Whirlpool 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 45

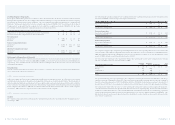

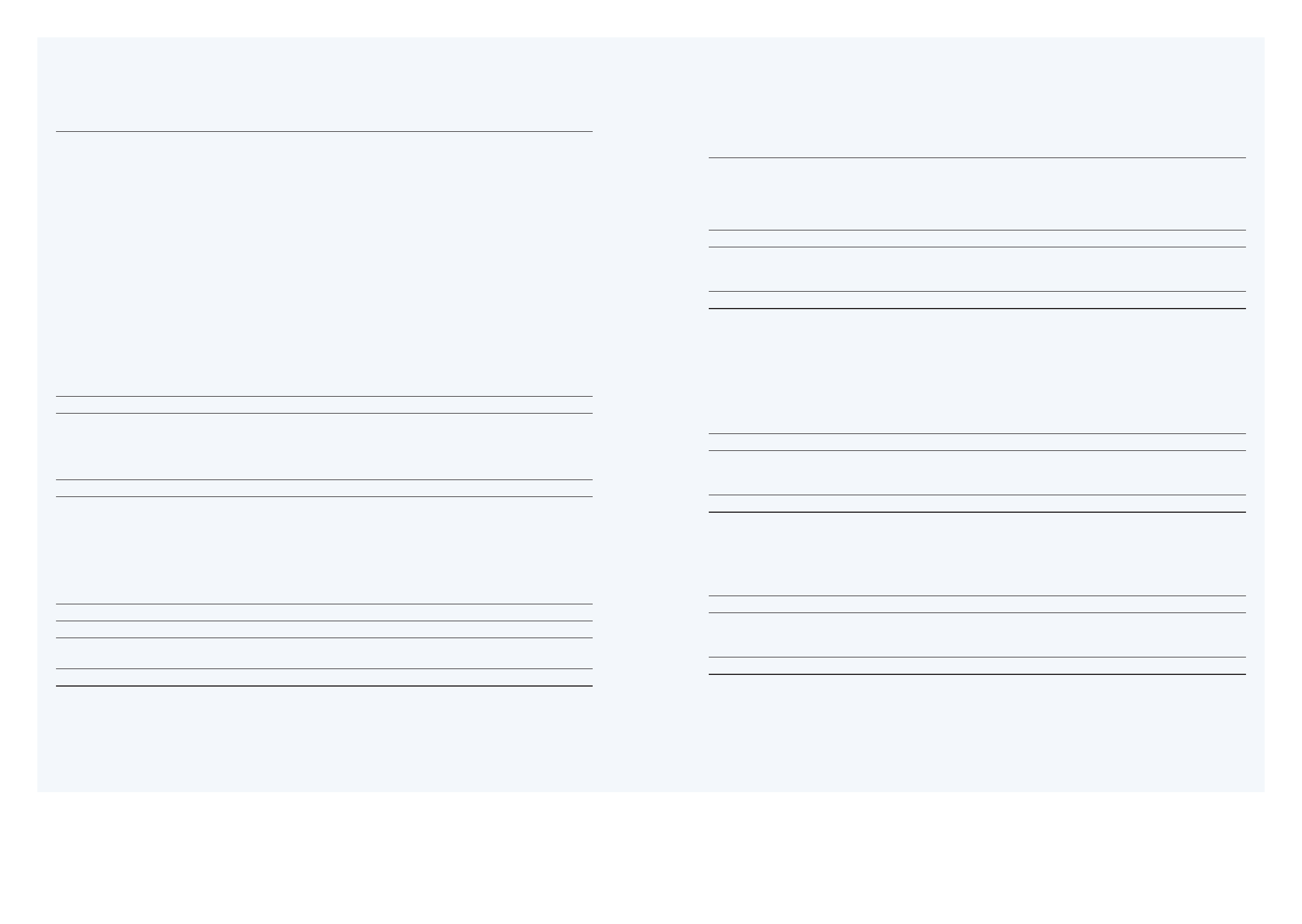

Consolidated Statements of Cash Flows

44

Consolidated Statements of Changes in Stockholders’ EquityConsolidated Statements of Cash Flows

