Toyota 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

breach of a covenant by the servicer with respect to the receiv-

able that materially and adversely affects the interest of the

securitization trust or of an extension or modification of a

receivable as to which Toyota, as servicer, does not commit to

make advances to fund reductions in interest payments. The

repurchase price is generally the outstanding principal balance

of the receivable and accrued interest. These provisions are

customary for securitization transactions.

Advancing requirements

As the servicer, Toyota is required to advance certain shortfalls

in obligor payments to the securitization trust to the extent it

believes the advance will be recovered from future collections of

that receivable. Generally, the securitization trust is required to

reimburse Toyota for these advances from collections on all

receivables before making other required payments. These pro-

visions are customary for securitization transactions.

Lending Commitments

Credit facilities with credit card holders

Toyota’s financial services operation issues credit cards to cus-

tomers. As customary for credit card businesses, Toyota main-

tains credit facilities with holders of credit cards issued by

Toyota. These facilities are used upon each holders’ requests up

to the limits established on an individual holder basis. Although

loans made to customers through this facility are not secured,

for the purposes of minimizing credit risks and of appropriately

establishing credit limits for each individual credit card holder,

Toyota employs its own risk management policy which includes

an analysis of information provided by financial institutions in

alliance with Toyota. Toyota periodically reviews and revises, as

appropriate, these credit limits. Outstanding credit facilities with

credit card holders were ¥2,350.8 billion as of March 31, 2006.

Credit facilities with dealers

Toyota’s financial services operation maintains credit facilities

with dealers. These credit facilities may be used for business

acquisitions, facilities refurbishment, real estate purchases, and

working capital requirements. These loans are typically collater-

alized with liens on real estate, vehicle inventory, and/or other

dealership assets, as appropriate. Toyota obtains a personal

guarantee from the dealer or corporate guarantee from the

dealership when deemed prudent. Although the loans are typi-

cally collateralized or guaranteed, the value of the underlying

collateral or guarantees may not be sufficient to cover Toyota’s

exposure under such agreements. Toyota prices the credit facili-

ties according to the risks assumed in entering into the credit

facility. Toyota’s financial services operation also provides

financing to various multi-franchise dealer organizations,

referred to as dealer groups, often as part of a lending consor-

tium, for wholesale inventory financing, business acquisitions,

facilities refurbishment, real estate purchases, and working capi-

tal requirements. Toyota’s outstanding credit facilities with deal-

ers totaled ¥1,334.4 billion as of March 31, 2006.

Guarantees

Toyota enters into certain guarantee contracts with its dealers

to guarantee customers’ payments of their installment payables

that arise from installment contracts between customers and

Toyota dealers, as and when requested by Toyota dealers.

Guarantee periods are set to match the maturity of installment

payments, and at March 31, 2006 range from one month to 35

years; however, they are generally shorter than the useful lives

of products sold. Toyota is required to execute its guarantee pri-

marily when customers are unable to make required payments.

The maximum potential amount of future payments as of

March 31, 2006 is ¥1,236.9 billion. Liabilities for these guaran-

tees of ¥3.3 billion have been provided as of March 31, 2006.

Under these guarantee contracts, Toyota is entitled to recover

any amounts paid by it from the customers whose obligations it

guaranteed.

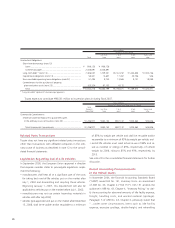

Tabular Disclosure of Contractual Obligations

For information regarding debt obligations, capital lease obliga-

tions, operating leases, and other obligations, including

amounts maturing in each of the next five years, see notes 13,

22 and 23 to the consolidated financial statements. In addition,

as part of Toyota’s normal business practices, Toyota enters into

long-term arrangements with suppliers for purchases of certain

raw materials, components and services. These arrangements

may contain fixed/minimum quantity purchase requirements.

Toyota enters into such arrangements to facilitate an adequate

supply of these materials and services.

The following tables summarize Toyota’s contractual obliga-

tions and commercial commitments as of March 31, 2006: