Whirlpool 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 63

Notes to Consolidated Financial Statements

62

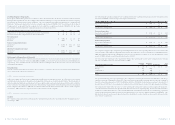

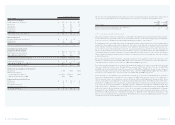

Significant components of the company’s deferred tax liabilities and assets are as follows:

Year ended December 31 –Millions of dollars 2002 2001

Deferred tax liabilities

Property, plant and equipment $ 150 $ 115

Financial services leveraged leases 69 120

Pensions 11 95

Software costs 16 21

Contested liabilities 24 22

LIFO Inventory 17 14

Other 108 73

Total deferred tax liabilities 395 460

Deferred tax assets

Postretirement obligation 205 196

Restructuring costs 29 12

Product warranty accrual 21 19

Receivable and inventory allowances 47 35

Loss carryforwards 260 182

Product recall reserves –93

Employee payroll and benefits 71 45

Other 130 144

Total deferred tax assets 763 726

Valuation allowances for deferred tax assets (65) (29)

Deferred tax assets, net of valuation allowances 698 697

Net deferred tax assets $ 303 $ 237

Other deferred tax liabilities relate to temporary differences in multiple foreign jurisdictions and various other items.

Other deferred tax assets relate to various reserves and accrued expenses, financing activities, and various other items.

The company has recorded valuation allowances to reflect the estimated amount of net operating loss carryforwards

that may not be realized. At December 31, 2002, the company has foreign net operating loss carryforwards of $632 million,

$525 million of which do not expire, with substantially all of the remaining $107 million expiring in various years

through 2007.

The company provides deferred taxes on the undistributed earnings of foreign subsidiaries and affiliates to the extent

such earnings are expected to be remitted. Generally, earnings have been remitted only when no significant net tax

liability would have been incurred. No provision has been made for U.S. or foreign taxes that may result from future

remittances of the undistributed earnings ($440 million at December 31, 2002) of foreign subsidiaries and affiliates

expected to be reinvested indefinitely. Determination of the deferred income tax liability on these unremitted earnings

is not practicable as such liability, if any, is dependent on circumstances existing when remittance occurs.

The company paid income taxes of $126 million in 2002, $148 million in 2001 and $262 million in 2000.

Income taxes payable of $186 million and $109 million are included in other current liabilities at December 31, 2002 and 2001.

>16 PENSION AND POSTRETIREMENT MEDICAL BENEFITS PLANS

The company sponsors defined benefit pension plans and defined contribution 401(k) plans for active employees and

certain medical benefit plans for retirees. The company’s funding policy is to contribute to its U.S. pension plans

amounts sufficient to meet the minimum funding requirement as defined by employee benefit and tax laws, plus

additional amounts which the company may determine to be appropriate. In certain countries other than the U.S., the

funding of pension plans is not common practice. The company has several unfunded, non-U.S. pension plans in certain

of these countries. The company pays for retiree medical benefits as they are incurred.

The company’s defined benefit pension plans include contributory and non-contributory plans and cover substantially

all North American employees and certain Brazilian and European employees. Pension benefits are based primarily on

either service and compensation during a specified period before retirement or specified amounts for each year of

service. Plan assets are held in trust and consist primarily of common stock and fixed income securities and cash. At

December 31, 2002, stocks represent 75% of the market value of pension assets for the U.S. plans, and fixed income

securities and cash represent 25%. As of December 31, 2002, the company’s U.S. pension plans held as investments

approximately $51 million, or 1 million shares, of Whirlpool Corporation common stock. This investment represented

approximately 4% of the total market value of assets held by these plans as of December 31, 2002.

The U.S. pension plans provide that in the event of a plan termination within five years following a change in control of

the company, any assets held by the plans in excess of the amounts needed to fund accrued benefits would be used to

provide additional benefits to plan participants. A change in control generally means either a change in the majority of

the incumbent board of directors or an acquisition of 25% or more of the voting power of the company’s outstanding

stock, without the approval of a majority of the incumbent board.

The company maintains a 401(k) defined contribution plan covering substantially all U.S. employees. Company matching

contributions for domestic hourly and certain other employees under the plan, based on the company’s annual operating

results and the level of individual participant’s contributions, amounted to $16 million, $12 million and $12 million in

2002, 2001 and 2000, respectively.

The company sponsors plans to provide selected health care benefits for eligible retired employees. Eligible retirees

are those full-time U.S. employees with 10 years of service who have attained age 55 while in service with the company.

The company’s practice with respect to these plans is to fund expenses as incurred. The Plan is currently noncontributory

and contains cost-sharing features such as deductibles, coinsurance and a lifetime maximum. The company has

reserved the right to modify the benefits. No significant postretirement medical benefits are provided by the company

to non-U.S. employees.

The company’s pension plans were underfunded on a combined basis as of December 31, 2002, which resulted in a

non-cash, after-tax charge to equity of $151 million to recognize a minimum pension liability. While certain plans

were overfunded, the projected benefit obligation, accumulated benefit obligation, and fair value of plan assets for the

underfunded plans at December 31, 2002, were $1,572 million, $1,414 million and $1,168 million. Although the company’s

pension plans were overfunded on a combined basis as of December 31, 2001 and 2000, several of the plans did not hold

or had minimal assets and were therefore underfunded. The projected benefit obligation, accumulated benefit obligation,

and fair value of plan assets for these plans were $197 million, $187 million and $109 million, respectively, as of December

31, 2001, and $83 million, $73 million and $6 million, respectively, as of December 31, 2000.