Year ended December 31 –Millions of dollars 2002 2001 2000

Operating activities

Net earnings (loss) $ (394) $ 21 $ 367

Adjustments to reconcile net earnings (loss) to net cash

provided by operating activities:

Cumulative effect of a change in accounting principle 613 (8) –

Equity in earnings (losses) of affiliated companies,

less dividends received 27 4 (3)

Loss on disposition of assets 32 33 15

Loss on discontinued operations 43 21 –

Depreciation and amortization 405 396 400

Changes in assets and liabilities, net of business acquisitions:

Trade receivables (67) 116 (348)

Inventories 101 (26) (80)

Accounts payable 63 230 221

Product recalls (239) 239 –

Restructuring charges, net of cash paid 33 74 (43)

Taxes deferred and payable, net 157 (129) 11

Tax paid on cross currency interest rate swap gain (86) ––

Other – net 124 53 (95)

Cash Provided by Operating Activities $ 812 $ 1,024 $ 445

Investing activities

Capital expenditures $ (430) $ (378) $ (375)

Acquisitions of businesses, less cash acquired (179) –(283)

Proceeds of cross-currency interest rate swaps –209 –

Cash Used for Investing Activities $ (609) $ (169) $ (658)

Financing activities

Net proceeds (repayments) of short-term borrowings $ (165) $ (790) $ 628

Proceeds of long-term debt 6 301 326

Repayments of long-term debt (30) (80) (408)

Dividends paid (91) (113) (70)

Purchase of treasury stock (46) (43) (427)

Other – net 37227

Cash Provided by (used for) Financing Activities $ (323) $ (653) $ 76

Effect of Exchange Rate Changes on Cash and Equivalents $ (4) $ –$ (10)

Increase (Decrease) in Cash and Equivalents $ (124) $ 202 $ (147)

Cash and Equivalents at Beginning of Year 316 114 261

Cash and Equivalents at End of Year $ 192 $ 316 $ 114

See notes to consolidated financial statements

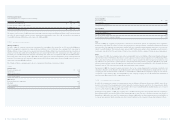

Treasury Accumulated

Stock/ Other

Common Paid-in Comprehensive Retained

Millions of dollars Stock Capital Income Earnings Total

Balances, January 1, 2000 $ 84 $ (42) $ (443) $ 2,268 $ 1,867

Comprehensive income

Net earnings 367 367

Minimum pension liability adjustments, net of tax of $4 (5) (5)

Foreign currency items, net of tax of $15 (47) (47)

Comprehensive income 315

Common stock repurchased (427) (427)

Common stock issued 25 25

Dividends declared on common stock (96) (96)

Balances, December 31, 2000 $ 84 $ (444) $ (495) $ 2,539 $ 1,684

Comprehensive loss

Net earnings 21 21

Cumulative effect of change

in accounting principle, net of tax of $7 (11) (11)

Unrealized loss on

derivative financial instruments, net of tax of $2 (6) (6)

Minimum pension liability adjustments, net of tax of $4 (7) (7)

Foreign currency items, net of tax of $3 (178) (178)

Comprehensive loss (181)

Common stock repurchased (43) (43)

Common stock issued 2 86 88

Dividends declared on common stock (90) (90)

Balances, December 31, 2001 $ 86 $ (401) $ (697) $ 2,470 $ 1,458

Comprehensive loss

Net loss (394) (394)

Unrealized loss on derivative financial instruments (3) (3)

Minimum pension liability adjustments, net of tax of $100 (151) (151)

Foreign currency items (148) (148)

Comprehensive loss (696)

Common stock repurchased, net of reissuances (35) (35)

Common stock issued 1 102 103

Dividends declared on common stock (91) (91)

Balances, December 31, 2002 $ 87 $ (334) $ (999) $ 1,985 $ 739

See notes to consolidated financial statements