Whirlpool 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 61

Notes to Consolidated Financial Statements

60

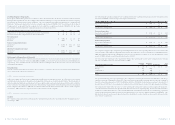

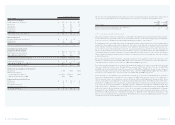

Details of the restructuring liability balance and full year restructuring and related activity for 2002 and 2001 are as follows:

Beginning Charge Ending

Millions of dollars Balance to Earnings Cash Paid Non-cash Translation Acquisitions Balance

2002

Restructuring

Termination costs $ 73 $ 92 $ (60) $ –$ 4 $ 7 $ 116

Non-employee exit costs 4 9 (7) –––6

Related charges

Miscellaneous buildings – 5 – (5) –––

Inventory – 1 – (1) –––

Miscellaneous equipment –16 –(16) –––

Various cash costs –38 (38) ––––

Total $ 77 $ 161 $ (105) $ (22) $ 4 $ 7 $ 122

2001

Restructuring

Termination costs $ 5 $ 134 $ (64) $ –$(2)$ –$73

Non-employee exit costs –16 (12) –––4

Related charges

Miscellaneous buildings –12 –(12) –––

Inventory – 7 – (7) –––

Miscellaneous equipment –25 –(25) –––

Various cash costs –18 (18) ––––

Total $ 5 $ 212 $ (94) $ (44) $ (2) $ –$77

>14 PRODUCT RECALLS

In September 2001, the company announced a voluntary recall of 1.8 million microwave hood combination units sold under

the Whirlpool, KitchenAid, and Sears Kenmore brands. The company recognized a product recall pre-tax charge of $300

million ($184 million after tax) during the third quarter of 2001 and recorded this charge as a separate component of

operating profit. During the fourth quarter of 2001 this liability was reduced by $79 million ($48 million after tax) due to

the development of a more efficient service repair procedure, which enabled faster repairs and reduced costs. During 2002,

the company incurred additional charges of approximately $9 million ($6 million after tax) for costs related to this recall.

In January of 2002, the company announced a voluntary recall of approximately 1.4 million dehumidifier units sold

under the Whirlpool, ComfortAire, and Sears Kenmore brands. The company recognized a product recall pre-tax

charge of $74 million ($45 million after tax) during the fourth quarter of 2001 and recorded this charge as a separate

component of operating profit.

>15 INCOME TAXES

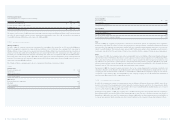

Income tax expense from continuing operations are as follows:

Year ended December 31 – Millions of dollars 2002 2001 2000

Current:

Federal $ 101 $ 201 $ 149

State and local (6) 14 14

Foreign 109 34 34

204 249 197

Deferred:

Federal 47 (121) 26

State and local 3 (21) 3

Foreign (61) (64) (26)

(11) (206) 3

Total income tax expense $ 193 $ 43 $ 200

Domestic and foreign earnings (loss) from continuing operations before income taxes and other items are as follows:

Year ended December 31 – Millions of dollars 2002 2001 2000

Domestic $ 485 $ 204 $ 479

Foreign 10 (111) 98

Total earnings from continuing operations before taxes and other items $ 495 $ 93 $ 577

Earnings before income taxes and other items, including discontinued operations (refer to Note 5), were $427 million, $58 million

and $577 million for 2002, 2001 and 2000, respectively.

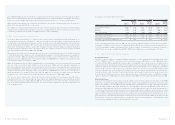

Reconciliations between tax expense at the U.S. federal statutory income tax rate of 35% and the consolidated effective

income tax rate for earnings before income taxes and other items from continuing operations are as follows:

Year ended December 31 – Millions of dollars 2002 2001 2000

Income tax expense computed at U.S. federal statutory rate $ 173 $ 33 $ 202

State and local taxes, net of federal tax benefit 3 (4) 5

Nondeductible expenses 6 7 (1)

Nondeductible goodwill amortization –66

Excess foreign taxes 411 1

Foreign dividends and subpart F income 7 13 13

Foreign government tax incentive (15) (22) (21)

Foreign tax credits (19) (9) (10)

Deductible interest on capital (8) (18) (5)

Foreign withholding taxes 13 6 5

Valuation allowances 36 16 1

Other items, net (7) 4 4

Income tax expense $ 193 $ 43 $ 200

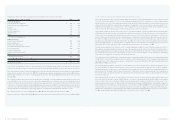

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and

liabilities used for financial reporting purposes and the amounts used for income tax purposes.