Toyota 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

In February 2006, FASB issued FAS No. 155, Accounting for

Certain Hybrid Instruments (“FAS 155”), which permits, but

does not require, fair value accounting for any hybrid financial

instrument that contains an embedded derivative that would

otherwise require bifurcation in accordance with FAS No. 133,

Accounting for Derivative Instruments and Hedging Activities

(“FAS 133”). The statement also subjects beneficial interests

issued by securitization vehicles to the requirements of FAS

133. FAS 155 is effective as of the beginning of first fiscal year

that begins after September 15, 2006. Management does not

expect this statement to have a material impact on Toyota’s

consolidated financial statements.

In March 2006, FASB issued FAS No. 156, Accounting for

Servicing of Financial Assets (“FAS 156”), which amends FAS

No. 140, Accounting for Transfers and Servicing of Financial

Assets and Extinguishments of Liabilities (“FAS 140”), with

respect to the accounting for separately recognized servicing

assets and servicing liabilities. FAS 156 is effective as of the

beginning of first fiscal year that begins after September 15,

2006, with earlier adoption permitted. Management does not

expect this statement to have a material impact on Toyota’s

consolidated financial statements.

Reclassifications—

Certain prior year amounts have been reclassified to conform

to the presentations for the year ended March 31, 2006.

U.S. dollar amounts presented in the consolidated financial

statements and related notes are included solely for the con-

venience of the reader and are unaudited. These translations

should not be construed as representations that the

yen amounts actually represent, or have been or could be

converted into, U.S. dollars. For this purpose, the rate of

¥117.47 = U.S. $1, the approximate current exchange rate at

March 31, 2006, was used for the translation of the accompa-

nying consolidated financial amounts of Toyota as of and for

the year ended March 31, 2006.

3. U.S. dollar amounts:

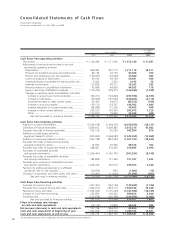

Cash payments for income taxes were ¥627,483 million,

¥694,985 million and ¥730,469 million ($6,218 million) for

the years ended March 31, 2004, 2005 and 2006, respective-

ly. Interest payments during the years ended March 31, 2004,

2005 and 2006 were ¥203,257 million, ¥226,615 million and

¥332,337 million ($2,829 million), respectively.

Capital lease obligations of ¥4,826 million, ¥3,571 million

and ¥6,673 million ($57 million) were incurred for the years

ended March 31, 2004, 2005 and 2006, respectively.

4. Supplemental cash flow information:

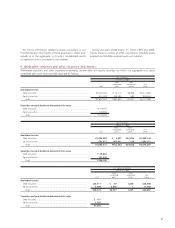

During the year ended March 31, 2004, Toyota acquired addi-

tional ownerships in the following four contract manufactur-

ers, Toyota Auto Body Corporation, Kanto Auto Works LTD,

Central Motor CO., LTD, and P.T. Toyota Motor

Manufacturing Indonesia. All of them are primarily engaged in

manufacturing Toyota brand vehicles. Until the date of each

acquisition, Toyota accounted for its investments in these con-

tract manufacturers by the equity method because Toyota was

considered to have significant influence of these companies.

Subsequent to the date of each acquisition, Toyota’s consoli-

dated financial statements include the accounts of these con-

tract manufacturers. The fair values of assets acquired and

liabilities assumed at the dates of acquisition based on the

allocation of the aggregate purchase price for these acquisi-

tions are as follows:

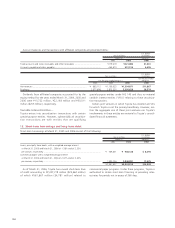

5. Acquisitions and dispositions:

Yen in millions

For the year ended

March 31, 2004

Assets acquired ........................................................................................................................................................................ ¥ 488,939

Liabilities assumed.................................................................................................................................................................... (372,277)

Minority interest....................................................................................................................................................................... (97,008)

Goodwill .................................................................................................................................................................................. 9,557

Less—Cash acquired................................................................................................................................................................. (11,703)

Net cash paid ........................................................................................................................................................................... ¥ 17,508