Tyson Foods 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to

consolidated

financial

statements

p 38

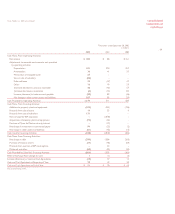

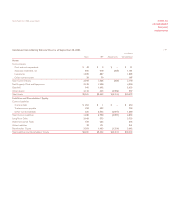

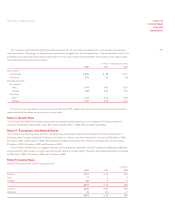

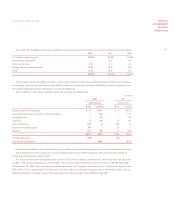

Note 7: Property, Plant and Equipment

The major categories of property, plant and equipment and accumulated depreciation, at cost, are as follows:

in millions

2002 2001

Land $ 111 $ 114

Buildings and leasehold improvements 2,154 2,085

Machinery and equipment 3,419 3,218

Land improvements and other 185 174

Buildings and equipment under construction 414 379

6,283 5,970

Less accumulated depreciation 2,245 1,885

Net property, plant and equipment $4,038 $4,085

The Company capitalized interest costs of $9 million in 2002, $3 million in 2001 and $2 million in 2000 as part of the cost of

major asset construction projects. Approximately $137 million will be required to complete construction projects in progress at

September 28, 2002.

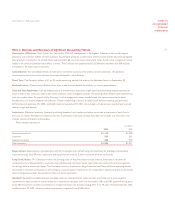

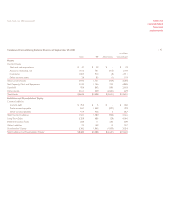

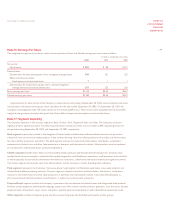

Note 8: Other Current Liabilities

Other current liabilities at September 28, 2002 and September 29, 2001 include:

in millions

2002 2001

Accrued salaries, wages and benefits $ 308 $270

Self insurance reserves 225 189

Income taxes payable 202 109

Property and other taxes 52 63

Other 297 226

Total other current liabilities $1,084 $857

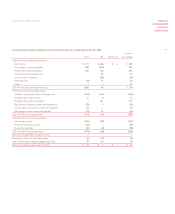

Note 9: Commitments

The Company leases certain farms and other properties and equipment for which the total rentals thereon approximated $105 million

in 2002, $76 million in 2001 and $66 million in 2000. Most farm leases have terms ranging from one to 10 years with various renewal

periods. The most significant obligations assumed under the terms of the leases are the upkeep of the facilities and payments of

insurance and property taxes.

Minimum lease commitments under non-cancelable leases at September 28, 2002, total $197 million composed of $72 million

for 2003, $41 million for 2004, $31 million for 2005, $25 million for 2006, $17 million for 2007 and $11 million for later years. These

future commitments are expected to be offset by future minimum lease payments to be received under subleases of approximately

$5 million.

The Company assists certain of its swine and chicken growers in obtaining financing for growout facilities by providing the

growers with extended growout contracts and conditional operation of the facilities should a grower default under their growout

or loan agreement. The Company also guarantees debt of outside third parties of $66 million.

The Company enters into various future purchase commitments for finished live cattle and hogs. These purchase commitments

are at a market-derived price at the time of delivery or were fully hedged if the price was determined at an earlier date. The

commitments deliverable in any year is less than the operating requirements of that year.

Tyson Foods, Inc. 2002 annual report