Whirlpool 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 33

Management’s Discussion and Analysis

32

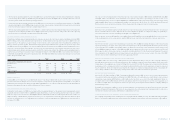

The table below reconciles 2002, 2001 and 2000 net earnings (loss) to core earnings from operations. The adjustments

to arrive at core earnings from operations are presented in the table on an after-tax and minority interests basis and

reference the related notes to the accompanying consolidated financial statements:

Millions of dollars 2002 2001 2000

Net earnings (loss) – U.S. GAAP $ (394) $ 21 $ 367

Cumulative effect of changes in accounting principle (Notes 1 and 3) 613 (8) -

Discontinued operations (Note 5) 43 21 -

Earnings from continuing operations 262 34 367

Restructuring and related charges (Note 13) 121 156 -

Write-off of equity interest and advances (Note 7) 22 - -

Goodwill impairment (Note 3) 9 - -

Product recall related charges (Note 14) 6 181 -

Core earnings from operations $ 420 $ 371 $ 367

We expect that the company will continue to face challenging economic conditions worldwide during 2003. Despite this,

we expect to see moderate growth during 2003, reflecting an accelerated pace of innovation and continued strengthening

of Whirlpool brands throughout the world. We will also recognize additional benefits from the recently completed

restructuring initiative and other productivity efforts. As a result, we expect to see improved earnings over 2002 levels.

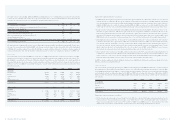

NET SALES

The total number of units sold in 2002 increased 7.8% over 2001. Consolidated net sales increased 6.5% over 2001,

which includes a negative impact from currency fluctuations. Excluding currency impact, net sales increased 7.3%.

Excluding the acquisitions of Vitromatic (Whirlpool Mexico) and Polar, as described in Note 4 to the Consolidated

Financial Statements, the total number of units and dollars sold increased 4.6% and 4.2%, respectively. Net sales in

2001 were up 3% over 2000 after excluding the impact of currency. The tables below provide the breakdown of units

and sales by region.

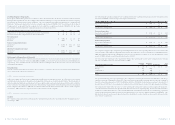

In thousands 2002 Change 2001 Change 2000

Units Sold:

North America 24,324 13.6% 21,404 3.7% 20,634

Europe 11,024 2.0 10,803 (0.7) 10,876

Latin America 4,386 (7.4) 4,738 (3.7) 4,918

Asia 2,279 11.2 2,050 4.7 1,958

Other/eliminations (31) –(36) –(31)

Consolidated 41,982 7.8% 38,959 1.6% 38,355

Millions of dollars 2002 Change 2001 Change 2000

Net Sales:

North America $ 7,306 11.0% $ 6,581 5.8% $ 6,223

Europe 2,199 6.9 2,058 (4.5) 2,156

Latin America 1,266 (14.9) 1,487 (12.8) 1,706

Asia 391 4.8 373 (4.4) 390

Other/eliminations (146) –(156) –(150)

Consolidated $ 11,016 6.5% $ 10,343 0.2% $ 10,325

Significant regional trends were as follows:

> In 2002, North American unit volumes increased 13.6%. Approximately one-third of the volume increase resulted

from the inclusion of Whirlpool Mexico in the company’s consolidated results since July 2002, when the remaining

51% ownership interest was acquired. While the North American industry was up, our market share in the region fell

slightly in 2002 from its record levels achieved during 2001. In 2002, net sales increased by slightly less than unit

volumes as the current year’s acquisition combined with competitive pricing pressures reduced average sales values.

> European unit volumes increased 2.0% versus 2001 in an industry that was down slightly. The increase is due to the

inclusion of sales from Polar, which we acquired in the second quarter of 2002 as described in Note 4 to the

Consolidated Financial Statements. Net sales increased by a larger percentage due primarily to positive currency

fluctuations. Excluding currency impact, net sales increased 1.7%. European unit volumes were down in 2001 versus

2000 and net sales decreased by a larger percentage due to currency fluctuations and continued pricing pressures.

> Unit shipments in Latin America decreased 7.4% versus 2001 due primarily to political instability and economic

volatility in the region. The region’s sales, which were down 14.9% compared to 2001, were also heavily affected by

currency fluctuations, including a currency devaluation in Brazil of approximately 35%. Excluding the impact of

currency fluctuations, net sales decreased 3.9%, which was less than the decrease in units shipped due to some

improvements in product mix and pricing. Net sales were also lower in 2001 versus 2000 due to an economic

slowdown in the region, an energy crisis in Brazil and Argentina, and currency fluctuations.

> Asia’s unit sales increased 11.2% over 2001, while net sales increased by 4.8% as product mix and pricing pressures

combined to reduce the benefit of higher volumes. Excluding currency fluctuations, net sales increased 5.2%. The

region continues to experience increased shipments in both the India and China markets. During 2001, Asia also

posted growth in units shipped, but net sales were hurt by currency and product mix issues.

In 2003, we believe appliance industry shipments will increase slightly in North America and Asia, remain flat in Latin

America, and decrease slightly in Europe.

GROSS MARGIN

The consolidated gross margin percentage in 2002 decreased slightly versus 2001 due primarily to continued global

pricing pressures offsetting productivity improvements. The consolidated gross margin percentage declined in 2001

versus 2000 due primarily to the impact of restructuring and related charges. The table below outlines the gross margin

percentages by region, excluding the impact of the 2002 and 2001 restructuring related charges of $43 million and $53

million from the regional percentages. The 2002 and 2001 restructuring related charges are included in the consolidated

percentages.

2002 Change 2001 Change 2000

Gross Margin

North America 23.6% 0.1pts 23.5% (0.8)pts 24.3%

Europe 22.2 0.9 21.3 (2.0) 23.3

Latin America 23.4 (2.6) 26.0 3.1 22.9

Asia 23.7 (2.5) 26.2 0.1 26.1

Consolidated 23.2% (0.2)pts 23.4% (0.7)pts 24.1%

Significant regional trends were as follows:

> North American gross margin increased slightly versus 2001 due to productivity improvements partially offset by

lower pension credits and increased warranty costs. This increase came on sharply higher sales resulting in

improved operating profit for the region. The decline in 2001 versus 2000 was due to unfavorable product and

channel mix, lower pension credits and increased warranty costs offsetting productivity improvements.