as a cash-flow hedge for accounting purposes. The fair value of this contract was a loss

of $12 million as of December 31, 2002, and a loss of $4 million as of December 31, 2001.

The company’s $200 million interest-rate swap maturing in 2003 is designated and is effective as a hedge of future

cash payments and is treated as a fair-value hedge for accounting purposes. The fair value of this contract was a gain

of $1 million as of December 31, 2002.

The company has designated a portion of its Euro-denominated, fixed-rate debt as a hedge to protect the value of its

net investments in its European subsidiaries. Translation adjustments related to this debt are not included in the

income statement, but are shown in the cumulative translation adjustment account included in accumulated other

comprehensive income. During the year ended December 31, 2002, the company recognized $1 million of net losses

included in the cumulative translation adjustment related to this net-investment hedge.

During the years ended December 31, 2002 and 2001, the company’s gains and losses related to the ineffective portion

of its hedging instruments were immaterial. The company did not recognize any gains or losses during the years ended

December 31, 2002 and 2001, for cash-flow hedges that were discontinued because the forecasted transaction was not

probable to occur.

The amount of unrealized gains and losses on derivative instruments included in other comprehensive income at

December 31, 2002, that will be reclassified into earnings during 2003 is not significant.

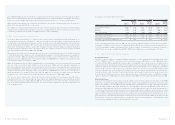

The company managed a portfolio of domestic and cross-currency interest-rate swaps that effectively converted U.S.

dollar denominated debt into that of various European currencies. Through May 15, 2000, such local currency

denominated debt served as an effective hedge against the company’s European cash flows and net assets. On May

15, 2000, the company undesignated these contracts as hedges of the net investment in its European operations and

entered into offsetting Euro-denominated currency swaps, effectively locking in its positive cash position on the

original swap portfolio. These contracts were not designated as hedges and, therefore, were marked-to-market each

period through earnings as a component of interest expense, with unrealized gains (losses) on the May 2000 swap

contracts substantially offsetting subsequent unrealized (losses) gains on the original swap portfolio. On October 5,

2001, the company monetized the above-referenced swaps, receiving $209 million in cash.

The net transaction losses recognized in other income (expense) in the statement of operations, including gains and

losses from those contracts not qualifying as hedges, were $17 million in 2002, $11 million in 2001 and $17 million in 2000.

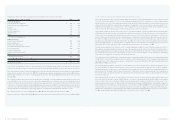

>11 STOCKHOLDERS’ EQUITY

On February 15, 2000, the company announced that its Board of Directors approved an extension of the company’s stock

repurchase program to $1 billion. The additional $750 million share repurchase authorization extends the previously

authorized $250 million repurchase program that was announced March 1, 1999. The shares are to be purchased in the open

market and through privately negotiated sales as the company deems appropriate. The company has purchased 12.7 million

shares at a cost of $683 million through December 31, 2002, under this stock repurchase program, of which 8.7 million

shares ($427 million) were purchased in 2000, 0.7 million shares ($43 million) were purchased in 2001, and 0.7 million shares

($46 million) were purchased in 2002. The 2002 shares were purchased from one of the company’s U.S. pension plans at an

average cost of $66.32 per share, which was based upon an average of the high and low market prices on the date of purchase.

The 2001 share repurchases included 0.6 million shares that were purchased from one of the company’s U.S. pension

plans at a cost of $41 million, or $67.78 per share, which was based upon an average of the high and low market prices

on the date of purchase.

In addition to its common stock, the company has 10 million authorized shares of preferred stock (par value $1 per

share), none of which is outstanding.

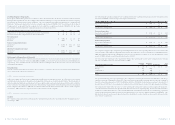

Accumulated other comprehensive income (loss), net of tax, consists of:

Millions of dollars 2002 2001

Foreign currency translation adjustments $ (821) $ (673)

Derivative financial instruments (20) (17)

Minimum pension liability adjustments (158) (7)

Total $ (999) $ (697)

Preferred Stock Purchase Rights

One Preferred Stock Purchase Right (Rights) is outstanding for each share of common stock. The Rights, which expire

May 22, 2008, will become exercisable 10 days after a person or group (an Acquiring Person) has acquired, or obtained

the right to acquire, beneficial ownership of 15% or more of the outstanding common stock (the Trigger Date) or 10

business days after the commencement, or public disclosure of an intention to commence, a tender offer or exchange

offer by a person that could result in beneficial ownership of 15% or more of the outstanding common stock. Each Right

entitles the holder to purchase from the company one one-thousandth of a share of a Junior Participating Preferred

Stock, Series B, par value $1.00 per share, of the company at a price of $300 per one one-thousandth of a Preferred

Share subject to adjustment.

If a person becomes an Acquiring Person, proper provision shall be made so that each holder of a Right, other than

Rights that are or were beneficially owned by the Acquiring Person (which will thereafter be void), shall thereafter

have the right to receive upon exercise of such Right that number of shares of common stock (or other securities) having

at the time of such transaction a market value of two times the exercise price of the Right. If a person becomes an

Acquiring Person and the company is involved in a merger or other business combination transaction where the

company is not the surviving corporation or where common stock is changed or exchanged or in a transaction or

transactions in which 50% or more of its consolidated assets or earning power are sold, proper provision shall be made

so that each holder of a Right (other than such Acquiring Person) shall thereafter have the right to receive, upon the

exercise thereof at the then current exercise price of the Right, that number of shares of common stock of the acquiring

company which at the time of such transaction would have a market value of two times the exercise price of the Right.

In addition, if an Acquiring Person, does not have beneficial ownership of 50% or more of the common stock, the

company’s Board of Directors has the option of exchanging all or part of the Rights for an equal number of shares of

common stock in the manner described in the Rights Agreement.

Prior to the Trigger Date, the Board of Directors of the company may redeem the Rights in whole, but not in part, at a