Whirlpool 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 59

Notes to Consolidated Financial Statements

58

price of $.01 per Right, payable in cash, shares of common stock or any other consideration deemed appropriate by the

Board of Directors. Immediately upon action of the Board of Directors ordering redemption of the Rights, the ability of

holders to exercise the Rights will terminate and such holders will only be able to receive the redemption price.

Until such time as the Rights become exercisable, the Rights have no voting or dividend privileges and are attached to,

and do not trade separately from, the common stock.

The company covenants and agrees that it will cause to be reserved and kept available at all times a sufficient number

of shares of Preferred Stock (and following the occurrence of a Triggering Event, shares of common stock and/or other

securities) to permit the exercise in full of all Rights from time to time outstanding.

>12 STOCK OPTION AND INCENTIVE PLANS

Stock option and incentive plans are accounted for in accordance with Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees,” and related Interpretations. Generally, no compensation expense is

recognized for stock options with exercise prices equal to the market value of the underlying shares of stock at the date

of grant. Stock options generally have 10-year terms, and vest and become fully exercisable over a two-year period after

date of grant. Compensation expense related to the company’s stock based incentive plans is recognized ratably over

each plan’s defined vesting period. Pre-tax expenses under the company’s stock based incentive plans were $20

million, $26 million and $1 million in 2002, 2001 and 2000.

The company’s stock option and incentive plans permit the grant of stock options and other stock awards covering up

to 14.5 million shares to key employees of the company and its subsidiaries, of which 4.9 million shares are available for

grant at December 31, 2002. Outstanding restricted and phantom shares totaled 1,557,123 with a weighted-average

grant-date fair value of $56.01 per share at December 31, 2002, and 1,060,000 with a weighted-average grant-date fair

value of $55.35 per share at December 31, 2001.

Under the Nonemployee Director Stock Ownership Plan, each nonemployee director is automatically granted 400

shares of common stock annually and is eligible for a stock option grant of 600 shares if the company’s earnings meet a

prescribed earnings formula. In addition, each nonemployee director is awarded annually deferred compensation in

the form of 400 shares of phantom stock, which is converted into common stock on a one-for-one basis and paid when

the director leaves the Board. This plan provides for the grant of up to 300,000 shares as either stock or stock options, of

which 152,385 shares are available for grant at December 31, 2002. The stock options vest and become exercisable six

months after date of grant. There were no significant expenses under this plan for 2002, 2001 or 2000.

The fair value of stock options used to compute proforma net earnings and diluted net earnings per share disclosures,

as presented in Note 1, is the estimated present value at grant date using the Black-Scholes option-pricing model with

the following assumptions for 2002, 2001 and 2000: expected volatility of 33.8%, 32.6% and 28.6%; dividend yield of

2.2%, 2.3% and 2.7%; risk-free interest rate of 2.7%, 4.3% and 5.1%, and a weighted-average expected option life of 5

years for all three years.

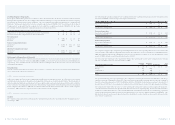

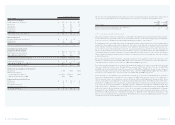

A summary of stock option information follows:

2002 2001 2000

Weighted- Weighted- Weighted-

Average Average Average

Number Exercise Number Exercise Number Exercise

Thousands of shares,except per share data of Shares Price of Shares Price of Shares Price

Outstanding at January 1 6,066 $ 51.83 6,437 $ 50.86 4,605 $ 52.21

Granted 1,466 67.07 1,401 54.30 2,222 47.59

Exercised (1,395) 51.48 (1,508) 50.19 (190) 42.23

Canceled or expired (172) 52.72 (264) 50.49 (200) 53.83

Outstanding at December 31 5,965 $ 55.63 6,066 $ 51.83 6,437 $ 50.86

Exercisable at December 31 3,639 $ 52.59 3,574 $ 52.68 3,545 $ 52.44

Fair value of options granted during the year $ 18.28 $ 15.59 $ 12.23

Of the outstanding options at December 31, 2002, 2.6 million options, of which 2.3 million are exercisable at a weighted-

average price of $49.24, have exercise prices ranging from $38.38 to $52.47 and a weighted-average remaining life of 6.3

years. The remaining 3.4 million outstanding options, of which 1.3 million are exercisable at a weighted-average price

of $57.97, have exercise prices ranging from $53.06 to $77.85 and a weighted-average remaining life of 7.6 years.

>13 RESTRUCTURING AND RELATED CHARGES

Restructuring Charges

Through December 31, 2002, the company had approved all phases of a restructuring program that began in the fourth

quarter of 2000 and resulted in cumulative pre-tax restructuring charges of $251 million, of which $101 million was

recognized during 2002 and $150 million was recognized during 2001. These charges have been identified as a

separate component of operating profit. The restructuring plan and related charges relate primarily to the closing of a

refrigeration plant in the company’s Latin American region, a parts packing facility and a cooking plant in the North

American region, a plastic components facility in the Asian region, the relocation of several laundry manufacturing

facilities in Europe, and a restructuring of the company’s microwave business in its European region. Employees

terminated to date under the plan include both hourly and salaried employees.However, the majority are hourly

personnel at the facilities listed above. For the initiatives announced through December 31, 2002, the company

expects to eliminate over 7,000 employees, of which approximately 5,000 had left the company through December 31, 2002.

Other Related Charges

As a result of the company’s restructuring activity, $122 million of pre-tax restructuring related charges, of which $60

million was recognized during 2002 and $62 million was recognized during 2001, have also been recorded primarily

within cost of products sold. The 2002 charges include $4 million and $1 million write-downs of buildings in the North

American and Latin American regions, inventory write-offs of $1 million in Europe, and $16 million of miscellaneous

equipment in North America, Europe and Latin America, as well as $38 million in cash costs incurred during the year

for various restructuring related activities, such as relocating employees and equipment and concurrent operating

costs. The 2001 charges included $12 million in write-downs of various fixed assets, primarily buildings that are no

longer used in the company’s business activities in its Latin American region, $7 million of excess inventory due to the

parts distribution consolidation in North America, $25 million in various assets in its North American, European and

Asian regions, which were primarily made up of equipment no longer used in its business, and $18 million in cash

costs incurred during 2001 for various restructuring related activities.