Tyson Foods 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to

consolidated

financial

statements

p 33

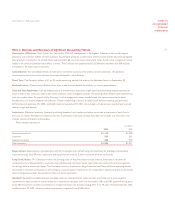

Use of Estimates: The consolidated financial statements are prepared in conformity with accounting principles generally accepted

in the United States which require management to make estimates and assumptions that affect the amounts reported in the

consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Recently Issued Accounting Standards: In June 2001, the Financial Accounting Standards Board (FASB) issued Statement

of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets” (SFAS 142). Under SFAS 142, goodwill and

indefinite lived intangible assets are no longer amortized but are reviewed annually or more frequently if impairment indicators

arise, for impairment. Separable intangible assets that have finite lives will continue to be amortized over their useful lives.

The Company elected to early adopt the provisions of SFAS 142 and discontinued the amortization of its goodwill balances and

intangible assets with indefinite useful lives effective September 30, 2001. The Company assessed its goodwill for impairment

upon adoption, and completed its required annual test for impairment in the fourth quarter of fiscal 2002. Neither impairment

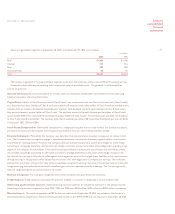

test indicated any impairment losses. Had the provisions of SFAS 142 been in effect during fiscal years 2001 and 2000, a reduction

in amortization expense and an increase to net income of $30 million or $0.14 per diluted share and $29 million or $0.13 per diluted

share respectively, would have been recorded.

In accordance with the guidance provided in Emerging Issues Task Force (EITF) Issue No. 00-14, “Accounting for Certain Sales

Incentives,” and EITF Issue No. 00-25, “Vendor Income Statement Characterization of Consideration Paid to a Reseller of the

Vendor’s Products,” beginning in the first quarter of fiscal 2002, the Company classifies the costs associated with sales incentives

provided to retailers and payments such as slotting fees and cooperative advertising to vendors as a reduction in sales. These costs

were previously included in selling, general and administrative expense. These reclassifications resulted in a reduction to sales and

selling, general and administrative expense of approximately $188 million and $142 million for fiscal years 2001 and 2000, respectively,

and had no impact on reported income before income taxes and minority interest, net income or earnings per share amounts.

In August 2001, the FASB issued SFAS No.143, “Accounting for Asset Retirement Obligations.” This statement requires the

Company to recognize the fair value of a liability associated with the cost the Company would be obligated to incur in order to

retire an asset at some point in the future. The liability would be recognized in the period in which it is incurred and can be

reasonably estimated. The standard is effective for fiscal years beginning after June 15, 2002. The Company expects to adopt this

standard at the beginning of its fiscal 2003. The Company believes the adoption of SFAS No. 143 will not have a material impact

on its financial position or results of operations.

In October 2001, the FASB issued SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.” SFAS No. 144

develops an accounting model, based upon the framework established in SFAS No.121, for long-lived assets to be disposed by sales.

The accounting model applies to all long-lived assets, including discontinued operations, and it replaces the provisions of ABP Opinion

No. 30, “Reporting Results of Operations –Reporting the Effects of Disposal of a Segment of a Business and Extraordinary, Unusual

and Infrequently Occurring Events and Transactions,” for disposal of segments of a business. SFAS No. 144 requires long-lived assets

held for disposal to be measured at the lower of carrying amount or fair values less costs to sell, whether reported in continuing

operations or in discontinued operations. The statement is effective for fiscal years beginning after December 15, 2001. The

Company intends to adopt this standard at the beginning of its fiscal 2003. The Company believes the adoption of SFAS No.144

will not have a material impact on its financial position or results of operations.

In July 2002, the FASB issued SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities.” SFAS No.146

addresses financial accounting and reporting for costs associated with exit or disposal activities and replaces EITF Issue No. 94-3,

“Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred

in a Restructuring).” SFAS No.146 requires that a liability for a cost associated with an exit or disposal activity be recognized when

the liability is incurred. SFAS No.146 also establishes that fair value is the objective for initial measurement of the liability. The statement

is effective for exit or disposal activities initiated after December 31, 2002. The Company believes the adoption of SFAS No.146 will

not have a material impact on its financial position or results of operations.

Tyson Foods, Inc. 2002 annual report