Tyson Foods 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to

consolidated

financial

statements

p 34

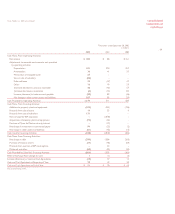

Note 2: Acquisition

In August 2001, the Company acquired 50.1% of IBP by paying $1.7 billion in cash. In September 2001, the Company issued 129 million

shares of Class A common stock, with a fair value of $1.2 billion, to acquire the remaining IBP shares, and assumed $1.7 billion of IBP

debt. The total acquisition cost of $4.6 billion was accounted for as a purchase in accordance with Statement of Financial Accounting

Standards (SFAS) No.141, “Business Combinations.” Accordingly, the tangible and identifiable intangible assets and liabilities have

been adjusted to fair values with the remainder of the purchase price recorded as goodwill.

The transaction was accounted for using the purchase method of accounting required by SFAS 141. Goodwill and identifiable

intangible assets recorded in the acquisition will be tested periodically for impairment as required by SFAS 142. The allocation of the

purchase price to specific assets and liabilities was based, in part, upon an outside appraisal of IBP’s long-lived assets. The allocation

of the purchase price has been completed.

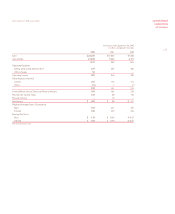

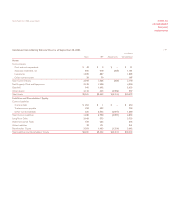

Fair value of assets acquired and liabilities assumed at August 3, 2001:

in millions

Cash and cash equivalents $37

Accounts receivable 641

Inventories 937

Other current assets 112

Property, plant and equipment 1,968

Goodwill 1,692

Other assets 385

Total Assets $5,772

Accounts payable and accruals $ 836

Other liabilities 227

Long-term debt 1,651

Deferred income taxes 221

Shareholders’ Equity 2,837

Total Liabilities and Shareholders’ Equity $5,772

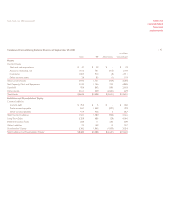

Identifiable intangible assets of $242 million consist of trademarks of $138 million, patents of $87 million and $17 million of supply

contracts (all of which are included in other assets). The amounts associated with trademarks are not subject to amortization

as management believes their useful lives to be indefinite. The amounts associated with patents and supply contracts are being

amortized over 15 and five years, respectively.

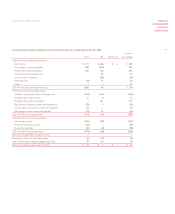

In August 2001, the Company completed the financing for the acquisition of IBP by entering into two bridge revolving credit facilities

consisting of a senior unsecured bridge credit agreement which provided for aggregate borrowings up to $2.5 billion (the Bridge

Facility) and a senior unsecured receivables bridge credit agreement which provided for aggregate borrowings up to $350 million

(the Receivables Bridge Facility). Subsequent to September 29, 2001, the Company refinanced both facilities.

Tyson Foods, Inc. 2002 annual report