Tyson Foods 2002 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2002 was an important year for Tyson Foods, Inc. Our team has made tremendous progress

integrating IBP, inc., and we have moved forward as one company. We are the world’s largest processor

and marketer of beef, chicken and pork and the second largest public food company in the United States.

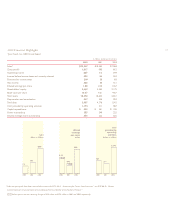

Reported diluted earnings per share were $1.08 compared to $0.40 last year. Of that increase, $0.23

was due to the inclusion of IBP, making it immediately accretive to our earnings. Reported sales were

$23.4 billion in 2002 compared to $10.6 billion in 2001. Last year’s results included nine weeks of IBP’s

results in our fourth quarter. Cash flow is one of the real strengths of our company, giving us the ability

to pay down debt and meet our plans for growth. We have paid down $914 million since closing

the cash tender offer on August 3, 2001, and $789 million this fiscal year. This brings our debt as a

percentage of total capital down to 52 percent at fiscal 2002 year end. We are well on our way to meet-

ing our goal of having debt to capital at 50 percent or below by the end of fiscal year 2003. In addition,

we achieved our synergy target of $50 million in 2002, and we are on track to achieve $100 million in

2003 and $200 million in 2004.

While the stock market has seen major swings this year, our stock price has outperformed the market

by generating a return to shareholders of 17.5 percent, compared to -20.5 percent for the S&P 500 Index

and -0.5 percent for the S&P Packaged Foods Index. We posted strong results for 2002, proving a company

focused on adding value to products can perform in difficult market conditions. By marketing the world’s

three preferred proteins, we have a large basket of goods to offer our customers. It is the total company,

the total portfolio of proteins and food products that generates our strong cash flows.

... with you, the Tyson Shareholders, in mind.

p 3

John Tyson

Chairman and Chief Executive Officer