Tyson Foods 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s

discussion

and analysis

p 23

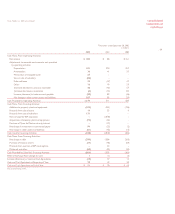

Total debt at September 28, 2002, was $3,987 million, a decrease of approximately $789 million from September 29, 2001. The

Company has unsecured revolving credit agreements totaling $1 billion that support the Company’s commercial paper program.

These $1 billion in facilities consist of $200 million that expires in June 2003, $300 million that expires in June 2005 and $500 million

that expires in September 2006. At September 28, 2002, there were no borrowings outstanding under these facilities. Additional

outstanding debt at September 28, 2002, consisted of $3.6 billion of debt securities, $75 million issued under accounts receivable

securitization debt, $24 million of commercial paper and other indebtedness of $281 million.

The revolving credit agreement, senior notes, notes and accounts receivable securitization debt contain various covenants, the

more restrictive of which contain a maximum allowed leverage ratio and a minimum required interest coverage ratio. The Company

is in compliance with these covenants at fiscal year end.

In October 2001, the Company refinanced $2.3 billion outstanding under a bridge financing facility through the issuance of

$2.25 billion of notes offered in three tranches consisting of $500 million of 6.625% notes due October 2004, $750 million of

7.25% notes due October 2006 and $1 billion of 8.25% notes due October 2011.

In October 2001, the Company entered into a receivables purchase agreement with three co-purchasers to sell up to $750 million

of trade receivables. The receivables purchase agreement has been accounted for as a borrowing and has an interest rate based on

commercial paper issued by the co-purchasers. Under this agreement, substantially all of the Company’s accounts receivable are sold

to a special purpose entity, Tyson Receivables Corporation (TRC), which is a wholly owned consolidated subsidiary of the Company.

TRC has its own separate creditors that are entitled to be satisfied out of all of the assets of TRC prior to any value becoming available

to TRC’s equity holders.

Market Risk

Market risks relating to the Company’s operations result primarily from changes in commodity prices, interest rates and foreign

exchange rates as well as credit risk concentrations. To address certain of these risks, the Company enters into various derivative

transactions as described below. If a derivative instrument is a hedge, depending on the nature of the hedge, changes in the fair

value of the instrument either will be offset against the change in fair value of the hedged assets, liabilities, or firm commitments

through earnings, or recognized in other comprehensive income (loss) until the hedged item is recognized in earnings. The

ineffective portion of an instrument’s change in fair value will be immediately recognized in earnings. Instruments that do not meet

the criteria for hedge accounting are marked to fair value with unrealized gains or losses reported currently in earnings. Additionally,

the Company held certain positions, primarily in grain and livestock futures and options, for which it does not apply hedge accounting,

but instead marks these positions to fair value through earnings at each reporting date.

In fiscal 2002, the Company changed its market risk disclosure type from a tabular presentation to a sensitivity analysis presentation.

Due to the acquisition of IBP, the Company’s commodity market risk became more diverse. As a result of a more complex risk profile,

the Company believes a sensitivity analysis provides a clearer understanding of the risks associated with the Company’s positions. The

sensitivity analyses presented below are the measures of potential losses of fair value resulting from hypothetical changes in market prices

related to commodities and hypothetical changes in exchange rates related to interest rates. Sensitivity analyses do not consider the

actions management may take to mitigate the Company’s exposure to changes, nor do they consider the effects that such hypothetical

adverse changes may have on overall economic activity. Actual changes in market prices may differ from hypothetical changes.

Tyson Foods, Inc. 2002 annual report

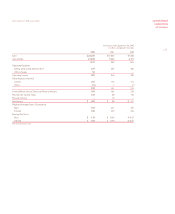

1,542

3,987

2000 2001 2002

2,175

4,776

3,354

3,662

debt

equity

total

capitalization

dollars in millions