Tyson Foods 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to

consolidated

financial

statements

p 37

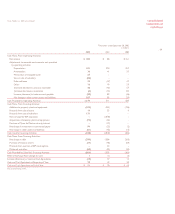

The effective portion of the cumulative gain or loss on the derivative instrument is reported as a component of other

comprehensive income (loss) in shareholders’ equity and recognized into earnings in the same period or periods during which the

hedged transaction affects earnings (for commodity hedges when the chickens that consumed the hedged grain are sold). The

remaining cumulative gain or loss on the derivative instrument in excess of the cumulative change in the present value of the future

cash flows of the hedged item, if any, is recognized in earnings during the period of change. No ineffectiveness was recognized on

cash flow hedges during fiscal 2002 or 2001. The Company expects that the after tax losses, net of gains, totaling approximately

$2 million recorded in other comprehensive income (loss) at September 28, 2002, related to cash flow hedges, will be recognized

within the next 12 months. The Company generally does not hedge cash flows related to commodities beyond 12 months.

Fair Value Hedges: The Company designates certain futures contracts as fair value hedges of firm commitments to purchase livestock

for slaughter. The Company also enters into foreign currency forward contracts to hedge changes in fair value of receivables and

purchase commitments arising from changes in the exchange rates of foreign currencies. Changes in the fair value of a derivative that

is highly effective and that is designated and qualifies as a fair value hedge, along with the loss or gain on the hedged asset or liability

that is attributable to the hedged risk (including losses or gains on firm commitments), are recorded in current period earnings.

Ineffectiveness results when the change in the fair value of the hedge instrument differs from the change in fair value of the hedged

item. Ineffectiveness recorded related to the Company’s fair value hedges was not significant during fiscal 2002 or 2001.

Undesignated Positions: The Company holds certain commodity futures contracts in the regular course of business to manage its

exposure against commodity price fluctuations on anticipated purchases of raw materials and anticipated sales of finished inventories.

The contracts are generally for short durations of less than one year. Although these instruments are economic hedges, the Company

does not designate these contracts as hedges for accounting purposes. As a result, the Company marks these contracts to market

and recognizes the change through earnings. At September 28, 2002, and September 29, 2001, these contracts had a fair value liability

of $11 million recorded on the consolidated balance sheet.

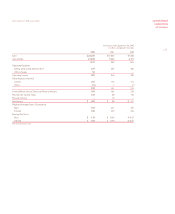

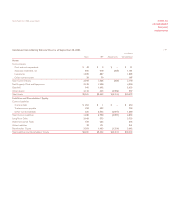

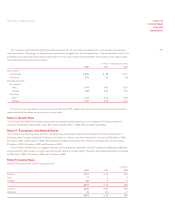

Fair Values of Financial Instruments:

in millions

2002 2001

Commodity derivative positions $ (12) $ (8)

Interest-rate derivative positions (6) (6)

Foreign currency derivative positions –(1)

Total debt $4,397 $4,740

Fair values are based on quoted market prices or published forward interest rate curves. All other financial instruments’ fair

values approximate recorded values at September 28, 2002, and September 29, 2001.

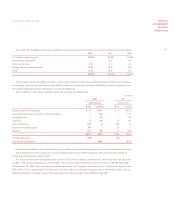

Concentrations of Credit Risk: The Company’s financial instruments that are exposed to concentrations of credit risk consist

primarily of cash equivalents and trade receivables. The Company’s cash equivalents are in high quality securities placed with major

banks and financial institutions. Concentrations of credit risk with respect to receivables are limited due to the large number of

customers and their dispersion across geographic areas. The Company performs periodic credit evaluations of its customers’

financial condition and generally does not require collateral. At September 28, 2002, approximately 10.8% of the Company’s total

accounts receivable balance was due from one customer. No other customer or customer group represents greater than 10% of

total accounts receivable.

Tyson Foods, Inc. 2002 annual report