Tyson Foods 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes to

consolidated

financial

statements

p 35

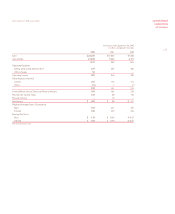

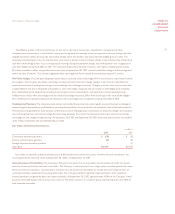

The pro forma unaudited results of operations for the years ended September 29, 2001, and September 30, 2000, assuming the

purchase of IBP had been consummated as of October 1, 1999, follows. Pro forma adjustments have been made to reflect additional

interest from debt associated with the acquisition and additional common shares issued.

in millions, except per share data

2001 2000

Pro Forma Pro Forma

Sales $24,975 $24,085

Net income before extraordinary items 82 314

Net income 82 297

Earnings per share before extraordinary items:

Basic 0.24 0.89

Diluted 0.24 0.89

Earnings per share:

Basic 0.23 0.84

Diluted 0.23 0.84

The unaudited pro forma results are not necessarily indicative of the actual results of operations that would have occurred had

the purchase actually been made at the beginning of fiscal 2000, or the results that may occur in the future.

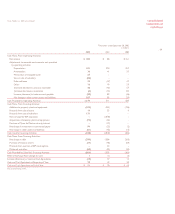

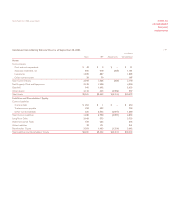

In May 2001, the Company increased its ownership in Tyson de Mexico, S.A. de C.V. (TdM) by acquiring common shares of

TdM from existing minority shareholders for cash and by a non-cash transaction whereby TdM exchanged minority shareholders’

common stock for $45 million of TdM redeemable preferred stock with an 8% coupon. In September 2001, the Company acquired

the remaining common shares of TdM held by minority shareholders. Upon completion of these transactions, the Company

now owns 100% of the common shares of TdM. The Company has entered into a call agreement with the holders of converted

TdM redeemable preferred stock which allows the Company to purchase the converted redeemable preferred stock over five

years. Additionally, in May 2001, TdM purchased the poultry assets of Nochistongo S.P.R. de R.L., a fully integrated broiler production

operation that markets products under the “Kory” brand. The purchase price of both transactions was allocated based upon the

estimated fair market values at the date of purchase. As of September 28, 2002, the Company had purchased $11 million of the

convertible redeemable preferred stock.

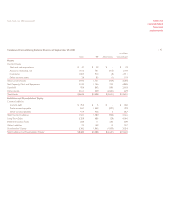

In May 2002, the Company acquired Millard Processing Services, a bacon processing operation, for approximately $73 million

in cash. The acquisition has been accounted for as a purchase and goodwill of approximately $14 million has been recorded.

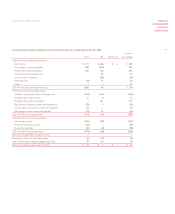

Note 3: Disposition

In September 2002, the Company completed the sale of its Specialty Brands, Inc. subsidiary. The subsidiary had been acquired with

the IBP acquisition and its results of operations were included in the Company’s prepared foods segment. The Company received

cash proceeds of approximately $131 million, which were used to reduce indebtedness, and recognized a pretax gain of $22 million

which is included in other income on the consolidated statement of income.

Tyson Foods, Inc. 2002 annual report