Whirlpool 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 65

Notes to Consolidated Financial Statements

64

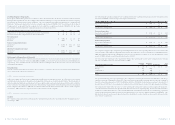

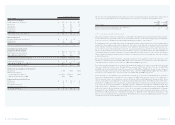

The company’s obligations and related expense for pension and postretirement health care plans are as follow:

Pension Benefits

US Foreign

Millions of dollars 2002 2001 2000 2002 2001 2000

Change in benefit obligation

Benefit obligation as of January 1 $ 1,269 $ 1,090 $ 1,044 $ 145 $ 193 $ 198

Service cost 56 53 38 7 8 10

Interest cost 95 88 86 11 13 15

Plan participants’ contributions ––––––

Amendments 29 48 11 (11) (3) –

Business combinations –––25 ––

Actuarial (gain) loss 124 55 44 12 (4) (6)

Settlements ––––(36) –

Benefits paid (70) (65) (165) (8) (11) (10)

Curtailments –––(13) (1) –

Special termination benefits ––32 –(3) –

Foreign currency exchange rate changes –––4 (11) (14)

Benefit obligation as of December 31 $ 1,503 $ 1,269 $ 1,090 $ 172 $ 145 $ 193

Change in plan assets:

Fair value of plan assets as of January 1 $ 1,460 $ 1,794 $ 2,050 $ 97 $ 147 $ 151

Actual return on plan assets (203) (275) (72) 1 6 15

Employer contributions 3 6 1 2 1 2

Settlements –––(11) (36) –

Plan participants’ contributions –––11–

401 (h) transfer ––(20) –––

Benefits paid (70) (65) (165) (8) (11) (10)

Foreign currency exchange rate changes –––(1) (11) (11)

Fair value of plan assets as of December 31 $ 1,190 $ 1,460 $ 1,794 $ 81 $ 97 $ 147

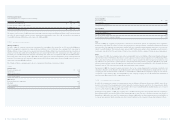

Pension Benefits (continued)

US Foreign

Millions of dollars 2002 2001 2000 2002 2001 2000

Reconciliation of prepaid (accrued)

cost and total amount recognized:

Funded status as of December 31 $ (313) $ 191 $ 704 $ (91) $ (48) $ (46)

Unrecognized actuarial loss (gain) 407 (118) (659) 17 (17) (42)

Unrecognized prior service cost 129 115 78 5 6 1

Unrecognized transition asset –(1) (3) 1 8 14

Prepaid (accrued) cost as of December 31 $ 223 $ 187 $ 120 $ (68) $ (51) $ (73)

Prepaid cost $ 43 $ 219 $ 155 $ –$5$5

Accrued benefit liability (188) (37) (43) (92) (63) (80)

Intangible asset 128 (5) (1) 5 5 2

Equity Charge and Other 240 10 9 19 2 –

Total recognized as of December 31 $ 223 $ 187 $ 120 $ (68) $ (51) $ (73)

Assumptions as of December 31

Discount rate 6.75% 7.50% 8.00% 5.5 - 11.3% 5.0 - 11.3% 5.0 - 11.3%

Expected return on assets 8.75% 10.00% 10.50% 5.5 - 11.3% 6.0 - 11.3% 6.0 - 11.3%

Rate of compensation increase 4.50% 5.00% 5.00% 2.5 - 8.0% 2.5 - 8.0% 1.0 - 8.0%

Components of net periodic

benefit cost (credit)

Service cost $ 56 $ 53 $ 38 $ 6 $ 8 $ 10

Interest cost 95 89 86 11 12 15

Expected return on plan assets (175) (177) (164) (7) (12) (14)

Recognized actuarial (gain) (22) (35) (37) (1) (1) (2)

Amortization of prior service cost 14 11 10 –––

Amortization of transition asset (1) (2) (4) 2 2 3

Net periodic benefit cost (credit) (33) (61) (71) 11 9 12

Curtailments –––(10) (1) –

Special termination benefits ––32 (2) 3 –

Settlements ––(71) (3) (20) –

Total pension cost (credit) $ (33) $ (61) $ (110) $ (4) $ (9) $ 12