Tyson Foods 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to

consolidated

financial

statements

p 55

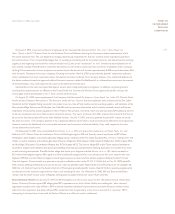

interference with contract. As of this date, the Company has moved to dismiss this action, with briefing to be completed during

December 2002. The Company intends to vigorously defend these claims; however, neither the likelihood of an unfavorable

outcome nor the amount of ultimate liability, if any, with respect to this case can be determined at this time.

In July 1996, a lawsuit was filed against IBP by certain cattle producers in the U.S. District Court, Middle District of Alabama,

seeking certification of a class of all cattle producers. The complaint alleges that IBP has used its market power and alleged “captive

supply” agreements to reduce the prices paid to producers for cattle. Plaintiffs have disclosed that, in addition to declaratory relief,

they seek actual and punitive damages. The original motion for class certification was denied by the Court; plaintiffs then amended

their motion, defining a narrower class consisting of only those cattle producers who sold cattle directly to IBP from 1994 through

the date of certification. The Court approved this narrower class in April 1999. The 11th Circuit Court of Appeals reversed the

District Court decision to certify a class on the basis that there were inherent conflicts amongst class members preventing the named

plaintiffs from providing adequate representation to the class. The plaintiffs then filed pleadings seeking to certify an amended class.

The Court denied the plaintiffs’ motion on October 17, 2000. Plaintiffs’ motion for reconsideration of the judge’s decision was

denied, and plaintiffs then asked the Court to certify a class of cattle producers who have sold exclusively to IBP on a cash market

basis, which the Court granted in December 2001. In January 2002, IBP filed a petition with the 11th Circuit Court of Appeals

seeking permission to appeal the class certification decision, which the Circuit Court of Appeals denied on March 5, 2002. The

District Court has set a schedule for completing the format of the class notice mailing. No trial date has been set. IBP has filed

motions for summary judgment on both liability and damages filed with the District Court, which are now pending. Plaintiffs have

claimed damages in the case in excess of $500,000,000. Management believes IBP has acted properly and lawfully in its dealings

with cattle producers and intends to vigorously defend this case. However, neither the likelihood of an unfavorable outcome nor

the amount of ultimate liability, if any, with respect to this case can be determined at this time.

On August 8, 2000, the Company was served with a complaint filed in the U.S. District Court for the District of Arizona styled

Lemelson Medical, Education & Research Foundation, Limited Partnership v. Alcon Laboratories, et al., CIV00-0661 PHX PGR.

The plaintiff sued the Company, along with approximately 100 other defendants in the food, beverage, drug, cosmetic and tobacco

industries, claiming that the defendants infringed various patents held by the Foundation. The alleged patent infringement is based

on the defendants’ alleged use of the Foundation’s automatic identification patents that relate to the use of bar coding and/or the

Foundation’s patents that relate to machine vision. The Foundation seeks treble damages for the defendants’ alleged infringement.

The case is currently stayed pending the resolution of related litigation. Neither the likelihood of an unfavorable outcome nor

the amount of ultimate liability, if any, with respect to this case can be determined at this time.

On September 12, 2002, 82 individual plaintiffs filed Michael Archer, et al. v. Tyson Foods, Inc. and The Pork Group, Inc., CIV 2002-497,

in the Circuit Court of Pope County, Arkansas. On August 18, 2002, the Company announced a restructuring of its live swine operations

which, among other things, will result in the discontinuance of relationships with 132 contract hog producers, including the plaintiffs.

In their complaint, the plaintiffs allege that the Company committed fraud and should be promissorily estopped from terminating

the parties’ relationship. The plaintiffs seek compensatory and punitive damages in an unspecified amount. The Company has filed

a motion to Stay All Proceedings and Compel Arbitration. The plaintiffs have responded to the Motion to Compel. Discovery has not

begun. The Company intends to vigorously defend these claims; however, neither the likelihood of an unfavorable outcome nor the

amount of ultimate liability, if any, with respect to this case can be determined at this time.

The Company is pursuing various antitrust claims relating to vitamins, methionine and choline. In the third quarter of 2002, the

Company received approximately $30 million in partial settlement of these claims. The Company has received, or expects to receive

under signed settlement arrangements, further settlements of approximately $26 million in the first quarter of 2003. Additional

settlements are anticipated. Amounts received for these claims are recorded as income only upon receipt of settlement proceeds.

Other Matters The Company is subject to other lawsuits, investigations and claims (some of which involve substantial amounts)

arising out of the conduct of its business. While the ultimate results of these matters cannot be determined, they are not expected

to have a material adverse effect on the Company’s consolidated results of operations or financial position.

Tyson Foods, Inc. 2002 annual report