Whirlpool 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 37

Management’s Discussion and Analysis

36

The company adopted SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended on

January 1, 2001. The adoption of Statement No. 133 resulted in $8 million of income, net of tax, in the company’s

statement of operations and a $11 million decrease, net of tax, in stockholders’ equity.

See Notes 1 and 3 to the Consolidated Financial Statements for a more detailed description of these changes in

accounting principles.

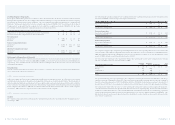

CASH FLOWS

The statements of cash flows reflect the changes in cash and equivalents for the last three years by classifying

transactions into three major categories: operating, investing and financing activities.

OPERATING ACTIVITIES

Our main source of cash flow is from operating activities consisting of net earnings adjusted for changes in operating assets

and liabilities, such as receivables, inventories and payables, and for non-cash operating items, such as depreciation.

Cash provided by operating activities totaled $812 million in 2002, $1,024 million in 2001 and $445 million in 2000. The

decrease in 2002 relates primarily to the $239 million in product recall payments made during the year and to changes

in deferred and current taxes. The increase in 2001 versus 2000 includes a $527 million improvement in working capital

cash flows versus 2000, of which $464 million was in accounts receivable.

INVESTING ACTIVITIES

The principal recurring investing activities are capital expenditures, which were $430 million, $378 million and $375

million in 2002, 2001 and 2000, respectively.

On November 18, 2002, we acquired the remaining 20% interest in Whirlpool Narcissus Shanghai Company Limited

(“Narcissus”) for $9 million. In accordance with the purchase agreement, 40% of the purchase price was paid during

2002, with the remaining 60% to be paid during 2003.

On July 3, 2002, we acquired the remaining 51% ownership in Vitromatic S.A. de C.V. (Whirlpool Mexico), an appliance

manufacturer and distributor in Mexico. The aggregate purchase price was $151 million in cash plus assumption of

outstanding debt at the time of acquisition, which totaled $143 million.

On June 5, 2002, we acquired 95% of the shares of Polar S.A. (Polar), a leading major home appliance manufacturer in

Poland. The aggregate purchase price was $27 million in cash plus outstanding debt at the time of acquisition, which

totaled $19 million.

On October 5, 2001, we closed our position in a portfolio of cross currency interest rate swaps resulting in the receipt of

$209 million.

On January 7, 2000, we completed our tender offer for the outstanding publicly traded shares in Brazil of our

subsidiaries Brasmotor and Multibras S.A. Eletrodomesticos (Multibras). In completing the offer, we purchased

additional shares of Brasmotor and Multibras for $283 million, bringing our equity interest in these companies to

approximately 94%. With this additional investment, our combined equity interest in all Brazilian subsidiaries

increased from approximately 55% to approximately 87%.

FINANCING ACTIVITIES

Total borrowings (repayments) of short-term and long-term debt were $(152) million, $(569) million and $546 million in

2002, 2001 and 2000, respectively, excluding the effect of currency fluctuations and acquired debt.

On July 3, 2001, we issued 300 million euro denominated 5.875% Notes, due 2006. The notes are general obligations of

the company, and the proceeds were used for general corporate purposes.

Dividends paid to stockholders totaled $91 million, $113 million and $70 million in 2002, 2001 and 2000, respectively.

The large payment in 2001 was affected by the timing of funding for the fourth quarter 2000 payment, which was paid on

January 2, 2001.

Under our stock repurchase program, we purchased 0.7 million shares ($46 million) in 2002, 0.7 million shares ($43

million) in 2001 and 8.7 million shares ($427 million) in 2000. See Note 11 to the Consolidated Financial Statements for

additional detail on the company’s stock repurchase program.

FINANCIAL CONDITION AND LIQUIDITY

Our financial position remains strong. At December 31, 2002, our total assets were $6.6 billion versus $7.0 billion at the

end of 2001. Stockholders’ equity declined from $1.5 billion at the end of 2001 to $0.7 billion at the end of 2002. The

decreases were primarily the result of a $613 million charge relating to the adoption of SFAS No. 142, “Goodwill and

Other Intangible Assets,” a $151 million charge to equity to recognize a minimum liability on defined benefit pension

plans and $148 million in foreign currency translation adjustments.

During 2002, long-term debt of $162 million was assumed through our acquisitions of Whirlpool Mexico and Polar.

Excluding this assumed debt, total debt for the company decreased by $100 million, as strong cash flows funded the

acquisition costs and were used to reduce indebtedness.

In May 2002, we renewed our existing $400 million committed 364-day credit facility for another 364 days. We also have

a $800 million committed credit facility that was entered into on June 1, 2001, and matures in 2006. These committed

facilities support our commercial paper programs and other operating needs. There were no borrowings under these

facilities during 2002 or 2001. We were in full compliance with our bank covenants throughout both 2002 and 2001.

None of our material debt agreements requires accelerated repayment in the event of a decrease in credit ratings. Our

debt continues to be rated investment grade by Moody’s (Baa1), Standard & Poor’s (BBB+) and Fitch (A-).

We guarantee the indebtedness of a European affiliate and certain customers of a Brazilian subsidiary as discussed in

Note 9 to the Consolidated Financial Statements. We do not expect these guarantees to have a material effect on our

financial condition or liquidity.

We believe that our capital resources and liquidity position at December 31, 2002, are adequate to meet anticipated

business needs and to fund future growth opportunities. Currently, we have access to capital markets in the U.S. and

internationally. See Note 8 to the Consolidated Financial Statements for additional details on our committed credit

facilities and debt obligations.

OTHER MATTERS

In December 1996, Multibras and Empresa Brasileira de Compressores S.A. (Embraco), Brazilian subsidiaries, were granted

additional export incentives in connection with the Brazilian government’s export incentive program (Befiex). These

incentives allowed the use of credits as an offset against current Brazilian federal excise tax on domestic sales. We

recognized credits of $42 million, $53 million and $52 million in 2002, 2001 and 2000, respectively, as a reduction of current

excise taxes payable and, therefore, an increase in net sales. The company’s remaining credits are approximately

$207 million at December 31, 2002. However, we do not expect to recognize additional Befiex credits beyond the first

quarter of 2003 until the calculation of the credit, which is currently under review, is confirmed by the Brazilian courts.

At December 31, 2002, our defined benefit pension plans were underfunded on a combined basis. Poor equity market

performance reduced the value of pension assets, while extremely low interest rates reduced the discount rate, which

increased the present value of liabilities. As a result, we recorded a $151 million, after-tax, non-cash charge to equity

during the fourth quarter of 2002 to recognize a minimum liability as required under SFAS No. 87, “Employers’

Accounting for Pensions.” We recognized consolidated pre-tax pension credits of $24 million, $70 million and $98

million in 2002, 2001 and 2000. The assumptions used in determining our obligation under our U.S. pension plans at