Tyson Foods 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management’s

discussion

and analysis

p 20

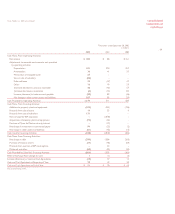

Beef segment sales were $10.5 billion, including beef case-ready sales of $689 million and international beef sales of $1.4 billion. Beef

segment operating income totaled $220 million. The beef segment resulted from the acquisition of IBP in the fourth quarter of fiscal 2001.

Chicken segment sales increased $165 million or 2.3% from the same period last year, with a 1.1% increase in average sale prices

and a 1.2% increase in volume. Foodservice chicken sales increased 4.9%, retail chicken sales increased 2.0% and international

chicken sales decreased 6.3%. In fiscal 2002, the Company’s Mexican subsidiary sales increased 36.1% from the same period last

year due to the acquisition of a production facility in Mexico in the third quarter of 2001. This increase was more than offset by

decreases in other international sales demand as markets continue to be impacted by import restrictions and political pressures

primarily in Russia and China. Operating income for Chicken increased $178 million from the same period last year primarily due to

decreases in live and production costs along with improvements in price and growth in value-added product mix. Additionally, prior

year costs were negatively impacted by weather related effects and higher grain and energy costs.

Pork segment sales including IBP’s pork processing revenues were $2.5 billion compared to $619 million for the same period

last year, including current year pork case-ready sales of $212 million and international pork sales of $248 million. Pork segment

operating income decreased $2 million from the same period last year. Sales and operating income were positively affected by the

inclusion of the IBP pork processing results in fiscal 2002. However, both were impacted by the negative results of the live swine

operation. Operating income was also affected by the restructuring charge related to the Company’s live swine operation of

approximately $26 million in the fourth quarter of fiscal 2002.

Prepared Foods segment sales increased $2.3 billion from the same period last year. The prepared foods segment operating

income increased $143 million from the same period last year. The increase in both sales and operating income is primarily due to

the inclusion of IBP results. Operating income was also influenced by lower and more stable raw material prices and improvement

in product mix. These increases were partially offset by the Thomas E. Wilson write-down adjustment of $27 million related to

the discontinuation of the brand.

Other segment operating income increased $64 million primarily due to the partial settlement of approximately $30 million

received in the third quarter of fiscal 2002 related to ongoing vitamin antitrust litigation combined with prior year IBP merger

related expenses of $19 million.

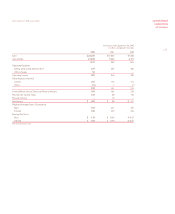

Acquisitions

In August 2001, the Company acquired 50.1% of IBP by paying approximately $1.7 billion in cash. In September 2001, the Company

issued approximately 129 million shares of Class A stock, with a fair value of approximately $1.2 billion, to acquire the remaining IBP

shares, and assumed approximately $1.7 billion of IBP debt. The total acquisition cost of approximately $4.6 billion was accounted

for as a purchase in accordance with Statement of Financial Accounting Standards (SFAS) No.141, “Business Combinations.”

Accordingly, the tangible and identifiable intangible assets and liabilities have been adjusted to fair values with the remainder of the

purchase price recorded as goodwill. The allocation of the purchase price has been completed.

In May 2002, the Company acquired the assets of Millard Processing Services, a bacon processing operation, for approximately

$73 million in cash. The acquisition has been accounted for as a purchase and goodwill of approximately $14 million has been recorded.

Tyson Foods, Inc. 2002 annual report