Tyson Foods 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

p 2

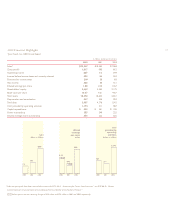

2002 Financial Highlights

Tyson Foods, Inc. 2002 Annual Report

in millions, except per share data

2002 2001 2000

Sales* $23,367 $10,563 $7,268

Gross profit* 1,817 903 815

Operating income 887 316 349

Income before income taxes and minority interest 593 165 234

Provision for income taxes 210 58 83

Net income 383 88 151

Diluted earnings per share 1.08 0.40 0.67

Shareholders’ equity 3,662 3,354 2,175

Book value per share 10.37 9.61 9.67

Total assets 10,372 10,632 4,841

Depreciation and amortization 467 335 294

Total debt 3,987 4,776 1,542

Cash provided by operating activities 1,174 511 587

Capital expenditures $ 433 $ 261 $ 196

Shares outstanding 353 349 225

Diluted average shares outstanding 355 222 226

7.3

10.6

23.4

0.74

0.47

1.08

587

511

1,174

2000 2001 2002 2000 2001 2002 2000 2001 2002

0.40

0.67

sales

dollars in billions

diluted

earnings

per share

dollars

cash

provided by

operating

activities

dollars in millions

*Sales and gross profit have been reclassified to account for EITF 00-14,

“

Accounting for Certain Sales Incentives,” and EITF 00-25,

“

Vendor

Income Statement Characterization of Consideration Paid to a Reseller of the Vendor’s Products.”

before pretax and non-recurring charges of $26 million and $24 million in 2001 and 2000, respectively