Whirlpool 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report 51

Notes to Consolidated Financial Statements

50

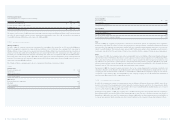

Other Intangible Assets

Other intangibles are comprised of the following:

December 31 – Millions of dollars 2002 2001

Trademarks (indefinite-lived) $ 49 $ 13

Patents and non-compete agreements 5 10

Pension related 128 –

Total other intangible assets, net $ 182 $ 23

The balance at December 31, 2002, includes trademarks acquired as part of the Whirlpool Mexico and Polar acquisitions

(see Note 4), and intangible assets related to minimum pension liabilities (see Note 16). Accumulated amortization

totaled $21 million and $16 million at December 31, 2002 and 2001.

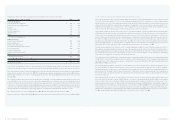

>04 BUSINESS ACQUISITIONS

Whirlpool Mexico

On July 3, 2002, the company acquired the remaining 51% ownership in Vitromatic S.A. de C.V. (now called Whirlpool

Mexico), an appliance manufacturer and distributor in Mexico. Prior to that date, the company’s 49% ownership in

Whirlpool Mexico was accounted for as an equity investment. Whirlpool Mexico has been included in the consolidated

financial statements within the North American operating segment since the acquisition date. The aggregate

purchase price was $151 million in cash plus outstanding debt at the time of acquisition, which totaled $143 million.

The transaction resulted in goodwill of $89 million, and is expected to result in additional synergies and operational

benefits. The transaction also generated approximately $15 million in indefinite-lived intangible assets related to

trademarks owned by Whirlpool Mexico.

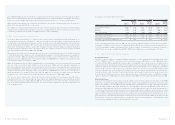

The Whirlpool Mexico opening balance sheet is summarized (in millions of dollars) as follows:

ASSETS

Current assets

Trade receivables, net $ 130

Inventories 60

Other current assets 15

Total Current Assets 205

Other assets

Property, plant and equipment 245

Goodwill 89

Other intangibles 15

Total Assets $ 554

LIABILITIES AND STOCKHOLDER’S EQUITY

Current liabilities

Accounts payable $ 112

Notes payable 132

Total Current Liabilities 244

Other liabilities

Other liabilities 80

Total Other Liabilities 80

Total Stockholder’s Equity 230

Total Liabilities and Stockholder’s Equity $ 554

Polar

On June 5, 2002, the company acquired 95% of the shares of Polar S.A. (Polar), a leading major home appliance

manufacturer in Poland. The results of Polar’s operations have been included in the consolidated financial statements

since that date. The aggregate purchase price was $27 million in cash plus outstanding debt at the time of acquisition,

which totaled $19 million. The transaction also generated $17 million in indefinite-lived intangible assets related to

trademarks owned by Polar. The operations of Polar have been included in the company’s European operating segment.

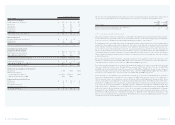

Other

On November 18, 2002, the company acquired the remaining 20% interest in Whirlpool Narcissus Shanghai Company

Limited (“Narcissus”) for $9 million. Narcissus is a home appliance manufacturing company located in Shanghai, China.

The transaction was largely necessitated by the exercise of a put option by the minority partner arising out of an

amendment to the joint venture contract agreed to in February 1998. The purchase resulted in $9 million of goodwill,

which was subsequently written off as impaired goodwill under the requirements of SFAS No. 142, “Goodwill and Other

Intangible Assets.” The entity is now a wholly owned subsidiary of the company.

On January 7, 2000, the company completed its tender offer for the outstanding publicly traded shares in Brazil of its

subsidiaries Brasmotor S.A. (Brasmotor) and Multibras S.A. Eletrodomesticos (Multibras). In completing the offer, the

company purchased additional shares of Brasmotor and Multibras for $283 million, bringing its equity interest in these

companies to approximately 94%. Including Embraco, the company’s equity interest in its Brazilian subsidiaries

increased from approximately 55% to approximately 87%.

>05 DISCONTINUED OPERATIONS

In 1997, the company discontinued its financing operations, Whirlpool Financial Corporation (WFC), and sold the

majority of its assets. The remaining assets consist primarily of an investment in a portfolio of leveraged leases, which

are recorded in other non-current assets in the balance sheets and totaled $44 million and $123 million, net of related

reserves, at December 31, 2002 and 2001, respectively.

During the fourth quarter of 2002, the company wrote off WFC’s investment in leveraged aircraft leases relating to

United Airlines (UAL) as a result of UAL’s filing for bankruptcy protection. The write-off resulted in a non-cash charge of

$68 million, or $43 million after tax. The company also reclassified $49 million in related long-term deferred tax liabilities

to current taxes payable, which is included in other current liabilities on the company’s Consolidated Balance Sheet.