Whirlpool 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 49

Notes to Consolidated Financial Statements

48

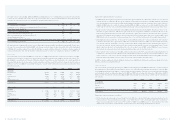

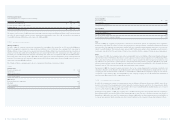

Stock-Based Employee Compensation

Stock option and incentive plans are accounted for under the intrinsic value method in accordance with Accounting

Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees,” and related Interpretations. The company

has adopted the disclosure provisions of SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and

Disclosure” but has not adopted the fair value recognition provisions of SFAS No. 123, “Accounting for Stock-Based

Compensation,” as amended. Had the company elected to adopt the recognition provisions of SFAS No. 123, pro forma

net earnings (loss) and diluted net earnings (loss) per share would be as follows:

Year ended December 31 – Millions of dollars, except per share data 2002 2001 2000

Compensation cost included in earnings as reported (net of tax benefits) $ 12 $ 16 $ 1

Pro forma total fair value compensation cost (net of tax benefits) $ 25 $ 29 $ 13

Net earnings (loss)

As reported $ (394) $ 21 $ 367

Pro forma (407) 8 355

Basic net earnings (loss) per share

As reported $ (5.79) $ 0.31 $ 5.24

Pro forma (5.99) 0.12 5.06

Diluted net earnings (loss) per share

As reported $ (5.68) $ 0.31 $ 5.20

Pro forma (5.87) 0.12 5.03

Net Earnings Per Common Share (in thousands)

Diluted net earnings per share of common stock includes the dilutive effect of stock options and stock based compensation

plans. For the year ended December 31, 2002, 2001 and 2000, a total of 1,885 options, 619 options, and 4,820 options,

respectively, were excluded from the calculation of diluted earnings per share because their exercise prices would

render them anti-dilutive.

Reclassifications

Certain reclassifications have been made to prior year data to conform to the current year presentation which had no

effect on net income reported for any period.

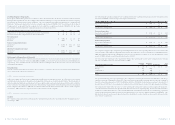

>02 NEW ACCOUNTING STANDARDS

In November 2002, the Financial Accounting Standards Board issued Interpretation No. 45, “Guarantor’s Accounting

and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others.” The Interpretation

includes additional disclosure provisions as well as recognition and measurement provisions which require a liability

to be recorded for certain guarantees at fair value. The disclosure requirements of this interpretation have been adopted

by the company at December 31, 2002. The recognition and measurement provisions became effective for the company

on January 1, 2003, and are not expected to have a material effect on the company.

>03 GOODWILL AND OTHER INTANGIBLES

Goodwill

The company adopted Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets,”

on January 1, 2002.

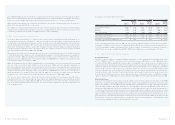

The following table provides comparative net earnings (loss) and net earnings (loss) per share had the non-amortization

provisions of SFAS No. 142 been adopted for all periods presented:

Millions of dollars, except per share data 2002 2001 2000

Reported net earnings (loss) $ (394) $ 21 $ 367

Goodwill amortization –27 27

Adjusted net earnings (loss) $ (394) $ 48 $ 394

Basic earnings per share

Reported net earnings (loss) $ (5.79) $ .31 $ 5.24

Goodwill amortization –.40 .38

Adjusted net earnings (loss) $ (5.79) $ .71 $ 5.62

Diluted earnings per share

Reported net earnings (loss) $ (5.68) $ .31 $ 5.20

Goodwill amortization –.40 .38

Adjusted net earnings (loss) $ (5.68) $ .71 $ 5.58

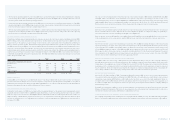

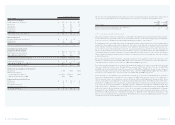

The company completed the transitional goodwill impairment review of its reporting units and recorded a non-cash

after-tax charge of $613 million, or $8.84 per diluted share, as a cumulative effect of a change in accounting principle in

2002. An additional impairment of $9 million, after tax, was recognized as a charge to operations during the fourth

quarter of 2002 relating to goodwill acquired in Asia (see Note 4).

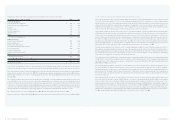

The following table summarizes the impairment charges by reporting unit as well as the changes in the carrying

amount of goodwill for the year ended December 31, 2002:

Beginning Impairment End

Reporting Unit – Millions of dollars of Year Charges Acquisitions of Year

North America $ 68 $ –$ 89 $ 157

Europe 367 (367) ––

Latin America 64 (60) – 4

Asia 186 (195) 9 –

Total $ 685 $ (622) $ 98 $ 161

The goodwill in Europe was related primarily to the company’s acquisition in 1989 (53%) and 1991 (47%) of the major

appliance business of Philips Electronics N.V. The Latin American goodwill was mainly generated by the company’s

majority ownership expansion in 1997 of its Brazilian affiliates. Within the Asian business segment, the majority of

goodwill arose in 1995 due to the acquisition of a majority interest in Kelvinator of India, Ltd., and expansion into China.

The company determined the fair value of each reporting unit using a discounted cash flow approach taking into

consideration projections based on the individual characteristics of the reporting units, historical trends and market

multiples for comparable businesses. The resulting impairment was primarily attributable to a change in the evaluation

criteria for goodwill utilized under previous accounting guidance to the fair value approach stipulated in SFAS No. 142.

External factors such as increased regional competition and global economic conditions also negatively impacted the

value of these acquisitions.