Tyson Foods 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s

discussion

and analysis

p 22

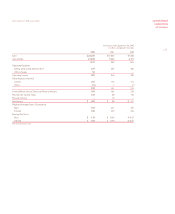

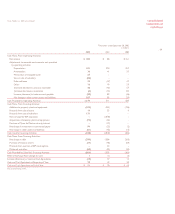

in millions

Operating Income (Loss) by Segment 2001 2000 Change

Beef $ 32 $ – $ 32

Chicken 250 316 (66)

Pork 27 23 4

Prepared Foods 15 7 8

Other (8) 3 (11)

Total $316 $349 $(33)

Beef segment sales, which include only the nine weeks of IBP results, were $2 billion, including case-ready sales of $116 million.

Beef segment operating income totaled $32 million. Beef sales and operating income are derived solely from the operations

acquired from IBP, and as such have no comparative data since the Company did not have a beef group prior to the IBP acquisition.

Chicken segment sales increased $290 million or 4.3% compared to 2000, with a 3.2% increase in average sales prices and a

1.0% increase in volume. Foodservice channel sales increased 1.0%, retail channel sales increased 1.2% and international channel

sales including Tyson de Mexico increased 26.9%. Operating income for chicken decreased $66 million or 20.9% from 2000

primarily due to increased production costs and sales promotional expenses which more than offset increases in bulk leg quarter

prices and certain other products.

Pork segment sales were $619 million compared to $157 million last year, with current year case-ready sales of $43 million. Pork

segment operating profit increased $4 million from the same period last year. The increase in both pork segment sales and operating

income is primarily due to the inclusion of nine weeks results for IBP.

Prepared Foods segment sales totaled $818 million compared to $292 million last year. The prepared foods segment operating

income increased $8 million from the same period last year. The increase in both the prepared foods segment sales and segment

operating income is primarily due to the inclusion of nine weeks results related to IBP.

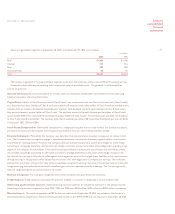

Liquidity and Capital Resources

Cash provided by operations continues to be the Company’s primary source of funds to finance operating requirements and capital

expenditures. In 2002, net cash of $1,174 million was provided by operating activities, an increase of $663 million from 2001. The

primary sources of the change are increases in net income of $295 million, depreciation and amortization of $132 million, and working

capital of $165 million. The Company’s foreseeable cash needs for operations and capital expenditures are expected to continue

to be met through cash flows provided by operating activities. Additionally, at September 28, 2002, the Company had borrowing

capacity of $1.5 billion consisting of $806 million available under its $1 billion unsecured revolving credit agreements and $675 million

under its $750 million accounts receivable securitization. At September 28, 2002, the Company had construction projects in

progress that will require approximately $137 million to complete.

Tyson Foods, Inc. 2002 annual report

587 511

1,174

2000 2001 2002

cash provided

by operating

activities

dollars in millions